Digit Insurance

Founded Year

2016Stage

IPO | IPOTotal Raised

$478.85MDate of IPO

5/23/2024Market Cap

325.97BStock Price

297.25Revenue

$0000About Digit Insurance

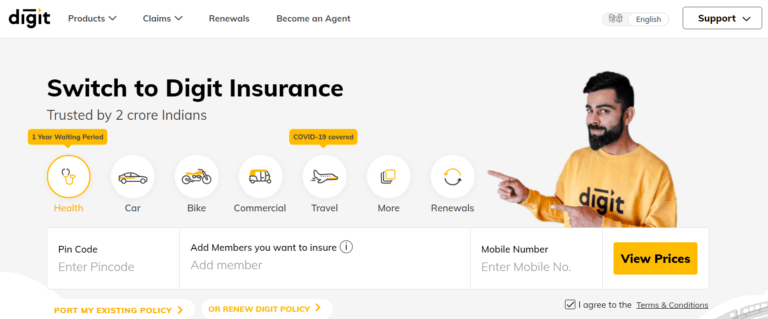

Digit Insurance (NSE: GODIGIT) (BSE: 544179) provides general insurance services that focus on the insurance process across various sectors. The company offers a range of insurance products, including motor, health, travel, home, and life insurance. Digit Insurance primarily serves individual and commercial customers. Digit Insurance was formerly known as Oben General Insurance. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Digit Insurance's Product Videos

_thumbnail.png?w=3840)

ESPs containing Digit Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital pet insurance providers market consists primarily of insurtech producers (e.g., agents and brokers) that provide pet insurance. Some of these companies are managing general agents and granted delegated authority from carrier partners. The market also includes full-stack insurtechs that underwrite their own pet insurance policies. Digital pet insurance providers may also offer preventat…

Digit Insurance named as Highflier among 15 other companies, including Trupanion, Lemonade, and Pets Best Insurance.

Digit Insurance's Products & Differentiators

Digit Health Care Plus

A comprehensive health insurance plan with simple online processes, no age-based co-payment, no room rent restriction, the option to bump up sum insured, a large network of hospitals pan India for cashless claims. The product is designed to suit youngsters, families, old & wise, fitness enthusiasts, corporate hotshots, employees and finally, value seekers. Customers can choose from three options - Smart, Comfort and Comfort Pro based on what suits their needs best.

Loading...

Research containing Digit Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

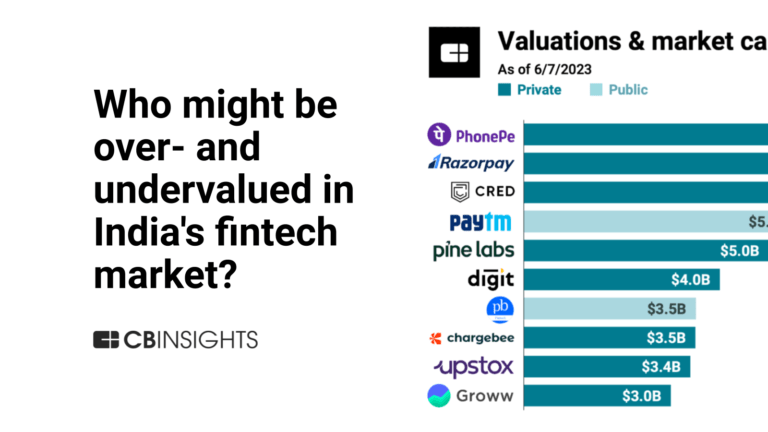

CB Insights Intelligence Analysts have mentioned Digit Insurance in 5 CB Insights research briefs, most recently on Aug 6, 2024.

Aug 6, 2024 report

State of Insurtech Q2’24 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Digit Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Digit Insurance is included in 5 Expert Collections, including Fintech 100.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,487 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,662 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Digit Insurance News

Mar 17, 2025

The proposed investment includes an equity investment of up to $35 million and an additional co-investment of up to $30 million. The International Finance Corporation (IFC) is deliberating an investment into the venture capital firm A91 Partners’ third fund, according to a disclosure on the firm’s website. IFC, which is part of the World Bank Group, is a United Nations agency that invests in private sector growth in developing countries. The institution is proposing an equity investment of up to $35 million and an additional co-investment of up to $30 million into the new fund. The investment would be part of the mid-stage VC firm’s third fund which is targeting $675 million in total commitments, making it the VC’s largest ever fund. Also Read According to the disclosure, the new fund will look to provide capital to small and mid-market companies across consumer, financial services, healthcare, manufacturing, and technology. The fund is expected to have an average ticket size in the range of $10 million to $50 million across 15 companies. Founded in 2018, Mumbai-based A91 had closed its first fund with a target corpus of $350 million; three years later, it raked in $550 million for its second fund. A91's portfolio companies include dairy products startup Akshayakalpa, speciality coffee brand Blue Tokai , and beauty and personal care brand Sugar. Its portfolio company Go Digit General Insurance, an insurance distribution firm,, went public last year. IFC's investment also comes at a time when Indian VC firms are busy raising new funds as capital flow in the country gradually picks up. For instance, Accel in January launched its $650-million eighth India-focused fund and, most recently, Bessemer Venture Partners earmarked $350 million of capital to its second India dedicated fund. Edited by Swetha Kannan

Digit Insurance Frequently Asked Questions (FAQ)

When was Digit Insurance founded?

Digit Insurance was founded in 2016.

Where is Digit Insurance's headquarters?

Digit Insurance's headquarters is located at Atlantis, 95, 4th B Cross Road, Bengaluru.

What is Digit Insurance's latest funding round?

Digit Insurance's latest funding round is IPO.

How much did Digit Insurance raise?

Digit Insurance raised a total of $478.85M.

Who are the investors of Digit Insurance?

Investors of Digit Insurance include HDFC Bank, Axis Bank, Peak XV Partners, IIFL Finance, RS Filmcraft and 17 more.

Who are Digit Insurance's competitors?

Competitors of Digit Insurance include Next Insurance, Bajaj Allianz General Insurance, NeueHealth, MobiKwik, BIMA and 7 more.

What products does Digit Insurance offer?

Digit Insurance's products include Digit Health Care Plus and 3 more.

Loading...

Compare Digit Insurance to Competitors

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

BIMA provides mobile-delivered insurance and health services in the financial services sector. The company offers a range of life, accident, and health insurance products that are registered and paid for via mobile technology, ensuring a paperless experience. BIMA primarily serves underserved communities through partnerships with mobile operators and microfinance institutions. It was founded in 2010 and is based in Singapore.

Alan focuses on providing health insurance services and preventive health solutions within the healthcare industry. The company offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. Alan primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Bimaplan develops an insurance technology platform. The company creates over-the-counter (OTC), low-premium insurance products to cater to low- and middle-income people with annual premiums. It was founded in 2020 an dis based in Bangalore, India.

Loading...