Epirus

Founded Year

2018Stage

Series D | AliveTotal Raised

$541.86MLast Raised

$250M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+112 points in the past 30 days

About Epirus

Epirus operates as a technology company that focuses on developing electronic warfare and directed energy systems within the defense and commercial sectors. The company offers solid-state, software-defined high-power microwave (HPM) systems that provide counter-electronics effects and power management solutions, leveraging artificial intelligence and advanced electronics. Epirus primarily serves government, communications, energy, and security markets with its technology solutions. It was founded in 2018 and is based in Torrance, California.

Loading...

Epirus's Product Videos

Epirus's Products & Differentiators

Epirus SmartPower (Intelligent Power Management Platform)

SmartPower by Epirus is the industry’s first full-stack hardware, software and AI services platform for the digital era of power and energy. By incorporating a purpose-built portfolio of hardware, software and embedded technology with patented sense-and-control techniques, our solutions deliver unparalleled management and efficiency outcomes across a wide spectrum of industries.Example markets and applications: Counter-UAS systems, Expeditionary power, Radar, High-power microwave, Intelligent microgrids, Directed energy, JADC2 development, Solid state amplifiers, Vehicle electrification, Energy 4.0 applications, Transmit/receive modules, Grid enhancing technologies, 5G and Next-G base stations, Wide-area wireless charging, Counter electronics, Milcom wireless, Carbon thermolysis and wireless ad hoc networks.

Loading...

Research containing Epirus

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Epirus in 1 CB Insights research brief, most recently on Aug 14, 2024.

Aug 14, 2024

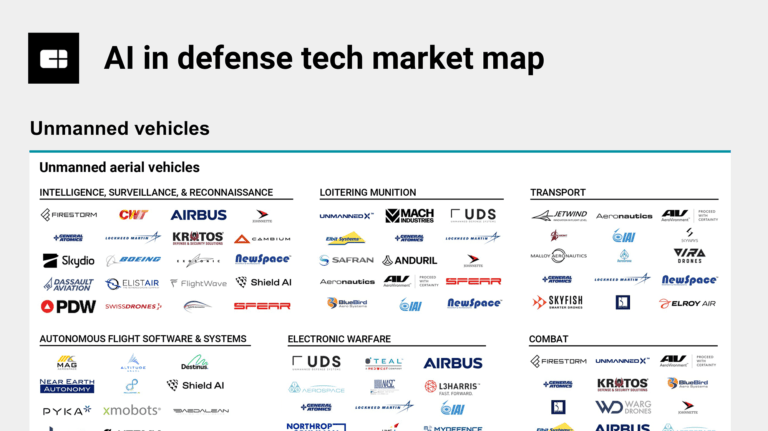

The AI in defense tech market mapExpert Collections containing Epirus

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Epirus is included in 4 Expert Collections, including Energy Management Software.

Energy Management Software

677 items

Companies creating software to help manage, optimize, and automate energy management and optimization.

Unicorns- Billion Dollar Startups

1,270 items

Defense Tech

1,020 items

Defense tech is a broad field that encompasses everything from weapons systems and equipment to geospatial intelligence and robotics. Company categorization is not mutually exclusive.

Artificial Intelligence

9,986 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Epirus Patents

Epirus has filed 34 patents.

The 3 most popular patent topics include:

- radio electronics

- broadcast engineering

- electronic amplifiers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/20/2023 | 3/4/2025 | Radio electronics, Vacuum tubes, Electronic circuits, Electronic amplifiers, Semiconductor device fabrication | Grant |

Application Date | 9/20/2023 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Radio electronics, Vacuum tubes, Electronic circuits, Electronic amplifiers, Semiconductor device fabrication |

Status | Grant |

Latest Epirus News

Mar 29, 2025

Venture capital-backed, $1bn companies are disrupting the way war will be waged with AI and futuristic weapons. Will they overthrow the traditional big military manufacturers, and what would that mean for the battlefield? Visit tech startup Skydio’s headquarters on the San Francisco peninsula in California and you’re likely to find flying robots buzzing on the roof overhead. Docking stations with motorised covers open to allow small drones that resemble the TIE fighters from Star Wars films to take off; when each drone lands back again, they close. The drones can fly completely autonomously and without GPS, taking in data from onboard cameras and using AI to execute programmed missions and avoid obstacles. Skydio, with more than $740m in venture capital funding and a valuation of about $2.5bn, makes drones for the military along with civilian organisations such as police forces and utility companies. The company moved away from the consumer market in 2020 and is now the largest US drone maker. Military uses touted on its website include gaining situational awareness on the battlefield and autonomously patrolling bases. Just across the water from its headquarters is Skydio’s manufacturing facility, where about 200 workers assemble hundreds of drones a month, including the defence model. The company has agreements to supply its drones to the US defence department, as well as 24 US allies, and they have been used by the Ukrainian military fighting Russia. “It is an absolute certainty that small, inexpensive, software-defined systems with rapid iteration are the future of defence,” says Adam Bry, Skydio’s co-founder and chief executive. It is an absolute certainty that small, inexpensive, software-defined systems with rapid iteration are the future of defence Adam Bry, Skydio co-founder and chief executive Skydio is one of a number of new military technology unicorns – venture capital-backed startups valued at more than $1bn – many led by young men aiming to transform the US and its allies’ military capabilities with advanced technology, be it straight-up software or software-imbued hardware. The rise of startups doing defence tech is a “big trend”, says Cynthia Cook, a defence expert at the Center for Strategic and International Studies, a Washington-based-thinktank. She likens it to a contagion – and the bug is going around. According to financial data company PitchBook, investors funnelled nearly $155bn globally into defence tech startups between 2021 and 2024, up from $58bn over the previous four years. The US has more than 1,000 venture capital-backed companies working on “smarter, faster and cheaper” defence, says Dale Swartz from consultancy McKinsey, adding that Europe has seen an uptick in defence tech startups too. While most of the funding has gone to US-based companies, some, such as German startup Helsing, have seen significant amounts. Yet a sector set on reinventing defence with Silicon Valley values also raises concerns, including whether it could bring us closer to war – and Donald Trump looms large. A Skydio drone returning to the startup’s rooftop dock. Photograph: Skydio As the upstart defence industry sees it, the current system is not set up to meet the needs of the modern war fighter. We are entering a new era where machines go to war, albeit working with humans, and there is a huge need for autonomy and AI that the “defence primes” – the massive companies the defence department has traditionally partnered with to build ships, planes, tanks and strategic deterrence weaponry such as Lockheed Martin, RTX and Boeing – do not have the right muscles to deliver. As a result, the US risks losing its edge in its ability to respond, which is something the startups say they can help fix. And the potential rewards are enormous. The US spends about $850bn annually on its military , approximately half of which goes on procuring new items or maintaining old equipment, while the total military spending globally is more than $2.4tn – an amount set to rise significantly as Europe assumes an increased burden for its own security. Not, says the defence startup sector, that it is just about money. Imbuing it is a zeal to help the US and its allies retain a military advantage over their adversaries in an increasingly dangerous world. “The engineering elite of Silicon Valley has an affirmative obligation to participate in the defence of the nation,” states the preface of The Technological Republic , a new book by Alex Karp, which can be viewed as a manifesto for the fast-rising industry. Karp is the chief executive and co-founder, along with billionaire Peter Thiel, of AI-driven software company Palantir Technologies , which, with Elon Musk’s SpaceX, is seen as a trailblazer for the upstart industry. And the sector is bullish about its prospects under the Trump administration, which has signalled it wants to revamp and modernise procurement. Their approach, say the startups, can deliver more for less money. The types of technologies the defence upstarts are working on are many and varied, though autonomy and AI feature heavily. To give a flavour, in addition to autonomous aerial drones such as Skydio’s, there are those that travel on the surface of the sea and underwater, as well as generative AI to enhance military planning and decision making, AI-powered counter-drone technology, autonomous strike weapons and even AI pilots for fighter jets, negating the need for human ones. One startup known for its aggressive and rapid expansion is southern California-based Anduril Industries . The company, which has received $3.7bn in venture capital funding and is valued at $14bn, was co-founded in 2017 by the inventor of the Oculus Rift virtual reality headset, Palmer Luckey. The business, which is focused on autonomous systems and weapons – including the Thunderbird-like Fury war fighter – is building a manufacturing facility in Ohio and is also reportedly planning a drone factory in the UK to serve as a European base. It is only in the past few years that defence has come to be seen as a viable market for startups. The prevailing belief before that was the US defence department was limited to working with the primes. Defence tech startup Epirus is developing its Leonidas high-power microwave counter-drone system. Photograph: Courtesy of Epirus/Skydio Yet the lion’s share of the funding is still going to the primes, the startups complain. The industry is “emerging fast in the outside world, but not so fast in terms of budgetary reassignment”, notes Andy Lowery, chief executive of Epirus, another high-valuation startup that is focused on disabling swarms of many thousands of attack drones using high-energy microwave forcefields, and is working with the British military’s Army Futures directorate on how the technology may be useful to the UK. The problem – and what needs to be disrupted, many in the emerging sector argue – is the US defence department’s antiquated system of military acquisition and procurement, which has long budget planning cycles and is oriented towards buying large, expensive, static hardware systems that can take many years to come to fruition and leave little space for innovation because the contracts are so overly prescriptive. US defence tech unicorn Shield AI is focusing on developing AI pilots. Photograph: Courtesy Shield AI The defence department is “very stuck in old cold war ways of doing things”, says Michael Brown, a partner at venture company Shield Capital and the former director of the US military’s defence innovation unit (DIU). And that strategy does not work well when threats are changing rapidly and new technology needs to be leveraged. Ryan Tseng, co-founder and chief executive of Shield AI, a defence tech unicorn focusing on AI pilots, agrees that military acquisition is overdue a shake-up. Tseng would like to see “millions of AI pilots”, so the US and its allies are ready for the future of war. “[But] at the moment it is basically at zero adoption,” he says. Another defence tech startup Castelion, also based in southern California, was founded in 2022 by former SpaceX employees and is pursuing autonomous strike weapons: hypersonic long-range missiles with AI capabilities. Hypersonic weapons – of which China has the world’s leading arsenal – can travel at above five times the speed of sound and though the US doesn’t have any yet, it is actively developing them with some of the primes. Castelion has won military contracts to build and test its prototypes, and in January announced its first big funding round of $100m to accelerate test cycles and build production facilities. Castelion’s approach is different from what the US is known for, says Bryon Hargis, its co-founder and chief executive. Rather than build limited numbers of costly and long-lasting systems with exquisite, high-end capabilities, Castelion wants to manufacture fear-inspiring quantities of low-cost “sufficiently capable weapons” – an approach, he says, that will “actually achieve a deterrent effect”. It is hoping to deliver its first weapons at scale in 2027, which would be exceedingly fast.

Epirus Frequently Asked Questions (FAQ)

When was Epirus founded?

Epirus was founded in 2018.

Where is Epirus's headquarters?

Epirus's headquarters is located at 19145 Gramercy Place, Torrance.

What is Epirus's latest funding round?

Epirus's latest funding round is Series D.

How much did Epirus raise?

Epirus raised a total of $541.86M.

Who are the investors of Epirus?

Investors of Epirus include 8VC, General Dynamics Land Systems, Gaingels, T. Rowe Price, Stepstone Group and 23 more.

Who are Epirus's competitors?

Competitors of Epirus include CAES and 6 more.

What products does Epirus offer?

Epirus's products include Epirus SmartPower (Intelligent Power Management Platform) .

Loading...

Compare Epirus to Competitors

Critical Frequency Design specializes in advanced photonics communications and sensing solutions within the defense industry. The company offers services and products such as free-space optical communication systems, microwave photonics, and various engineering services aimed at enhancing military capabilities. Critical Frequency Design primarily serves the defense sector, providing technologies that support warfighters in contested environments. It was founded in 2011 and is based in Melbourne, Florida.

NewSpace Research and Technologies operates as an aerospace and defense research and development company that creates unmanned aerial systems. The company is involved in the design and development of high-altitude pseudo satellites and drones for earth observation and communications, with operational altitudes and endurance capabilities from a few days to months. NewSpace Research and Technologies serves sectors such as the Indian Ministry of Defence, National Disaster Response Force, and the Ministry of Home Affairs. It was founded in 2017 and is based in Bengaluru, India.

Antenna Research Associates is involved in the design, development, and manufacturing of antennas and radio frequency systems for military and civilian applications. The company provides products including antennas for communication networks, satellite communication, radar, and electronic warfare, addressing defense and civilian markets. It was founded in 1963 and is based in Laurel, Maryland.

Teledyne Defense Electronics provides solutions for the defense, space, and commercial sectors. The company offers products including avionics, energetics, electronic warfare systems, missile components, radar, satellite communications, space systems, and test and measurement equipment. It is based in Rancho Cordova, California.

Collins Aerospace is a company focused on innovative aerospace solutions across various sectors of the industry. They offer a wide range of products and services that enhance passenger safety and comfort, facilitate mission success, support space exploration, and improve operational efficiency and sustainability. Collins Aerospace serves the commercial aviation, business aviation, military and defense, helicopter, and space industries, as well as airports and air traffic management. It was founded in 2018 and is based in Charlotte, North Carolina.

Archangel Imaging develops and deploys AI systems within the defense and security sectors. The company provides sensing solutions for drones and unmanned systems, allowing them to operate in outdoor environments and providing threat detection and response capabilities. Archangel Imaging's technology is used in law enforcement, wildlife protection, and energy infrastructure monitoring. It was founded in 2016 and is based in Oxfordshire, England.

Loading...