Gynger

Founded Year

2021Stage

Series A | AliveTotal Raised

$41.7MLast Raised

$20M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+311 points in the past 30 days

About Gynger

Gynger serves as an AI payments platform that specializes in embedded financing for the technology sector. The company offers financing solutions that enable businesses to pay, manage, and finance technology-related expenses through a unified dashboard. Gynger primarily serves businesses looking to manage technology spending. It was founded in 2021 and is based in New York, New York.

Loading...

Gynger's Product Videos

Gynger's Products & Differentiators

Gynger for Buyers

Software and infrastructure financing platform. You simply submit expenses you’d like to finance, select a custom repayment term, and have Gynger pay your bills on your behalf. By enabling you to access flexible payment terms for any expense in your technology stack, Gynger helps you improve cash flow, extend runway, and invest in growth. Get underwritten in minutes, immediate access to non-dilutive capital and your vendors are paid the next day. You also get a simple dashboard to manage your software contracts. Use Cases: 1. Software financing - spread out SaaS invoices over via net-30/60/90 terms, monthly payments, or quarterly payments 2. Infrastructure financing - Defer usage based monthly usage-based cloud/infra bills into quarterly payments 3. Hardware financing - flexible financing for servers, data centers

Loading...

Research containing Gynger

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gynger in 1 CB Insights research brief, most recently on Oct 24, 2024.

Oct 24, 2024 report

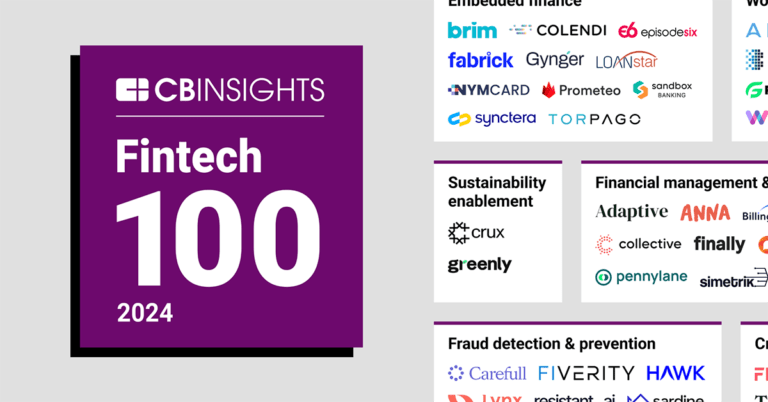

Fintech 100: The most promising fintech startups of 2024Expert Collections containing Gynger

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gynger is included in 7 Expert Collections, including Payments.

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Future Tech Hotshots

52 items

The 52 startups our data says are most likely to get a successful exit in the next decade

Artificial Intelligence

7,221 items

Fintech 100 (2024)

100 items

Latest Gynger News

Dec 16, 2024

ALBANY, N.Y.--(BUSINESS WIRE)---- $SLNH #SLNH--Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH), a developer of green data centers for intensive computing applications including Bitcoin mining and AI, announced a strategic partnership between its subsidiary Soluna Cloud and Gynger, the leading embedded payments platform for technology. The Soluna Cloud and Gynger partnership aims to make renewable-powered high-performance computing solutions more accessible to customers. Through this partnership,

Gynger Frequently Asked Questions (FAQ)

When was Gynger founded?

Gynger was founded in 2021.

Where is Gynger's headquarters?

Gynger's headquarters is located at 157 West 18th Street, New York.

What is Gynger's latest funding round?

Gynger's latest funding round is Series A.

How much did Gynger raise?

Gynger raised a total of $41.7M.

Who are the investors of Gynger?

Investors of Gynger include Deciens Capital, Gradient Ventures, Velvet Sea Ventures, Bag Ventures, PayPal Ventures and 7 more.

Who are Gynger's competitors?

Competitors of Gynger include Fundbox and 7 more.

What products does Gynger offer?

Gynger's products include Gynger for Buyers and 1 more.

Who are Gynger's customers?

Customers of Gynger include Cylera, Driveway, Lovd and Rhythm.

Loading...

Compare Gynger to Competitors

Ratio is a financial technology company providing financing solutions for SaaS and technology sectors. The company offers two products: Ratio Boost, a buy now pay later (BNPL) solution that allows SaaS companies to offer payment terms while receiving upfront payment, and Ratio Trade, which provides upfront capital based on the company's portfolio of customer contracts. Ratio serves the SaaS and tech industries, providing tools to support sales and optimize capital structure. It was founded in 2021 and is based in San Mateo, California.

SaaSPay is a financial services company that provides Buy Now Pay Later (BNPL) solutions for Software as a service (SaaS) expenses. The company offers repayment plans for SaaS and cloud subscriptions, allowing businesses to handle their tech expenses. SaaSPay serves the technology sector, offering access to credit lines and discounts on annual software subscriptions. It was founded in 2022 and is based in Bengaluru, India.

OatFi specializes in providing working capital infrastructure for B2B payments within various industries. The company offers an API-powered platform that enables businesses to integrate cash flow management tools into their payment processes, allowing for instant credit decisions, acceleration of receivables, and deferral of payables. OatFi's solutions are designed to help businesses optimize their cash flow conversion cycle and monetize credit products without assuming credit risk. It was founded in 2021 and is based in New York, New York.

Pipe provides financial services and specializes in non-dilutive capital solutions for businesses. It offers a modern capital platform that allows entrepreneurs to access funding based on their revenue with payment terms. It primarily serves the financial needs of small to midsize businesses and entrepreneurs seeking growth without equity dilution. It was formerly known as the Third Base Pipe. The company was founded in 2019 and is based in San Francisco, California.

Clearco specializes in providing working capital to the e-commerce sector and focuses on funding invoices and receipts for businesses. The company offers a rapid funding process that allows e-commerce businesses to receive capital in as little as 24 hours without the need for collateral, personal guarantees, or equity dilution. Clearco's services are designed to help e-commerce businesses manage cash flow and invest in growth by funding operational expenses such as inventory, marketing, and logistics. Clearco was formerly known as Clearbanc. It was founded in 2015 and is based in Toronto, Canada.

Lighter Capital provides growth capital within the technology sector and focuses on startups and SaaS companies. The company offers revenue-based financing solutions that enable tech entrepreneurs to access funding without giving up equity or board seats. Lighter Capital provides clients with various resources and discounts to assist in startup growth and scaling. It was founded in 2010 and is based in Seattle, Washington.

Loading...