Freenome

Founded Year

2014Stage

Series F | AliveTotal Raised

$1.353BLast Raised

$254M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-116 points in the past 30 days

About Freenome

Freenome focuses on early cancer detection through blood tests. The company's main offerings include next-generation blood tests that utilize multiomics technology and machine learning to identify cancer in its early stages. Freenome primarily serves the healthcare sector with a focus on improving cancer screening and detection. It was founded in 2014 and is based in Brisbane, California.

Loading...

ESPs containing Freenome

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The liquid biopsy cancer screening market offers a non-invasive alternative to traditional tissue biopsies for detecting cancer. This market includes various solutions such as circulating tumor DNA (ctDNA) and circulating tumor cells (CTCs) tests, which can detect cancer at an early stage and monitor treatment effectiveness. The liquid biopsy method is less invasive, faster, and more cost-effectiv…

Freenome named as Challenger among 15 other companies, including Exact Sciences, QIAGEN, and Veracyte.

Loading...

Research containing Freenome

Get data-driven expert analysis from the CB Insights Intelligence Unit.

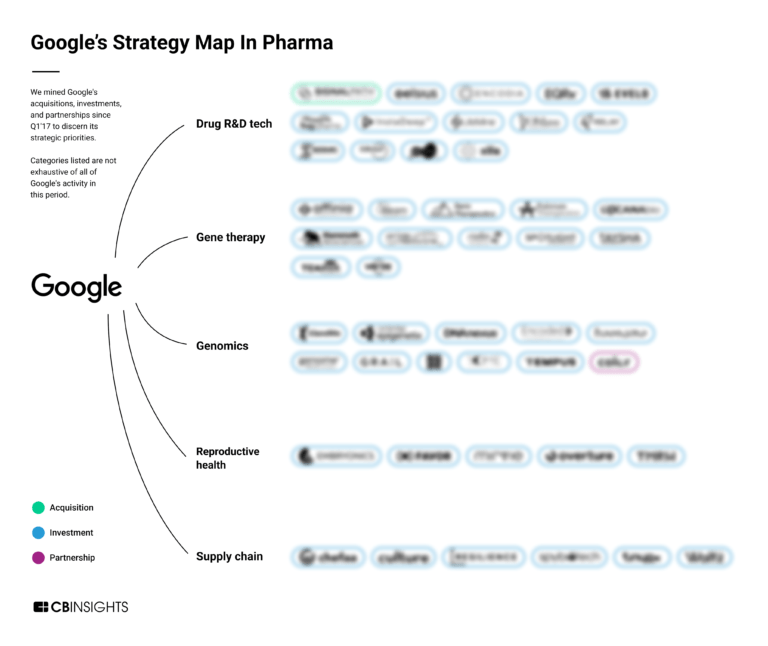

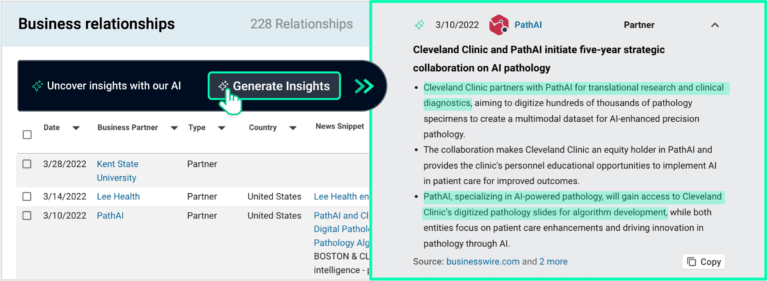

CB Insights Intelligence Analysts have mentioned Freenome in 9 CB Insights research briefs, most recently on Jan 16, 2025.

Jan 16, 2025 report

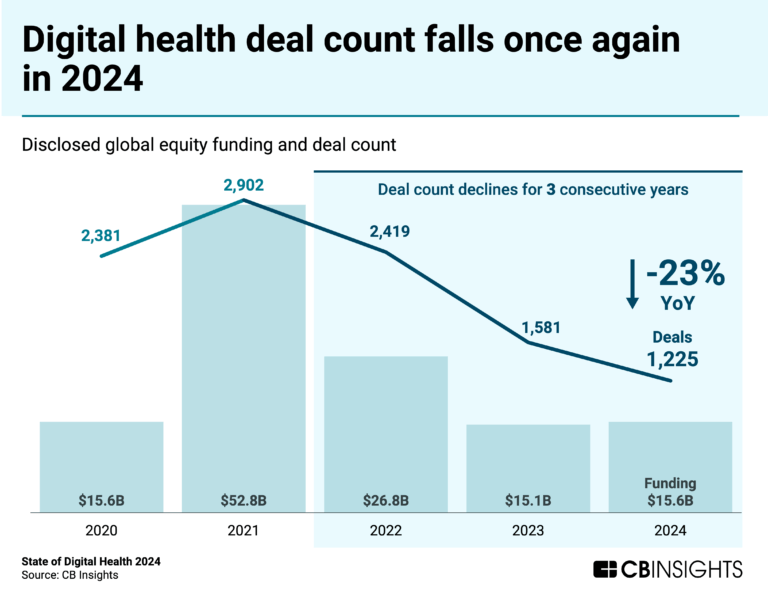

State of Digital Health 2024 Report

Apr 25, 2024 report

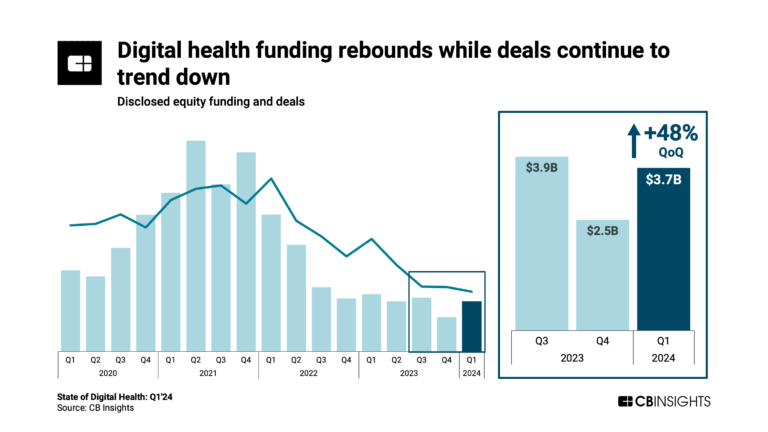

State of Digital Health Q1’24 Report

Apr 4, 2024 report

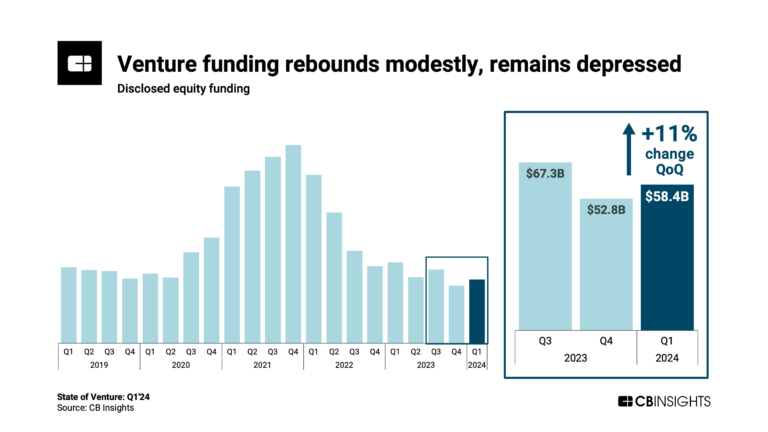

State of Venture Q1’24 Report

Aug 10, 2023

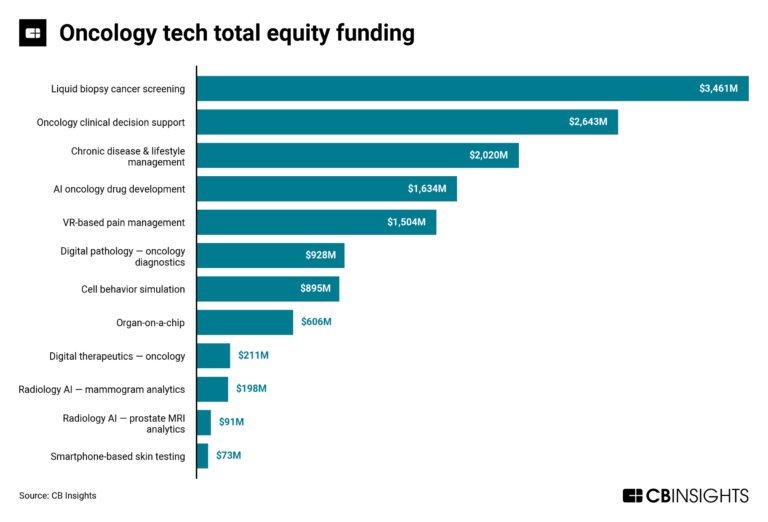

The oncology tech market map

Aug 1, 2023

The state of healthcare AI in 5 chartsExpert Collections containing Freenome

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Freenome is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

AI 100

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Precision Medicine Tech Market Map

160 items

This CB Insights Tech Market Map highlights 160 precision medicine companies that are addressing 9 distinct technology priorities that pharmaceutical companies and healthcare providers face.

Freenome Patents

Freenome has filed 22 patents.

The 3 most popular patent topics include:

- molecular biology

- genetics

- microrna

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/18/2023 | 3/11/2025 | Clusters of differentiation, Blood tests, Blood, Human cells, Immunology | Grant |

Application Date | 8/18/2023 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Clusters of differentiation, Blood tests, Blood, Human cells, Immunology |

Status | Grant |

Latest Freenome News

Mar 26, 2025

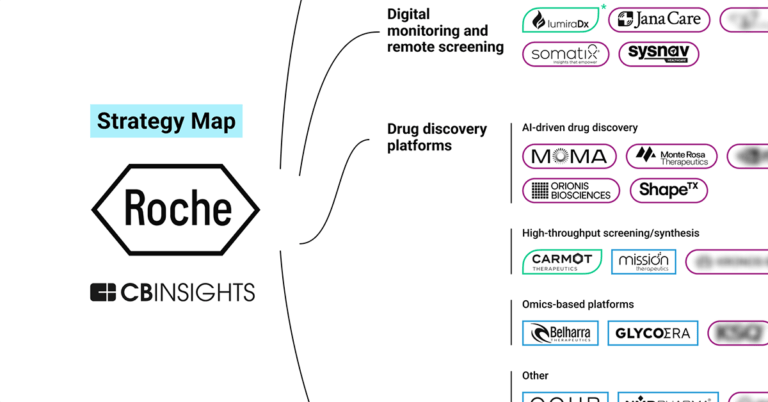

| USD 19.31 Bn & CAGR 7.38% Growth By 2032 Liver Cancer Diagnostics Industry 2024–2032 Liver cancer, predominantly hepatocellular carcinoma (HCC), remains one of the most aggressive and leading causes of cancer-related deaths worldwide. The liver cancer diagnostics market is critical for early detection, accurate diagnosis, and effective treatment planning for liver cancer. The market encompasses a range of diagnostic approaches, including imaging techniques (such as ultrasound, CT scans, and MRI), biopsies, blood tests (including alpha-fetoprotein or AFP biomarker), and newer methodologies like liquid biopsies that analyze circulating tumor DNA. The Global Liver Cancer Diagnostics Market is anticipated to see significant growth from 2024 to 2032, primarily driven by the rising incidence of liver cancer, advancements in diagnostic technologies, and increasing healthcare access in both developed and developing regions. As of 2023, the market value is estimated at approximately $10.17 billion and is expected to grow at a compound annual growth rate (CAGR) of 7.38% through to 2032, reaching around $19.31 billion. Geographically, the North American and Asia-Pacific regions are leading, with North America benefiting from advanced healthcare systems and Asia-Pacific experiencing a high burden of liver disease, especially hepatitis B and C, which are strongly associated with liver cancer. Increasing healthcare awareness, enhanced screening programs, and innovative diagnostic solutions are expected to be key drivers of market growth during the forecast period. Learn how this report can boost your revenue - request a sample@ https://www.vantagemarketresearch.com/liver-cancer-diagnostics-market-2527/request-sample Market Drivers The liver cancer diagnostics market is being primarily driven by an alarming rise in liver cancer cases globally, with over 1 million new diagnoses annually. This surge is largely attributed to chronic viral infections such as hepatitis B and C, excessive alcohol consumption, and the growing prevalence of non-alcoholic fatty liver disease (NAFLD). Hepatitis B and C infections are responsible for approximately 80% of HCC cases in developing regions, while NAFLD, which affects approximately 25% of adults globally, is becoming an increasingly prevalent risk factor for liver cancer in industrialized nations. Additionally, technological advancements are playing a significant role in driving the market. Newer imaging technologies, such as high-resolution MRI and AI-enhanced algorithms, have improved diagnostic accuracy by up to 20–30%, significantly reducing false-negative rates in liver cancer detection. Furthermore, liquid biopsies, which involve detecting circulating tumor DNA or RNA from blood samples, are emerging as a non-invasive alternative to traditional diagnostic methods. These liquid biopsies are expected to capture 15–20% of the market share by 2032, providing a significant boost to the overall market. Government initiatives aimed at eliminating viral hepatitis by 2030, as outlined by the World Health Organization (WHO), are also fueling the market's expansion. Increased screening programs and enhanced insurance coverage for early diagnostic testing, particularly in developed nations such as the United States and Japan, are further driving the growth of the liver cancer diagnostics market. Market Challenges Despite the market's promising growth, several challenges remain that may hinder its full potential. One of the significant obstacles is the high cost of diagnostic procedures, particularly advanced imaging technologies and genomic tests. These costs make early and accurate liver cancer diagnosis inaccessible to populations in low-income regions, where healthcare infrastructure is limited. For instance, over 60% of liver cancer cases in Sub-Saharan Africa are diagnosed at later stages, which reduces treatment efficacy and survival rates. In addition to cost, regulatory barriers also present significant challenges. The approval process for new biomarkers and diagnostic technologies can be slow, delaying the introduction of promising innovations into the market. In particular, the U.S. Food and Drug Administration (FDA) approval process for novel diagnostic biomarkers can be lengthy, hindering the timely commercialization of groundbreaking diagnostic tools. Furthermore, regional disparities in healthcare access and reimbursement policies make it challenging for emerging economies to adopt advanced diagnostic solutions. Cultural stigma and lack of awareness about liver cancer in certain regions may also limit the adoption of screening programs. Many patients in developing countries are either unaware of the importance of early detection or hesitant to undergo diagnostic procedures due to fear or misconceptions surrounding liver disease. Exclusive 30% Instant Discount on Direct Purchases @ https://www.vantagemarketresearch.com/buy-now/liver-cancer-diagnostics-market-2527/0 Key Opportunities: The report examines the key opportunities in the Liver Cancer Diagnostics Market and identifies the factors that are driving and will continue to drive the industry's growth. It takes into account past growth patterns, growth drivers, and current and future trends. Highlights of Our Report: Extensive Market Analysis: A comprehensive examination of the manufacturing capabilities, production volumes, and technological innovations within the Liver Cancer Diagnostics Market. Corporate Insights: An in-depth review of company profiles, highlighting major players and their strategic moves in the market's competitive landscape. Consumption Trends: A detailed analysis of consumption patterns, offering insight into current demand dynamics and consumer preferences. Segmentation Details: An in-depth breakdown of end-user segments, illustrating the market's distribution across various applications and industries. Pricing Evaluation: An examination of pricing structures and the factors that influence market pricing strategies. Future Outlook: Predictive insights into market trends, growth prospects, and potential challenges ahead. Segment Overview The liver cancer diagnostics market can be segmented based on type, end-user, and region. The market is divided into various diagnostic test types, including imaging, biopsy, blood tests, and biomarkers. Imaging methods, particularly ultrasound and MRI, dominate the market, accounting for around 45% of the overall market share. These imaging techniques are favored for their non-invasive nature and high diagnostic accuracy. Biomarkers, such as the AFP test, and emerging exosome-based tests are the fastest-growing segment within the market, with a projected CAGR of 9.5%. These tests offer promising solutions for early-stage liver cancer detection and are benefiting from increased research investment. Hospitals lead the market in terms of end-users, representing approximately 50% of the market share. This is largely due to the availability of integrated diagnostic services and the high volume of diagnostic procedures performed in hospitals. However, diagnostic laboratories are also gaining traction, driven by partnerships with telehealth platforms and a shift toward outpatient care in many regions. Regionally, Asia-Pacific is expected to experience the highest growth rate, with a CAGR of 9.2%. This is attributed to the high prevalence of hepatitis B and C in countries like China and India, combined with improving healthcare infrastructure. The global Liver Cancer Diagnostics market can be categorized by test type, End Use, and Region. By Test Type Research Analysis Recent research has highlighted the crucial role of artificial intelligence (AI) in enhancing diagnostic accuracy for liver cancer. For instance, a 2023 study published in The Lancet demonstrated that AI-enhanced CT scans improved HCC detection by 18%, underscoring the potential of AI to reduce diagnostic errors and facilitate early detection. Additionally, liquid biopsy research, including advanced techniques like CRISPR-based cfDNA analysis, is expected to revolutionize liver cancer diagnosis, offering non-invasive and highly sensitive detection methods. Numerous clinical trials are ongoing to explore novel biomarkers, such as glypican-3 and DKK1, which may provide additional tools for the early detection of cancer. Collaborative efforts between diagnostic companies, such as Illumina and KingMed Diagnostics' partnership in 2023, aim to commercialize genomic diagnostic panels, which could have a significant impact on the market. One of the key challenges in the research space is the validation of multi-omics approaches, which integrate data from genomics, proteomics, and metabolomics for the diagnosis of liver cancer. While these methods have shown promising results, they face challenges in terms of standardization and scalability. However, advancements in federated learning models, which enable cross-institutional data sharing, are helping address these limitations by improving sample sizes for research. Explore Detailed Insights on the Global Liver Cancer Diagnostics Market @ https://www.vantagemarketresearch.com/industry-report/liver-cancer-diagnostics-market-2527 Market Overview According to analysts at Vantage Market Research, the global Liver Cancer Diagnostics Market was valued at USD 10.17 billion in 2023 and is projected to reach a value of USD 19.31 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.38% between 2024 and 2032. Market estimates for the liver cancer diagnostics sector are based on a combination of primary interviews with key industry stakeholders, secondary research from reputable sources such as the WHO and GLOBOCAN, and analytical models, including Porter’s Five Forces. These methods provide a comprehensive understanding of the competitive landscape and regional market dynamics. Porter’s Five Forces analysis indicates that the liver cancer diagnostics market is highly competitive, with key players such as Roche, Siemens Healthineers, and Thermo Fisher Scientific holding significant market shares. These companies are focused on expanding their product portfolios through acquisitions, partnerships, and technological innovations, particularly in AI-driven imaging and genomic testing. Data triangulation, which combines multiple data sources, is used to account for regional disparities; however, underreporting in certain regions, particularly in Africa, remains a limitation. Custom market reports often segment demand based on hospital versus outpatient settings, revealing that approximately 60% of advanced diagnostics occur in hospital settings due to the availability of integrated services. For in-depth competitive analysis, buy now and get up to 25-35% Discount At: https://www.vantagemarketresearch.com/buy-now/liver-cancer-diagnostics-market-2527/0 Why Should You Obtain This Report? Statistical Advantage: Gain access to vital historical data and projections for the Liver Cancer Diagnostics Market, arming you with key statistics. Competitive Landscape Mapping: Identify and analyze the roles of market players, offering a comprehensive view of the competitive landscape. Insight into Demand Dynamics: Gain comprehensive information on demand characteristics, uncovering market consumption trends and identifying growth opportunities. Identification of Market Opportunities: Accurately recognize market potential, enabling stakeholders to make informed strategic decisions. Acquiring this report ensures you are equipped with the most current and trustworthy data, sharpening your market strategies and providing a well-informed stance in the complex domain of liver cancer diagnostics. Each report is meticulously prepared, guaranteeing that our clients receive the critical intelligence needed to excel in this evolving market. Competitive Landscape The liver cancer diagnostics market is highly competitive, with a wide range of global and regional players. Key companies in the market include Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. Roche, for instance, has strengthened its market position through strategic acquisitions, such as its 2023 purchase of LumiraDx, which expanded its point-of-care diagnostics offerings. Siemens Healthineers has been actively advancing AI-enhanced imaging technology and has partnered with companies like NVIDIA to accelerate the deployment of AI in diagnostic applications. Startups like Freenome, focusing on multi-omics blood tests, are also disrupting the market with innovative solutions. Freenome’s $300 million funding round in 2023 underscores the growing investor interest in innovative diagnostic approaches. The market is characterized by ongoing consolidation, with the top five companies controlling about 55% of the total market share. Expansion into the Asia-Pacific region and integration of direct-to-consumer telehealth platforms are key strategies for growth. At the same time, emerging competition from Chinese firms, such as BGI Genomics, is introducing competitive pricing dynamics that could impact the market structure moving forward. Overall, the liver cancer diagnostics market is set for significant growth, driven by innovations in diagnostic technology, increasing healthcare access, and a rising incidence of liver cancer globally. Top 10 Companies

Freenome Frequently Asked Questions (FAQ)

When was Freenome founded?

Freenome was founded in 2014.

Where is Freenome's headquarters?

Freenome's headquarters is located at 3300 Marina Boulevard, Brisbane.

What is Freenome's latest funding round?

Freenome's latest funding round is Series F.

How much did Freenome raise?

Freenome raised a total of $1.353B.

Who are the investors of Freenome?

Investors of Freenome include Andreessen Horowitz, DCVC, Section 32, T. Rowe Price, RA Capital Management and 49 more.

Who are Freenome's competitors?

Competitors of Freenome include Owlstone Medical, 20/20 GeneSystems, BioTwin, GRAIL, Diagu and 7 more.

Loading...

Compare Freenome to Competitors

20/20 GeneSystems focuses on cancer screening and diagnostic testing within the life sciences sector. The company offers diagnostic tests including OneTest for Cancer, which analyzes cancer biomarkers from a single blood sample, and CoronaCheck, which provides viral testing services. It serves the healthcare industry with its diagnostic tests. It was founded in 2000 and is based in Gaithersburg, Maryland.

Owlstone Medical focuses on breath analysis for disease detection within the healthcare sector. The company develops technology for discovering and validating biomarkers in breath, employing chemical analysis and sensor technology for diagnosis. Owlstone Medical's products and services are intended for academic, clinical, and pharmaceutical research partners involved in developing breath-based diagnostics. It was founded in 2004 and is based in Cambridge, United Kingdom.

OncoTAb specializes in biotechnology with a focus on cancer diagnostic solutions. The company offers Agkura® Personal Score, a non-invasive blood test that measures tumor protein levels to aid in breast cancer detection. This test serves as a supplemental tool to mammography, which often misses cancers in women with dense breast tissue. It is based in Charlotte, North Carolina.

Liquid Genomics provides testing services for the detection of cancer gene mutations through blood-based testing within the healthcare and biotechnology sectors. The company utilizes digital PCR and allele-specific blocker PCR technologies to identify and quantify mutations in blood or tissue samples. Its services are aimed at the healthcare industry, focusing on cancer diagnostics and research. It is based in Torrance, California.

AccuraGen develops liquid biopsy technology for the cancer diagnostics industry. The company provides services related to DNA and RNA sequencing to assist in treatment plans for cancer patients, emphasizing non-invasive diagnostic methods. AccuraGen serves the healthcare sector, particularly in oncology. It is based in Menlo Park, California.

Artificial Intelligence Expert focuses on AI technologies related to early detection of cancer within the healthcare sector. The company provides tests that can identify various types of cancer with reported accuracy rates. It is based in Cluj-Napoca, Romania.

Loading...