Investments

1296Portfolio Exits

283Funds

6Partners & Customers

3Service Providers

2About Google Ventures

Google Ventures (GV) seeks to discover and invest in companies across a broad range of industries, including consumer internet, software, hardware, clean technology, biotechnology, and health care. It invests amounts ranging from seed funding to tens of millions of dollars, depending on the stage of the opportunity and the company's need for capital. It was founded in 2009 and is based in Mountain View, California.

Expert Collections containing Google Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Google Ventures in 13 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

29 items

Companies that are using technology to make farms more efficient

Synthetic Biology

382 items

Research containing Google Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Google Ventures in 17 CB Insights research briefs, most recently on Feb 4, 2025.

Feb 4, 2025 report

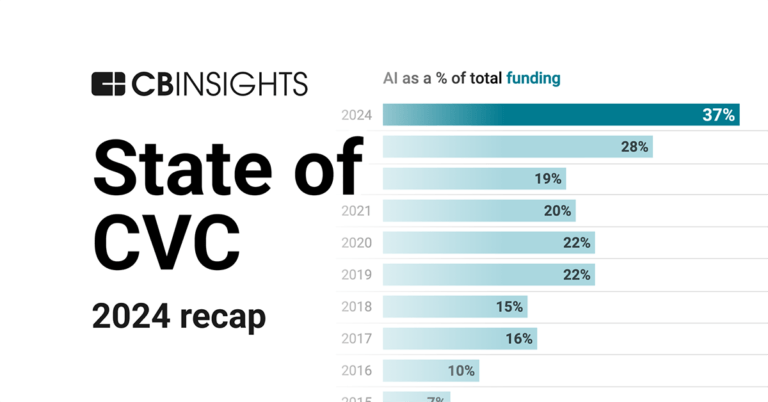

State of CVC 2024 Report

Jan 30, 2025 report

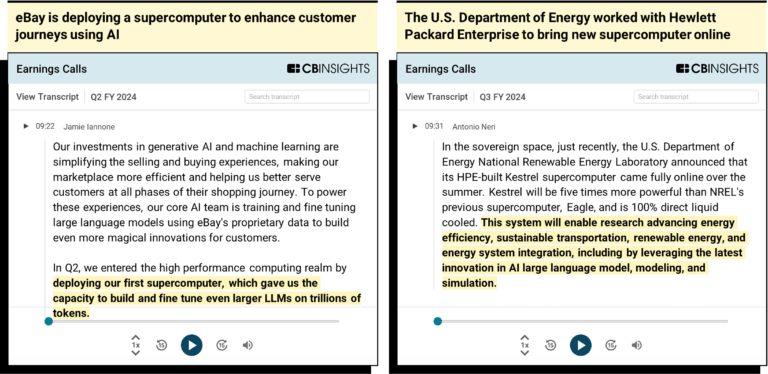

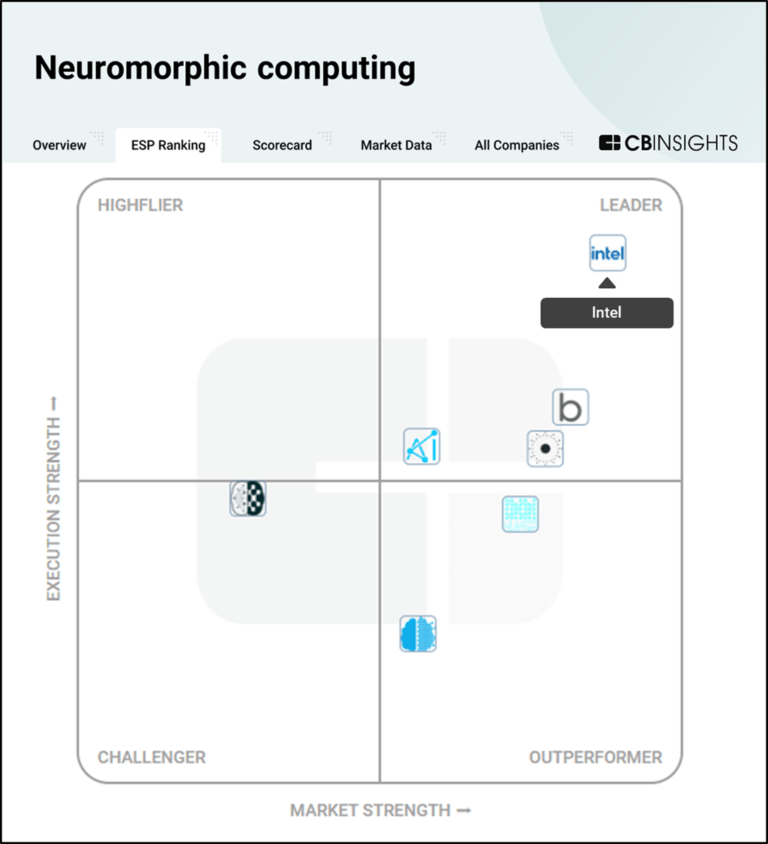

State of AI Report: 6 trends shaping the landscape in 2025

Dec 3, 2024 report

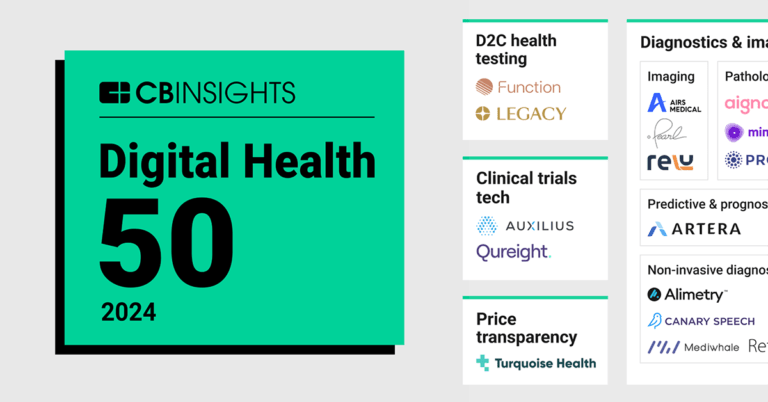

Digital Health 50: The most promising digital health startups of 2024

Nov 14, 2024 report

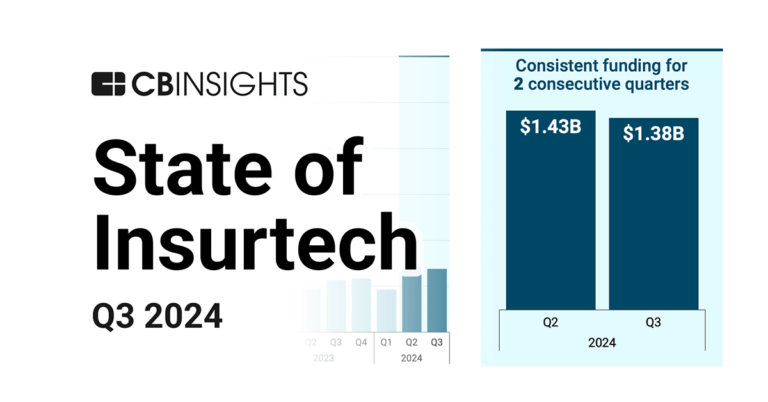

State of Insurtech Q3’24 Report

Oct 11, 2024

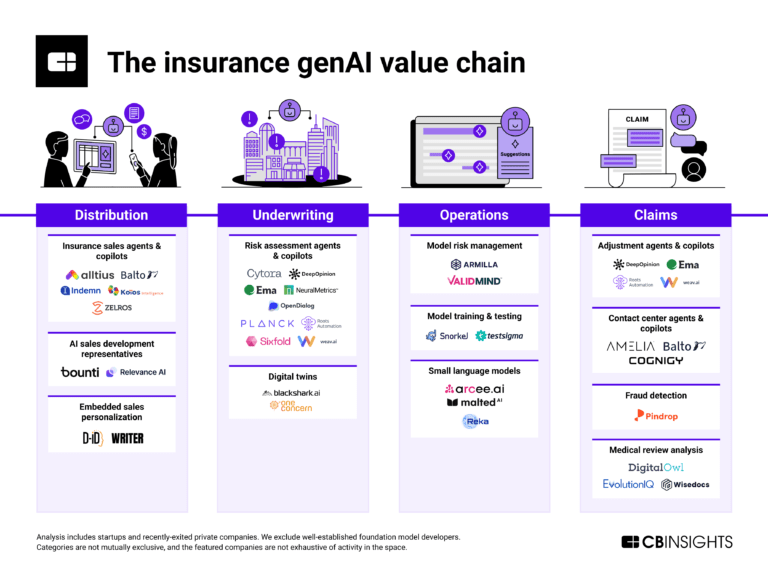

How genAI is reshaping the insurance value chain

Oct 4, 2024

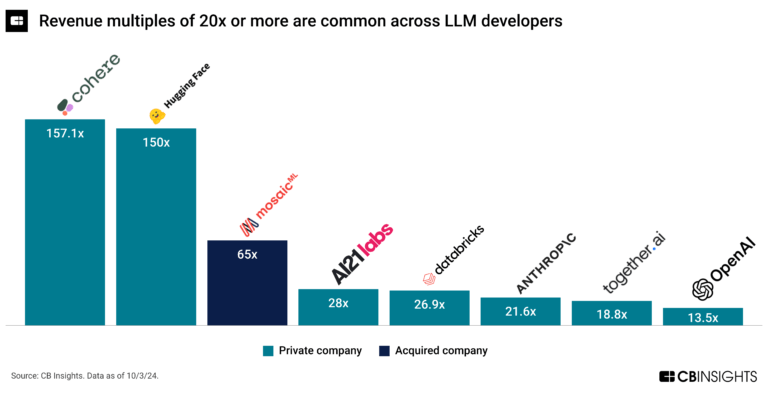

The 3 generative AI markets most ripe for exitsLatest Google Ventures News

Mar 31, 2025

The company will use the funds for AI research and to advance its programs in clinical development. Photo: Hero Images/Getty images Drug design and development company Isomorphic Labs announced it raised $600 million dollars in its first external funding round. Thrive Capital led the round with participation from GV (Google Ventures) and existing investor Alphabet . WHAT IT DOES Isomorphic Labs, launched in 2021 with Google DeepMind, unveiled its newest joint AI offering AlphaFold 3, an AI model that was developed by Isomorphic Labs and Google DeepMind . The aim of AlphaFold3 was to accurately predict the structure of proteins, DNA, RNA, ligands and how they interact. A ligand is an ion or molecule with a functional group that binds to a central metal atom to form a coordination complex. The two companies said they expect AlphaFold3 to help transform the understanding of the biological world and drug discovery. Since its launch, Isomorphic Labs has built an AI drug design engine beyond the AlphaFold system that is made up of predictive and genAI models that have the ability to work across multiple therapeutic areas and drug modalities. The company aims to use the funds to apply its AI drug design engine to deliver biomedical breakthroughs as well as advance its drug design programs across multiple therapeutic areas and drug modalities. "We're excited to bring together a top-tier investor group with deep AI and life sciences expertise as we aim to transform this industry through an interdisciplinary approach," Isomorphic Labs founder and CEO, Demis Hassabis, said in a statement. "This funding will further turbocharge the development of our next-generation AI drug design engine, help us advance our own programs into clinical development, and is a significant step forward towards our mission of one day solving all disease with the help of AI." MARKET SNAPSHOT In February, Isomorphic Labs entered into an agreement to expand its strategic research collaboration with pharmaceutical giant Novartis. The agreement came in the wake of a previous collaboration between the two companies in 2024. In the new agreement, IsoLabs and Novartis expanded the scope of the initial collaboration, adding up to three additional research programs on the same financial terms as the original agreement. Last year, Isomorphic Labs entered into a strategic research collaboration with Eli Lilly and Company to discover small molecule therapeutics against multiple targets. Isomorphic received an upfront cash payment of $45 million. Isomorphic also entered into a strategic research collaboration with Novartis to discover small molecule therapeutics against three undisclosed targets. Google DeepMind launched AlphaProteo , an AI system aimed at helping biological and health researchers design novel, high-strength proteins that bind to target molecules with accuracy and strength. AlphaProteo was trained on the Protein Data Bank (PDB) that allows breakthroughs in science and education by providing access and tools for exploration, visualization and analysis of experimentally-determined 3D structures from the PDB archive.

Google Ventures Investments

1,296 Investments

Google Ventures has made 1,296 investments. Their latest investment was in Isomorphic Laboratories as part of their Series A on March 31, 2025.

Google Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

3/31/2025 | Series A | Isomorphic Laboratories | $600M | Yes | Alphabet, and Thrive Capital | 4 |

3/27/2025 | Series A | Layer Health | $21M | No | Define Ventures, Flare Capital Partners, and MultiCare Capital Partners | 2 |

3/18/2025 | Seed VC | Leta | $5M | Yes | Equator, and Speedinvest | 3 |

3/13/2025 | Series B - II | |||||

2/28/2025 | Series A |

Date | 3/31/2025 | 3/27/2025 | 3/18/2025 | 3/13/2025 | 2/28/2025 |

|---|---|---|---|---|---|

Round | Series A | Series A | Seed VC | Series B - II | Series A |

Company | Isomorphic Laboratories | Layer Health | Leta | ||

Amount | $600M | $21M | $5M | ||

New? | Yes | No | Yes | ||

Co-Investors | Alphabet, and Thrive Capital | Define Ventures, Flare Capital Partners, and MultiCare Capital Partners | Equator, and Speedinvest | ||

Sources | 4 | 2 | 3 |

Google Ventures Portfolio Exits

283 Portfolio Exits

Google Ventures has 283 portfolio exits. Their latest portfolio exit was theSkimm on March 19, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

3/19/2025 | Acquired | Everyday Health Group | 4 | ||

2/28/2025 | Acq - Pending | Helix Acquisition II | 3 | ||

2/25/2025 | Acq - Fin | 5 | |||

Date | 3/19/2025 | 2/28/2025 | 2/25/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acq - Pending | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | Everyday Health Group | Helix Acquisition II | |||

Sources | 4 | 3 | 5 |

Google Ventures Fund History

6 Fund Histories

Google Ventures has 6 funds, including Google Digital News Initiative Innovation Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/22/2015 | Google Digital News Initiative Innovation Fund | UNKNOWN | Closed | $170M | 1 |

9/12/2014 | Google Cloud Platform for Startups | ||||

7/9/2014 | Google Ventures Europe | ||||

Google Ventures London Fund | |||||

Google Africa Investment Fund |

Closing Date | 10/22/2015 | 9/12/2014 | 7/9/2014 | ||

|---|---|---|---|---|---|

Fund | Google Digital News Initiative Innovation Fund | Google Cloud Platform for Startups | Google Ventures Europe | Google Ventures London Fund | Google Africa Investment Fund |

Fund Type | UNKNOWN | ||||

Status | Closed | ||||

Amount | $170M | ||||

Sources | 1 |

Google Ventures Partners & Customers

3 Partners and customers

Google Ventures has 3 strategic partners and customers. Google Ventures recently partnered with Metabiota on September 9, 2015.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

9/24/2015 | Client | United States | Google Ventures Backs Metabiota to Forecast Disease Outbreaks Google Ventures will also partner with Metabiota Inc , offering its big-data expertise to help the company serve its customers -- insurers , government agencies and other organizations -- by offering them forecasting and risk-management tools , Metabiota Inc founder Dr. Nathan Wolfe said ... Document DJFVW00120150924eb9oallz9 | 3 | |

6/14/2011 | Partner | ||||

Vendor |

Date | 9/24/2015 | 6/14/2011 | |

|---|---|---|---|

Type | Client | Partner | Vendor |

Business Partner | |||

Country | United States | ||

News Snippet | Google Ventures Backs Metabiota to Forecast Disease Outbreaks Google Ventures will also partner with Metabiota Inc , offering its big-data expertise to help the company serve its customers -- insurers , government agencies and other organizations -- by offering them forecasting and risk-management tools , Metabiota Inc founder Dr. Nathan Wolfe said ... Document DJFVW00120150924eb9oallz9 | ||

Sources | 3 |

Google Ventures Service Providers

2 Service Providers

Google Ventures has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | ||

|---|---|---|

Associated Rounds | ||

Provider Type | Counsel | |

Service Type | General Counsel |

Partnership data by VentureSource

Google Ventures Team

28 Team Members

Google Ventures has 28 team members, including current Chief Executive Officer, Managing Partner, David Krane.

Compare Google Ventures to Competitors

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Andreessen Horowitz (a16z) is a venture capital firm. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

New Enterprise Associates is a global venture capital firm focused on technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from seed stage to IPO. NEA primarily serves the technology and healthcare industries, investing in companies. It was founded in 1977 and is based in Menlo Park, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Loading...