Carta

Founded Year

2012Stage

Valuation Change | AliveTotal Raised

$1.158BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-35 points in the past 30 days

About Carta

Carta provides tools for private equity and venture capital within the financial services industry. The company offers a fund administration platform that includes services such as capitalization table management, valuations, tax compliance, and equity program management for private businesses. Carta serves the private capital market, including investors, limited partners, and portfolio companies. Carta was formerly known as eShares. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Carta

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

Private capital fund management solutions help venture capital (VC) and private equity (PE) firms manage their investment portfolios and operations more efficiently. These platforms typically include features for deal flow management, portfolio monitoring, capital call administration, investor reporting, and performance analytics. The software replaces spreadsheets with centralized systems that im…

Carta named as Leader among 10 other companies, including FactSet, Intapp, and Allvue Systems.

Loading...

Research containing Carta

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Carta in 3 CB Insights research briefs, most recently on Jan 3, 2024.

Jan 3, 2024

2024 prediction: Rippling acquires Pulley

Dec 22, 2022 report

The top 50 angel investing groupsExpert Collections containing Carta

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

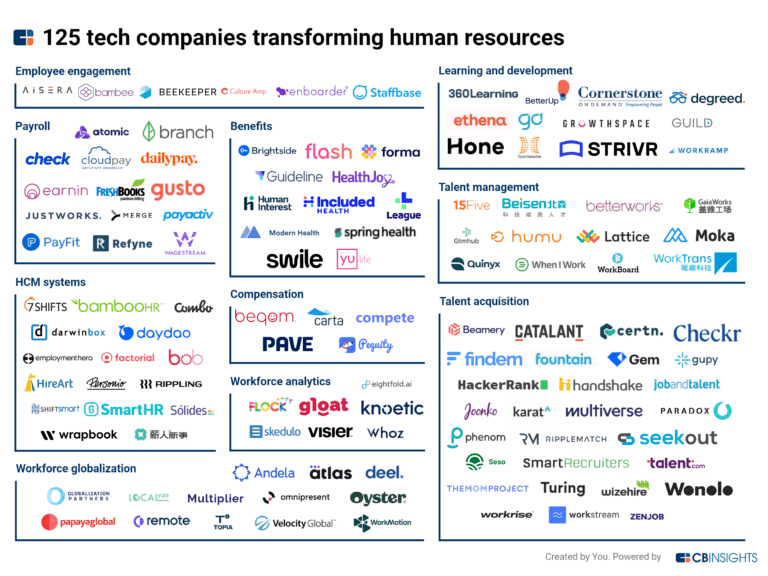

Carta is included in 8 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,161 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

SMB Fintech

1,231 items

Tech IPO Pipeline

568 items

Carta Patents

Carta has filed 2 patents.

The 3 most popular patent topics include:

- 3d computer graphics

- 3d imaging

- automotive safety technologies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/5/2021 | 2/20/2024 | 3D imaging, Geodesy, Computer vision, Stereophotogrammetry, 3D computer graphics | Grant |

Application Date | 3/5/2021 |

|---|---|

Grant Date | 2/20/2024 |

Title | |

Related Topics | 3D imaging, Geodesy, Computer vision, Stereophotogrammetry, 3D computer graphics |

Status | Grant |

Latest Carta News

Mar 12, 2025

Fusion Ventures published an interesting report on the state of pre-seed in Israel in 2025 . We at Remagine Ventures happy to participate alongside fellow Israeli-pre-seed funds. I’ve waded through the data and wanted to share the main takeaways for founders who are raising or looking to raise pre-seed rounds. It’s good timing as Carta and Concept Ventures released similar reports on Pre-seed in the last couple of weeks so it’s a good opportunity to compare and contrast with the US and UK markets. In a nutshell Pre-Seed is Still Very Much a Thing: Deals are happening. Money is flowing. No groundbreaking news here, but confirmation that even in these times, early stage is still kicking. Almost exactly one year ago, I wrote a blog post on the rise in pre-seed rounds and it’s nice to see it validated in this report. AI, AI, Everywhere (But Is It Really AI? ): AI is the word of the day, the week, the year, probably the decade. The report highlights a massive chunk of pre-seed ventures pitching themselves as AI-powered. But not all AI companies are the same and the report does a good job defining the differences. Israeli Pre-Seed Characteristics: Fast, Focused, and (Slightly) Smaller Rounds: Israel being Israel, things are moving quickly. Rounds are getting done, but the report hints at a more pragmatic approach – maybe slightly smaller rounds, definitely focused on very specific problems. Is it really AI if you’re just using an API? This “AI” thing. It’s the elephant in every Zoom room, the buzzword in every pitch deck. Fusion Ventures’ report, like most we’re seeing, shows a dominance of AI-related ventures at the pre-seed stage. But not all AI is created equal. Within the pre-seed landscape, there two primary categories of AI-related ventures: Core AI Development: This category encompasses ventures focused on fundamental advancements in artificial intelligence. These are characterised by the development of novel algorithms, foundational models, and core machine learning technologies. These ventures represent deep technology initiatives, often requiring significant research and development, even at the pre-seed stage. AI-Enabled Applications: The majority of ventures leveraging AI at the pre-seed stage fall into this category. These companies are characterised by the application of existing AI models, APIs, and frameworks to address specific challenges within vertical markets. The ‘Use AI’ vs. ‘Develop AI’. This approach is basically the application layer: it focuses on leveraging established AI technologies to enhance product functionality, optimise processes, or create innovative applications across diverse sectors. It is crucial to recognise that while these ventures capitalise on the current AI trend, their core innovation may reside in market application and business model rather than fundamental AI breakthroughs. Comparing Israel with US and Europe Pre-seed valuations average $6.45M post-money (median $6M), with typical funding rounds ranging from $825K to $1.5M. For pre-seed investments, more than half of VCs now exclusively use post-money SAFE agreements. The structure of pre-seed rounds in 2024 shows more VCs participating with smaller check sizes, while fewer angels are making larger individual investments. Before investing, over two-thirds of investors (both VCs and angels) require founders to commit to full-time work for a specified period. More than half of pre-seed investment in 2025 went towards application-layer AI solutions and vertical AI. A picture is worth 1,000 words: Pre-seed in the USA Fusion’s findings are more or less in line with Carta’s ‘ State of Pre-seed 2024 ‘ report published two weeks ago, based on mainly US data. In US pre-seed rounds: Pre-seed activity grew in Q1 and Q2 of 2024 but proceeded to decline in the 2nd half of 2024 Steady valuation caps: Median valuation caps for post-money SAFEs have remained relatively stable, sitting at $10 million for rounds between $500,000 and $1 million. 90% of SAFEs have a valuation cap and over half of them have a discount Pre-seed in Europe Conveniently, this week Concept Ventures published ‘Zero to One’ a report focused on pre-seed activity in Europe analysing data from 2018 to 2024. 66% of pre-seed rounds were done in ASAs (Advanced Subscription Agreements, the UK’s equivalent to SAFEs) The average pre-seed round is about $600,000 The average number of investors per round dropped from 10-11 in 2020-2021 to 6-7 in 2024 Average Pre-money valuation in UK pre-seed rounds stands at approximately $4.8M USD (£3.75M GBP) Takeaways for Founders My advice for founders is that the bar for raising each round (seed, series A) has risen and therefore the role of the pre-seed round or inception round is to help the founders build a strong initial team, build their MVP and get their early traction going. To minimise dilution impact, founders need to understand what are the milestones they are expected to achieve and build a budget for the pre-seed that enables them to get there. Some mistakes to avoid: avoid raising SAFEs on top of SAFEs. You can alternative between SAFE and equity rounds, but the dilution impact of several consecutive SAFE notes can be too great. Finally, when thinking about valuation, try to avoid ego and aim for being able to double of triple the valuation of your startup between rounds. If you start from a reasonable price, that shouldn’t be a problem. But founders that optimise for a high valuation in their pre-seed round, might find it hard to justify such a jump within 12 to 18 months of raising, so be aware.

Carta Frequently Asked Questions (FAQ)

When was Carta founded?

Carta was founded in 2012.

Where is Carta's headquarters?

Carta's headquarters is located at 333 Bush Street, San Francisco.

What is Carta's latest funding round?

Carta's latest funding round is Valuation Change.

How much did Carta raise?

Carta raised a total of $1.158B.

Who are the investors of Carta?

Investors of Carta include Silver Lake, SierraMaya360, Fidelity International Strategic Ventures, Premji Invest, Foothill Ventures and 37 more.

Who are Carta's competitors?

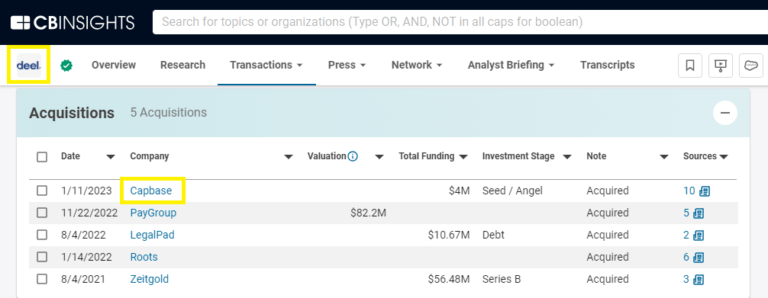

Competitors of Carta include Qapita, Aption, Nasdaq Private Market, Capbase, Shoobx and 7 more.

Loading...

Compare Carta to Competitors

Shareworks is a company that focuses on providing workplace financial solutions, operating within the financial services industry. The company offers a range of services including equity plan administration, retirement readiness programs, deferred compensation plan services, and executive services, all designed to help employees achieve their financial goals and companies to grow. The company primarily serves sectors such as private companies, public companies, and strategic partners. It was founded in 1999 and is based in New York, New York.

Pulley operates as an equity management platform for fundraising. The company offers solutions including cap table management, fundraising modeling, crypto and tokens, a communications hub, and more. It primarily serves the financial services sector. The company was founded in 2019 and is based in Oakland, California.

Upstock specializes in equity management solutions within the financial technology sector. It offers RSU-based equity plans and a platform for real-time tracking and management of worker equity, designed to empower founders and team members to align and achieve collective success. Upstock primarily serves startups, legal experts, contractors, and companies looking to integrate equity into their compensation and culture. It was founded in 2019 and is based in Wilmington, Delaware.

Ledgy is an equity management platform that specializes in streamlining equity-related processes for businesses. The company offers solutions for cap table management, equity plan automation, and financial reporting, designed to simplify workflows, ensure compliance, and enhance employee engagement through intuitive dashboards. Ledgy's platform is tailored to serve various sectors, including HR and compensation, finance and accounting, and legal and operations. It was founded in 2017 and is based in Zurich, Switzerland.

Aption specializes in equity pooling solutions within the financial services sector. The company offers services that allow individuals to leverage their equity positions to access investment opportunities in other startups. Aption was formerly known as Apeiros. It was founded in 2022 and is based in Scottsdale, Arizona.

EquityZen develops an investment platform. It connects shareholders of private companies with investors seeking alternative investments. It enables clients to provide the opportunity to invest in large private firms and address liquidity and risk concerns. It was founded in 2013 and is based in New York, New York.

Loading...