dtcpay

Founded Year

2019Stage

Angel | AliveTotal Raised

$16.5MLast Raised

$16.5M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+47 points in the past 30 days

About dtcpay

dtcpay is a regulated payment service provider operating in the digital payment solutions industry. The company offers a range of services including multi-currency swaps, online payment transaction processing, and point-of-sale solutions, enabling businesses to accept both fiat and digital currencies. dtcpay primarily serves sectors such as automotive, healthcare, travel and hospitality, retail, and professional services. It was founded in 2019 and is based in Singapore.

Loading...

ESPs containing dtcpay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

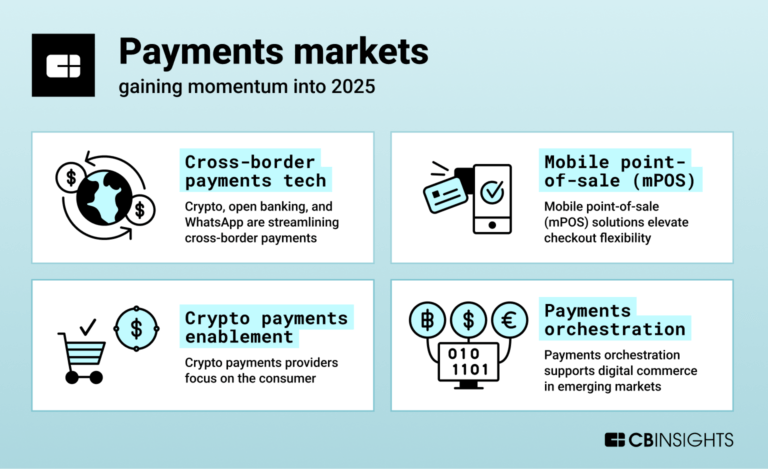

The crypto payment acceptance market offers solutions to help businesses and consumers process and convert cryptocurrency payments. The tools are especially useful for cross-border payments, where using fiat currencies might still be slow or expensive. Some of the solutions also enable users to buy or sell cryptocurrencies.

dtcpay named as Challenger among 15 other companies, including Coinbase, Nuvei, and PayPal.

Loading...

Research containing dtcpay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned dtcpay in 2 CB Insights research briefs, most recently on Mar 28, 2025.

Expert Collections containing dtcpay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

dtcpay is included in 2 Expert Collections, including Payments.

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,661 items

Excludes US-based companies

Latest dtcpay News

Mar 3, 2025

Monday 3 March 2025 12:25 CET | News Worldwide Stablecoin Payment Network ( WSPN ) has announced that its stablecoin, WUSD, is now accepted at Metro Department Store through dtcpay ’s payment solution. This partnership aims to bring stablecoin technology to mainstream retail, as shoppers at Singapore’s department stores can now purchase using WUSD. Accelerated adoption of WUSD The integration follows dtcpay's recently announced partnership with Metro Department Store, which enables customers to pay with stablecoins such as USDT, USDC, and WUSD. This allows shoppers to pay directly with WUSD at checkout, creating a simpler experience that makes digital assets more accessible and practical for everyday use. The expansion of WUSD acceptance as a stablecoin pegged to the US dollar at a 1:1 ratio and backed by fiat currency reserves highlights the growing utility of stablecoin 2.0 in real-world retail environments, according to WSPN. The company expects to observe further adoption across the broader market as more customers conveniently use WUSD for retail purchases. Latest updates from dtcpay The new development builds upon dtcpay’s partnership with WSPN announced in October 2024, which established WUSD as a digital payment option within dtcpay's expanding merchant network. In December 2024 , dtcpay discontinued its support for cryptocurrencies in favour of stablecoins. The platform now supports Tether's USDt, Circle's USD Coin (USDC), First Digital USD (FDUSD) and Worldwide USD (WUSD). The company’s decision to transition to a stablecoin-only payment model aligns with its strategy to provide what it describes as a more secure and scalable payment system. The company noted that stablecoins already account for a significant portion of its transaction volume, based on annual transaction data. In September 2024 , dtcpay partnered with Visa to upgrade the digital payments ecosystem in Singapore by integrating its payment technologies with Visa’s global network. This provided access to 130 million merchants across 200 countries. The initial phase will introduce the dtcpay Visa Infinite card, allowing users to convert digital currencies into fiat at competitive real-time rates. The card will be available for public registration in Q4 2024.

dtcpay Frequently Asked Questions (FAQ)

When was dtcpay founded?

dtcpay was founded in 2019.

Where is dtcpay's headquarters?

dtcpay's headquarters is located at 139 Cecil Street, Singapore.

What is dtcpay's latest funding round?

dtcpay's latest funding round is Angel.

How much did dtcpay raise?

dtcpay raised a total of $16.5M.

Who are the investors of dtcpay?

Investors of dtcpay include Kwee Liong Tek, David Tung, Jean-Marc Poullet, Sai Choy Tham and Mastercard Start Path Crypto.

Who are dtcpay's competitors?

Competitors of dtcpay include DigiliraPAY and 4 more.

Loading...

Compare dtcpay to Competitors

SHAZAM offers services to support community banks and credit unions. The company specializes in payment network services, core processing platforms, debit card issuance, digital banking, ATM management, risk mitigation, and merchant processing. SHAZAM primarily serves financial institutions and businesses. It was founded in 1976 and is based in Johnston, Iowa.

Payall operates as a cross-border payment processor for banks operating in the financial technology sector. The company offers automated compliance and risk management solutions to facilitate international transactions. Payall's technology provides a global platform with accounts and special-purpose payment processing for global payments, along with payout options for recipients. It was founded in 2018 and is based in Miami Beach, Florida.

Akbank operates as a financial institution specializing in corporate banking and trade finance services. The company offers a range of financial products including corporate loans, trade financing, and fixed-term deposit accounts. Akbank primarily serves large corporate clients and institutional investors. It was founded in 2006 and is based in Istanbul, Turkey.

NETOPIA Payments specializes in online payment processing and operates within the financial technology sector. The company offers a range of services including processing of debit and credit card payments, SMS microtransactions, and digital wallet solutions. NETOPIA Payments caters primarily to the eCommerce industry, providing merchants with various payment integration options and anti-fraud measures to ensure secure transactions. It was founded in 2003 and is based in Bucharest, Romania.

Platerq provides payment solutions for restaurants through its integrated platform. Its platform allows users to pay directly using their card or other online payment gateway services. It was founded in 2021 and is based in Oradea, Romania.

Float operates as a financial technology company that specializes in global payment solutions. The company offers a platform for businesses to make domestic and international payments using various methods such as card, automated clearing house (ACH), wire, society for worldwide interbank financial telecommunication (SWIFT), and local payments, as well as features for managing invoices, collections, and vendor relationships. It primarily serves the financial service sector. Float was formerly known as Swipe Technologies. It was founded in 2020 and is based in San Francisco, California.

Loading...