Everly Health

Founded Year

2015Stage

Secondary Market | AliveTotal Raised

$255.55MValuation

$0000Last Raised

$75M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-65 points in the past 30 days

About Everly Health

Everly Health is a digital health platform that specializes in diagnostic-driven care and the healthcare sector. The company offers at-home testing kits and digital tools for diagnosing and managing recurring health conditions, providing results online. Everly Health primarily serves the healthcare ecosystem, including individual consumers and enterprise clients. Everly Health was formerly known as Everly Well. It was founded in 2015 and is based in Austin, Texas.

Loading...

ESPs containing Everly Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

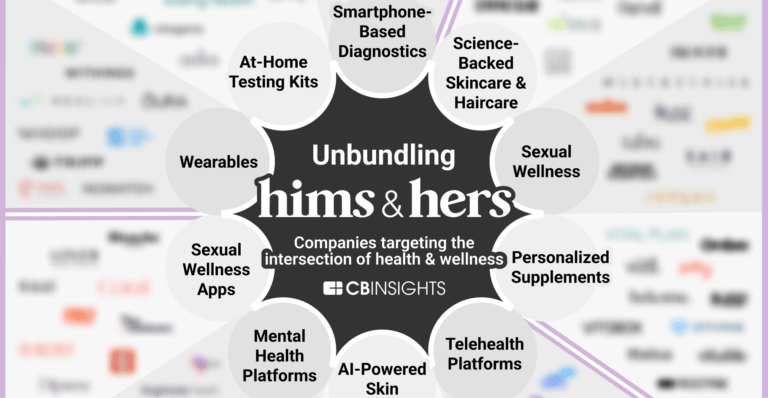

The at-home diagnostic testing platforms market includes companies that provide consumer-friendly testing solutions enabling individuals to collect and analyze biological samples in their own homes. Core solutions encompass a range of testing modalities including blood, urine, saliva, and DNA analysis, supported by digital platforms that deliver lab-certified results, personalized health insights,…

Everly Health named as Highflier among 13 other companies, including Quest Diagnostics, LetsGetChecked, and Function Health.

Loading...

Research containing Everly Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Everly Health in 2 CB Insights research briefs, most recently on Sep 28, 2022.

May 26, 2022

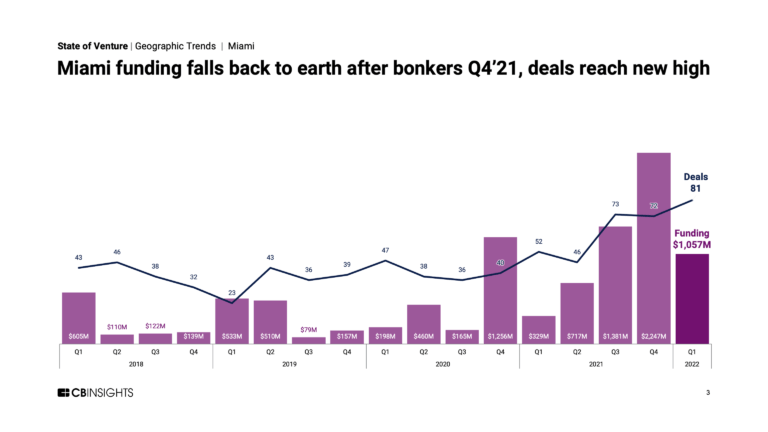

Where are the next US tech hubs?Expert Collections containing Everly Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Everly Health is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Beauty & Personal Care

858 items

These startups aim to provide health treatments, diagnosis tools, and products that do not require a prescription or connection with a health professional to enhance personal wellbeing. This includes supplements, women's health maintenance, OTC medicines, and more.

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Everly Health Patents

Everly Health has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/16/2023 | 2/27/2024 | Grant |

Application Date | 6/16/2023 |

|---|---|

Grant Date | 2/27/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest Everly Health News

Mar 26, 2025

Search jobs 26-Mar-2025 Direct-to-consumer Genetic DNA Tests Market Forecast: 12.1% CAGR to Drive Growth to US$ 5.3 Billion by 2032 – Analysis by VMR Direct-to-consumer Genetic DNA Tests Market Size and Forecast The Direct-to-consumer (DTC) genetic DNA testing market has witnessed exponential growth in recent years, driven by advances in genomic technology, increasing consumer demand for personalized health insights, and heightened awareness of genetic predispositions. These genetic tests, typically conducted via saliva or cheek swabs, provide individuals with the opportunity to access genetic data regarding ancestry, health risks, and personalized wellness recommendations, including optimal nutrition and fitness routines. This shift toward direct-to-consumer (DTC) testing enables consumers to bypass traditional healthcare providers, empowering them to take charge of their health and heritage independently. Pioneered by companies such as 23andMe, AncestryDNA, and MyHeritage, the direct-to-consumer (DTC) genetic testing market has experienced explosive growth in popularity, particularly among millennials and Gen Z, who are more attuned to the concepts of self-care and personalized medicine. The Direct-to-consumer Genetic DNA Tests Market was valued at approximately $2.1 billion in 2023 and is forecast to grow at a Compound Annual Growth Rate (CAGR) of 12.1%, reaching $5.3 billion by 2032. A significant factor in this rapid growth is the decreasing cost of DNA sequencing, which now makes genetic testing more affordable, with tests available for under $100. Furthermore, the integration of telehealth services and the increasing prevalence of chronic diseases have further fueled market expansion. North America currently dominates the market, holding a 45% share, but regions such as the Asia-Pacific are experiencing rapid growth due to increasing disposable income, urbanization, and growing interest in genetic health insights. Learn how this report can boost your revenue - request a sample Highlights of Our Report: Extensive Market Analysis: A comprehensive examination of the manufacturing capabilities, production volumes, and technological innovations within the Direct-to-consumer Genetic DNA Tests Market. Corporate Insights: An in-depth review of company profiles, highlighting major players and their strategic moves in the market's competitive landscape. Consumption Trends: A detailed analysis of consumption patterns, offering insight into current demand dynamics and consumer preferences. Segmentation Details: An in-depth breakdown of end-user segments, illustrating the market's distribution across various applications and industries. Pricing Evaluation: An examination of pricing structures and the factors that influence market pricing strategies. Future Outlook: Predictive insights into market trends, growth prospects, and potential challenges ahead. Market Drivers The growth of the direct-to-consumer (DTC) genetic DNA testing market is driven by several key factors. First and foremost is the consumer demand for personalized healthcare. By 2023, more than 30 million users are expected to have undertaken at-home genetic tests, leading to an increasing demand for insights into their health, wellness, and ancestry. A growing interest in proactive healthcare, spurred by the surge in global health consciousness during the COVID-19 pandemic, has fueled demand for these tests. Additionally, technological advancements, such as CRISPR gene-editing technology and AI-powered data interpretation, have contributed to the increased accuracy, affordability, and accessibility of genetic testing services. The partnerships between DTC test companies and pharmaceutical giants further stimulate market growth. For instance, the collaboration between 23andMe and GlaxoSmithKline (GSK) focuses on leveraging genetic databases for drug discovery, which provides DTC genetic testing companies with new revenue streams and expanded services. Furthermore, social media influencers and celebrities sharing their personal DNA test results have helped normalize and popularize genetic testing among a wider demographic, particularly younger consumers. As a result, millennials and Gen Z have become key adopters of these tests, further driving demand in the wellness segment, which is the fastest-growing aspect of the market. Additionally, increasing support from insurers and employers, who are beginning to offer subsidies for genetic tests as part of their preventive healthcare plans, has expanded the accessibility of these tests to a wider audience. This, combined with the growing awareness of how genetics can influence wellness, nutrition, and even skincare, contributes to the rise in market adoption. Market Overview According to analysts at Vantage Market Research, the Global Direct-to-Consumer Genetic DNA Tests Market is valued at USD 2.1 billion in 2023 and is projected to reach a value of USD 5.3 billion by 2032, at a compound annual growth rate (CAGR) of 12.1% between 2024 and 2032. This comprehensive market report covers the entire DTC genetic testing landscape from 2024 to 2032. It provides a 360-degree analysis of market dynamics, trends, and opportunities across regions and segments. The report is specifically designed for investors, biotech companies, and policymakers, providing valuable insights into market entry strategies, product development, and investment opportunities. Additionally, the report includes data on patents, mergers and acquisitions, and key collaborations within the industry, helping stakeholders make informed strategic decisions. Competitive Landscape The direct-to-consumer (DTC) genetic DNA testing market is highly concentrated, with a few key players dominating the space. 23andMe (30% market share) and AncestryDNA (25%) are the two largest players, followed by smaller but growing companies such as Nebula Genomics and Color Genomics. The market is characterized by heavy competition, not just on pricing but also on innovation, with some companies differentiating themselves by offering whole-genome sequencing or clinical-grade health tests. Key strategic initiatives in the market include partnerships, acquisitions, and the development of new testing methodologies. For instance, 23andMe has integrated telehealth services into its platform, allowing users to discuss test results with healthcare providers. Similarly, companies like Everlywell are diversifying their offerings to include other health-related tests such as hormone and STD tests. New entrants and startups, such as Vinome (wine preference genetics) and GenoPalate (personalized nutrition), are targeting niche markets, further intensifying competition. Top 12 Companies Market Challenges Despite the rapid growth, the DTC genetic DNA testing market faces several challenges that could impact its long-term trajectory. One of the most significant concerns is data privacy. The highly sensitive nature of genetic data has raised concerns about its misuse, particularly following high-profile breaches, such as the 2022 MyHeritage breach, where over 92 million user records were exposed. The growing amount of genetic data being stored by companies heightens the risk of data theft, raising concerns about how these companies protect users' genetic information. Moreover, the market is challenged by regulatory fragmentation, as different countries have distinct regulations governing genetic testing. In the United States, the FDA requires approval for health-related genetic tests, whereas in the European Union, the General Data Protection Regulation (GDPR) imposes strict restrictions on the use of personal data. Navigating these diverse regulatory landscapes can be challenging for companies seeking to operate globally. Additionally, there is a risk of misinterpretation of genetic results, especially in the context of health-related findings. Without proper genetic counseling, consumers may overreact to potential health risks (e.g., a false-positive result for a genetic predisposition to a condition like cancer). This can lead to unnecessary stress or even inappropriate lifestyle changes based on inaccurate information. Moreover, the ethical concerns surrounding genetic testing—ranging from genetic discrimination by employers or insurers to debates on genetic engineering and "designer babies"—pose potential barriers to wider acceptance of these services. The competitive nature of the market poses another challenge. With the increasing number of players entering the market, price wars have emerged, forcing smaller companies to offer lower prices, which can squeeze their margins and impact their ability to invest in innovation and quality. Segment Overview The DTC genetic DNA testing market can be segmented into several categories, providing deeper insights into its diverse consumer base and market dynamics. By Test Type: Ancestry Testing (40% market share): This segment is led by services such as AncestryDNA, which offers users ethnicity estimates and family tree matching. Health Risk Testing (35%): Companies like 23andMe dominate this segment, offering FDA-approved reports on genetic risks associated with conditions such as Alzheimer's, BRCA mutations, and others. Wellness Testing (25%): This category, which encompasses tests for nutrigenomics and skincare, is experiencing rapid growth, particularly among health-conscious consumers seeking to optimize their lifestyle based on genetic insights. By Demographics: Consumers aged 25–34 years represent the largest demographic (45% of users), with a focus on preventive health and personal wellness. By Region: North America remains the dominant region, with the largest share (45%), but the Asia-Pacific region is expected to be the fastest-growing, with countries such as China and India experiencing rising demand due to urbanization and increased disposable income. By Distribution Channel: The majority of sales (75%) come from online platforms, although retail partnerships, such as those with Walmart, are expanding the reach of these tests into more rural and underserved areas. Exclusive 30% Instant Discount on Direct Purchases @ https://www.vantagemarketresearch.com/buy-now/direct-to-consumer-relationship-dna-tests-market-0487/0 Why Should You Obtain This Report? Statistical Advantage: Gain access to vital historical data and projections for the Mesenchymal Stem Cells Market, arming you with key statistics. Competitive Landscape Mapping: Identify and analyze the roles of market players, offering a comprehensive view of the competitive landscape. Insight into Demand Dynamics: Gain comprehensive information on demand characteristics, uncovering market consumption trends and identifying growth opportunities. Identification of Market Opportunities: Accurately recognize market potential, enabling stakeholders to make informed strategic decisions. Acquiring this report ensures you are equipped with the most current and trustworthy data, sharpening your market strategies and securing a well-informed stance in the complex domain of the Mesenchymal Stem Cells industry. Each report is meticulously prepared, guaranteeing that our clients receive the critical intelligence needed to excel in this evolving market. Research Analysis Market research in this industry involves both primary and secondary data analysis. Primary research involves conducting interviews with industry leaders, healthcare providers, and consumers, while secondary research utilizes company reports, industry publications, and academic studies. Analytical frameworks, such as Porter’s Five Forces, reveal intense competition, with low differentiation between many products and high entry barriers due to regulatory costs. The SWOT analysis further highlights the strengths of technological innovation in DNA testing, as well as weaknesses such as privacy concerns and the challenge of ensuring data security. Trends in the market include the use of AI-powered analytics to predict health outcomes and the adoption of blockchain technology to secure consumer data. According to a 2023 consumer survey, while 68% of users trust DTC genetic tests for ancestry purposes, only 32% would rely on the results for making medical decisions, underscoring the need for consumer education and reassurance regarding the clinical validity of health-related findings. Conclusion The DTC genetic DNA tests market is poised for transformative growth, driven by technological innovation, consumer demand for personalized health information, and evolving industry dynamics. However, challenges related to data privacy, regulatory compliance, and ethical concerns must be addressed to ensure long-term market sustainability. With the market projected to reach $5.3 billion by 2032, stakeholders must prioritize consumer education, data security, and transparency to harness the potential of this rapidly expanding industry fully. Explore Detailed Insights on the Global Direct-to-consumer Genetic DNA Tests Market @ https://www.vantagemarketresearch.com/industry-report/direct-to-consumer-relationship-dna-tests-market-0487 Questions Answered by the Report: Who are the dominant players in the Direct-to-Consumer Genetic DNA Tests Market? What will be the size of the Direct-to-consumer Genetic DNA Tests Market in the coming years? Which segment will lead the Direct-to-consumer Genetic DNA Tests Market? How will market development trends evolve over the next five years? What is the nature of the competitive landscape of the Direct-to-consumer Genetic DNA Tests Market? What are the go-to strategies adopted in the Direct-to-consumer Genetic DNA Tests Market? Browse more health care industry News

Everly Health Frequently Asked Questions (FAQ)

When was Everly Health founded?

Everly Health was founded in 2015.

Where is Everly Health's headquarters?

Everly Health's headquarters is located at 823 Congress Avenue, Austin.

What is Everly Health's latest funding round?

Everly Health's latest funding round is Secondary Market.

How much did Everly Health raise?

Everly Health raised a total of $255.55M.

Who are the investors of Everly Health?

Investors of Everly Health include HealthQuest Capital, Highland Capital Partners, Goodwater Capital, The Chernin Group, Morningside Venture Partners and 15 more.

Who are Everly Health's competitors?

Competitors of Everly Health include LetsGetChecked, imaware, Hello Cake, Viome, Molecular You and 7 more.

Loading...

Compare Everly Health to Competitors

LetsGetChecked is a virtual care company that provides at-home health testing and telehealth services. The company offers a variety of health tests with online results, virtual consultations, and prescription medication delivery. LetsGetChecked serves individuals seeking healthcare solutions and organizations looking for employee wellness programs. It was founded in 2015 and is based in New York, New York.

Ash Wellness specializes in at-home diagnostic testing and the integration of remote healthcare services within the healthcare industry. The company offers an end-to-end solution that includes white-labeled test kits, a HIPAA-compliant telehealth platform, and API infrastructure to facilitate at-home testing for patients. Ash Wellness primarily serves sectors such as universities, public health, pharmaceutical companies, digital health, and medical institutions. It was founded in 2019 and is based in New York, New York.

Thriva operates as a healthcare platform that provides personalized health tests. It is a digital health business that provides tests to monitor and track a range of biomarkers, from gut health to heavy metals to hormones, to help people understand the state of their health. It offers finger-prick blood tests that can be done at home. The company was founded in 2016 and is based in London, United Kingdom.

Color specializes in genetic testing and health services. It focuses on early detection and management of cancer and hereditary diseases. The company offers genetic screenings to assess the risk for hereditary cancer and heart conditions, as well as services to understand medication responses, aiming to facilitate preventative health measures and personalized care plans. Color primarily serves employers, health plans, unions, and clinicians, providing them with tools to manage the health of their populations. Color was formerly known as Color Global. It was founded in 2014 and is based in Burlingame, California.

DasLab provides a digital infrastructure for point-of-care diagnostics. The company onboards lab testing facilities, lab takers, and logistics providers onto its platform. The company was founded in 2020 and is based in Munich, Germany.

Mira provides hormone testing and monitoring within the healthcare sector. The company offers products, including hormone tests, supplements, and consultations, to assist individuals in their fertility journeys. Mira's services address various health goals such as getting pregnant, managing hormones, and navigating menopause. It was formerly known as Quanovate. It was founded in 2014 and is based in San Ramon, California.

Loading...