Formlabs

Founded Year

2011Stage

Series F | AliveTotal Raised

$261.64MLast Raised

$390K | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+20 points in the past 30 days

About Formlabs

Formlabs develops and manufactures high-resolution stereolithography (SLA) and selective laser sintering (SLS) 3D printers. The company provides a range of printers, materials, and post-processing solutions for rapid prototyping, end-use part production, and manufacturing aids across various industries. Formlabs serves sectors such as engineering, manufacturing, automotive, aerospace, dental, medical, education, entertainment, and jewelry. It was founded in 2011 and is based in Somerville, Massachusetts.

Loading...

ESPs containing Formlabs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The industrial 3D printing — polymers market involves the use of additive manufacturing techniques to produce three-dimensional objects using polymer-based materials. This technology offers advantages such as design flexibility, rapid prototyping, and cost-effective production. The market is driven by the growing demand for customized and complex components across various industries, including aut…

Formlabs named as Leader among 15 other companies, including Stratasys, 3D Systems, and Nano Dimension.

Loading...

Research containing Formlabs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

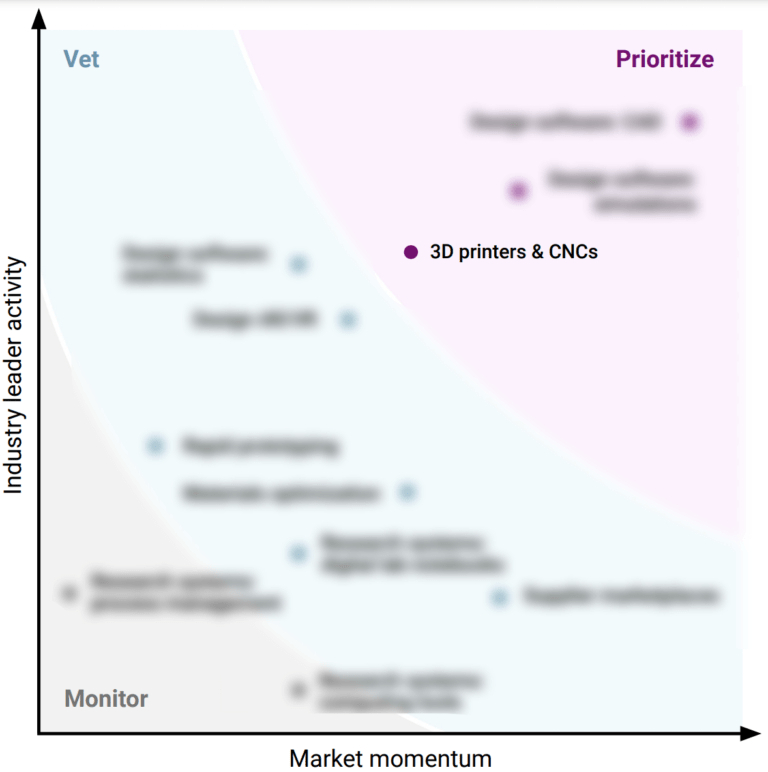

CB Insights Intelligence Analysts have mentioned Formlabs in 1 CB Insights research brief, most recently on Jun 8, 2022.

Jun 8, 2022 report

Why advanced manufacturers are prioritizing 3D printers & CNCsExpert Collections containing Formlabs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Formlabs is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Advanced Manufacturing

7,111 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Advanced Manufacturing 50

50 items

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Formlabs Patents

Formlabs has filed 138 patents.

The 3 most popular patent topics include:

- 3d printing

- 3d printing processes

- manufacturing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/7/2022 | 2/25/2025 | 3D printing processes, 3D printing, Fused filament fabrication, Manufacturing, Industrial design | Grant |

Application Date | 12/7/2022 |

|---|---|

Grant Date | 2/25/2025 |

Title | |

Related Topics | 3D printing processes, 3D printing, Fused filament fabrication, Manufacturing, Industrial design |

Status | Grant |

Latest Formlabs News

Mar 21, 2025

Posted on According to Arizton’s latest research report, the digital denture market is growing at a CAGR of 8.40% during 2024-2030. Market Size (2024): $1.35 Billion CAGR (2024-2030): 8.40% Geographical Analysis: North America, Europe, APAC, Latin America, and Middle East & Africa Market Overview The global digital denture market is experiencing significant growth, driven by advancements in digital dentistry, increasing demand for customized prosthetics, and the integration of CAD/CAM technologies. Europe and North America lead the market, with APAC emerging as a high-growth region due to rising awareness, disposable incomes, and better dental service accessibility. Key drivers include technological advancements such as CAD/CAM integration, 3D printing, and AI-driven design, along with the increasing demand for aesthetic, comfortable, and customizable dentures. However, challenges like high initial costs, training gaps, regulatory barriers, and competition from traditional dentures persist. Future opportunities include expanding into emerging markets, leveraging AI and machine learning for better customization, material innovations, and strategic partnerships. Despite these challenges, the market is poised for continued growth, with companies focusing on innovation and collaboration to lead the next phase of digital denture evolution. The Growth and Impact of CAD/CAM Technologies in the Digital Denture Market The global digital denture market is rapidly evolving, largely due to the increasing adoption of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) technologies. These digital solutions are transforming the denture production process, offering enhanced precision, efficiency, and improved patient outcomes. Traditional denture fabrication, which often requires multiple patient visits and extended production times, is being replaced by digital workflows that significantly reduce time and material waste. As a result, dental professionals are increasingly investing in CAD/CAM systems to streamline operations, lower costs, and deliver high-quality prosthetics. Key factors driving this investment include the growing demand for customized dentures, which can be designed to fit individual patients more precisely, and the cost-effectiveness of digital solutions that reduce labor and material waste. The integration of 3D printing technologies further boosts production speed and efficiency. Large Dental Service Organizations (DSOs) are also accelerating the adoption of these digital technologies across multiple clinics, especially in North America and Europe. Leading companies like Dentsply Sirona, 3Shape, and Formlabs are pioneering the development of advanced CAD/CAM systems, software, and materials. As digital dentistry continues to advance, CAD/CAM investment is expected to grow, leading to improved denture quality, faster production, and greater patient satisfaction. Dental Clinics are the Major End-Users in the Digital Denture Market Dental clinics are the primary end-users in the digital denture market, playing a crucial role in adopting and integrating digital technologies into their practices. The demand for digital dentures in these clinics is driven by factors such as the growing prevalence of edentulism, patient expectations for quicker treatments, and advancements in CAD/CAM technologies. The aging population, which experiences higher rates of tooth loss, has further increased the need for dentures. Traditional denture fabrication, which involves multiple visits and lengthy production times, is being replaced by digital workflows that streamline the process, making digital dentures more attractive for modern dental practices. Digital dentures offer several advantages for dental clinics, including enhanced precision and fit through 3D scanning and CAD software, as well as faster production times due to 3D printing. These benefits result in reduced patient visits, improved comfort, and higher satisfaction. Additionally, the customization capabilities provided by CAD software allow for personalized, natural-looking prosthetics, with digital records enabling future modifications without the need for a complete remake. Increasing investments in CAD/CAM systems, 3D printing, and AI-powered design tools are helping dental clinics produce high-quality dentures in-house, reducing dependence on external labs and improving efficiency. Complete Denture Leading the Market Complete dentures hold the largest share in the digital denture market due to several factors, particularly the high demand driven by the prevalence of edentulism, especially among the aging population. As the number of elderly individuals rises globally, the incidence of complete tooth loss increases, creating a substantial need for complete dentures. Digital complete dentures, which are fabricated using advanced CAD/CAM systems and 3D printing technologies, offer superior efficiency, accuracy, and comfort compared to traditional methods. These technologies allow for precise designs that ensure better fit, reducing the need for multiple adjustments and improving patient satisfaction. Additionally, digital workflows significantly shorten the time required for denture production, making the process faster and more cost-effective for both dental professionals and patients. This efficiency, coupled with enhanced patient outcomes such as better aesthetics, improved comfort, and fewer visits to the clinic, makes digital complete dentures a highly attractive option. As a result, the growing demand from the aging population, along with the benefits offered by digital technology, has made complete dentures the dominant segment in the digital denture market. The Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the digital denture market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/digital-denture-market How big is the global digital denture market? What is the growth rate of the global digital denture market? What are the significant trends in the digital denture market? Which region dominates the global digital denture market share? Who are the key players in the global digital denture market? Global Dental Implants Market – Focused Insights 2024-2029 About Us: Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services. We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts. Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports. Media Contact

Formlabs Frequently Asked Questions (FAQ)

When was Formlabs founded?

Formlabs was founded in 2011.

Where is Formlabs's headquarters?

Formlabs's headquarters is located at 35 Medford Street, Somerville.

What is Formlabs's latest funding round?

Formlabs's latest funding round is Series F.

How much did Formlabs raise?

Formlabs raised a total of $261.64M.

Who are the investors of Formlabs?

Investors of Formlabs include DFJ Growth Fund, Foundry, SoftBank, Paycheck Protection Program, New Enterprise Associates and 22 more.

Who are Formlabs's competitors?

Competitors of Formlabs include Markforged, Shapeways, BigRep, Sinterit, Desktop Metal and 7 more.

Loading...

Compare Formlabs to Competitors

Carbon is a 3D printing technology company that specializes in 3D printing services and additive manufacturing across various sectors. The company offers an integrated platform that includes end-use production materials, software, and production-scale 3D printers designed to accelerate the product development process from idea to production. Carbon primarily serves industries such as automotive, consumer goods, industrial manufacturing, and life sciences, including dental product fabrication and custom orthodontic solutions. It was founded in 2013 and is based in Redwood City, California.

Markforged focuses on industrial additive manufacturing and 3D printing technologies. The company provides three dimensional (3D) printers for metal and composite materials, software solutions, and engineering-grade materials intended for manufacturing workflows. Markforged's products are used in aerospace, automotive, and industrial equipment for applications such as parts production and maintenance operations. It was founded in 2013 and is based in Waltham, Massachusetts.

MakerVerse is a platform for sourcing industrial parts within the manufacturing sector. The company provides manufacturing technologies such as CNC machining, additive manufacturing, sheet metal fabrication, and injection molding, along with engineering services to assist in the production process. MakerVerse serves sectors that require manufacturing and prototyping, including aerospace, automotive, and industrial industries. It was founded in 2022 and is based in Berlin, Germany.

B9Creations provides additive manufacturing solutions in the 3D printing industry. The company offers 3D printers, scanning equipment, and materials and software that can produce parts. B9Creations serves sectors including aerospace, biomedical engineering, dental, education, entertainment, jewelry, manufacturing, and medical fields. It was founded in 2005 and is based in Rapid City, South Dakota.

Velo3D provides metal additive manufacturing solutions within the 3D printing industry. The company has a system that includes printers, software for print preparation and quality assurance, and services that support the production of parts. Velo3D's technology is used in sectors including aerospace, defense, energy, and automotive, facilitating the creation of components. It was founded in 2014 and is based in Fremont, California.

Impossible Objects focuses on advanced composite-based additive manufacturing within the 3D printing industry. The company offers a proprietary technology that produces geometrically complex parts at faster speeds than traditional methods, utilizing materials such as carbon fiber, PEEK, and fiberglass. Impossible Objects primarily serves sectors that require durable components, including aerospace, automotive, electronics manufacturing, and healthcare. It was founded in 2011 and is based in Northbrook, Illinois.

Loading...