FalconX

Founded Year

2018Stage

Series D | AliveTotal Raised

$427MValuation

$0000Last Raised

$150M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-34 points in the past 30 days

About FalconX

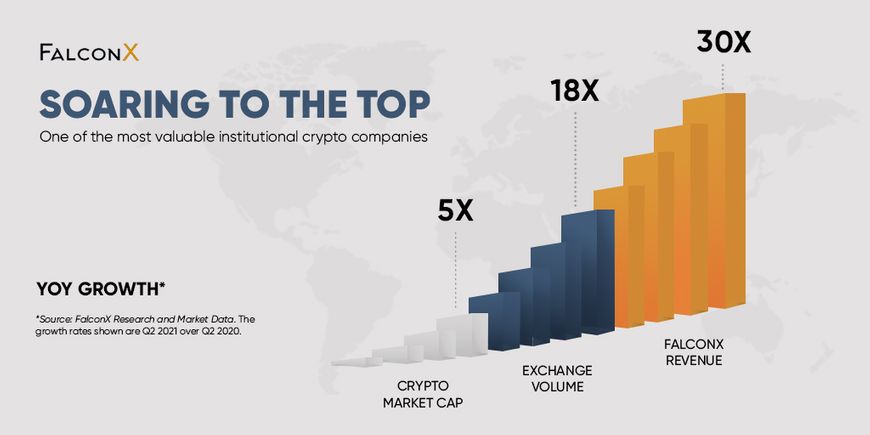

FalconX is a digital asset prime brokerage that provides financial services for institutions. The company offers services including principal liquidity, derivatives, financing, direct market access, exchange-traded (ETF) solutions, and foreign exchange (FX) trading to assist with trading in the crypto market. FalconX serves the institutional finance sector and aims to address the needs of its clients. It was founded in 2018 and is based in San Mateo, California.

Loading...

FalconX's Product Videos

ESPs containing FalconX

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

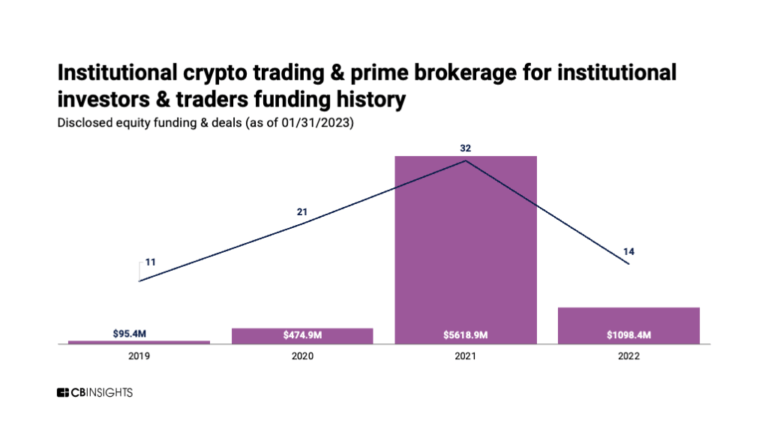

The institutional crypto trading & prime brokerage market is a complex and fragmented market that requires secure and reliable platforms to manage the operational complexity, security, and scale of trading cryptocurrencies. Vendors in this market offer built-in-house proprietary solutions that promise to combine prime brokerage, trade execution, and custody seamlessly. The market aims to unlock th…

FalconX named as Challenger among 15 other companies, including Coinbase, BitGo, and HTX.

FalconX's Products & Differentiators

Satoshi

Satoshi is a first-of-its-kind co-pilot for investors that assists with various trade lifecycle events. From offering real-time news and insights about volatile financial markets to summarizing podcasts and research reports relevant to their investment interests, to providing in-depth portfolio analysis and simulating different trading scenarios, Satoshi helps traders prototype effective investment strategies

Loading...

Research containing FalconX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned FalconX in 4 CB Insights research briefs, most recently on Feb 23, 2023.

Expert Collections containing FalconX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FalconX is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,708 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,450 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Blockchain 50

50 items

Capital Markets Tech

121 items

Latest FalconX News

Mar 28, 2025

They all want them. Mar 28, 2025, 4:46 p.m. UTC It was a bad week for crypto prices, with BTC and ETH both falling and the CoinDesk 20 , which covers 80% of the market, losing 7% since Monday. But less speculative assets showed plenty of volume. Stablecoins, in particular, were the name of the game this week. The U.S. House introduced a stablecoin bil l, following up on the Senate version that was approved by committee last week. Jesse Hamilton reported. Wyoming (aka “The Blockchain State”) wants its own stablecoin and it’s testing the idea on Avalanche, Solana and Ethereum , Kris Sandor reported. World Liberty Financial (WLFI), the financial protocol backed by Donald Trump and his family, confirmed the launch of its stablecoin (USD1) this week. And Don Trump Jr. trumpeted the news at the DC Blockchain Summit. Meanwhile, Fidelity Investment, an early TradFi innovator in crypto, is in the advanced stages of launching its own stablecoin . The venture is part of a strategy to enter the tokenized bond market, Jamie Crawley reported. Meanwhile, Circle, the issuer of the second biggest stablecoin (USDC), has finally secured a license to operate in Japan in partnership with local heavyweight SBI Holdings , Sam Reynolds reported. In news from our Europe team, Ian Allison had a scoop about Sam Altman's World Network holding talks with Visa on linking on-chain card features to a self-custody crypto wallet. Will Canny heard from a source that Sam Hill, Zodia Custody's COO had left and was returning to a role in TradFi . He was able to persuade the Standard Chartered-backed company to confirm the move and we beat the competition with the story. Canny followed up the next day with a story, unreported elsewhere, on the wave of senior staff losses at crypto prime broker FalconX. (BlackRock, by contrast, was adding talent to its digital assets team in the U.S. ) We continued to report on Strategy (MicroStrategy), pioneer of the corporate bitcoin treasury. Christine Lee had a two-hour interview with executive chairman Michael Saylor , where he mused about bitcoin as a $200 trillion asset and promised to burn bitcoin in the name of immortality. Strategy has invested about $33 billion in bitcoin so far through various stock offerings, both common and preferred. And James Van Straten explained the differences between the company's fund-raising instruments for bitcoin purchases. Tom Carreras followed up later with a nice piece showing how MSTR stockholders might be at risk from Saylor’s buy-every-bitcoin strategy. Meanwhile, the SEC continued to drop enforcement actions against crypto companies ( Immutable was the latest , as Cheyenne Ligon reported). But, strangely, one involving Unicoin stayed open, much to the CEO’s chagrin . It almost felt like a normal sort of week — more incremental than monumental. But then the president’s own media company announced that it was launching its own ETFs and ETPs with Crypto.com. Thankfully, crypto still has the power to surprise. Sheldon Reback is CoinDesk editorial's Regional Head of Europe. Before joining the company, he spent 26 years as an editor at Bloomberg News, where he worked on beats as diverse as stock markets and the retail industry as well as covering the dot-com bubble of 2000-2002. He managed the Bloomberg Terminal's main news page and also worked on a global project to produce short, chart-based stories across the newsroom. He previously worked as a journalist for a number of technology magazines in Hong Kong. Sheldon has a degree in industrial chemistry and an MBA. He owns ether and bitcoin below CoinDesk's notifiable limit.

FalconX Frequently Asked Questions (FAQ)

When was FalconX founded?

FalconX was founded in 2018.

Where is FalconX's headquarters?

FalconX's headquarters is located at 1850 Gateway Drive, San Mateo.

What is FalconX's latest funding round?

FalconX's latest funding round is Series D.

How much did FalconX raise?

FalconX raised a total of $427M.

Who are the investors of FalconX?

Investors of FalconX include Tiger Global Management, B Capital, Adams Street Partners, Wellington Management, GIC and 16 more.

Who are FalconX's competitors?

Competitors of FalconX include Bosonic and 7 more.

What products does FalconX offer?

FalconX's products include Satoshi.

Loading...

Compare FalconX to Competitors

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Paxos specializes in regulated blockchain infrastructure and financial solutions within the financial services sector. The company offers a suite of services, including crypto brokerage, stablecoin issuance, and tokenization infrastructure for assets such as gold. Paxos primarily serves enterprises in the financial services industry, providing technology that enables them to launch innovative blockchain and digital asset solutions. It was founded in 2012 and is based in New York, New York.

Sakana AI focuses on developing artificial intelligence through nature-inspired foundation models within the research and development sector. The company's main offering includes creating a new kind of foundation model that draws inspiration from natural intelligence, designed to advance the field of AI. It was founded in 2023 and is based in Tokyo, Japan.

ElevenLabs provides artificial intelligence (AI) audio technology, focusing on text-to-speech and AI voice generation across sectors. It offers tools for the creation of speech and sound effects for applications, including audiobooks and video voiceovers. It serves industries such as media and entertainment, publishing, and sectors requiring audio content creation and localization. It was founded in 2022 and is based in New York, New York.

Hype AI specializes in generative AI technology for the marketing sector. It provides tools designed to enhance content creation and marketing strategies. The company offers a platform that assists in generating various types of marketing content, including email campaigns, blog posts, social media content, and promotional materials. Hype AI's services are primarily utilized by professionals in the marketing and advertising sectors. It was founded in 2023 and is based in San Francisco, California.

Wonder is a research platform that provides insights and expertise to answer business questions across various sectors. The company offers services including competitor moves analysis, regulatory tracking, market trends monitoring, startup activity monitoring, venture capital investment analysis, patent analysis, technology monitoring, and research insights. It was founded in 2012 and is based in Dallas, Texas.

Loading...