EvolutionIQ

Founded Year

2019Stage

Acquired | AcquiredTotal Raised

$60.35MValuation

$0000About EvolutionIQ

EvolutionIQ focuses on claims guidance for the insurance sector. The platform offers insights and guidance to aid in insurance claims processing. The company serves the insurance industry, providing solutions that support the operational tasks of claims professionals across various lines of business. EvolutionIQ was formerly known as DeepFraud AI. It was founded in 2019 and is based in New York, New York. In December 2024, EvolutionIQ was acquired by CCC Intelligent Solutions.

Loading...

ESPs containing EvolutionIQ

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fraud, waste, and abuse (FWA) detection platforms market refers to the use of technology to identify instances of fraud, waste, and abuse in the healthcare industry. These platforms use artificial intelligence to detect patterns that may indicate fraudulent activity. This can include billing for services that were not actually provided or billing for unnecessary services. The goal is to identi…

EvolutionIQ named as Leader among 7 other companies, including Shift Technology, 4L Data Intelligence, and Leapstack.

EvolutionIQ's Products & Differentiators

IQInvestigate

Focused on monitoring Disability Claims in real time to identify which claims no longer meet the definition of disabled so examiners can focus on claims that can be resolved and reduce investment on low priority claims

Loading...

Research containing EvolutionIQ

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EvolutionIQ in 7 CB Insights research briefs, most recently on Feb 13, 2025.

Feb 13, 2025 report

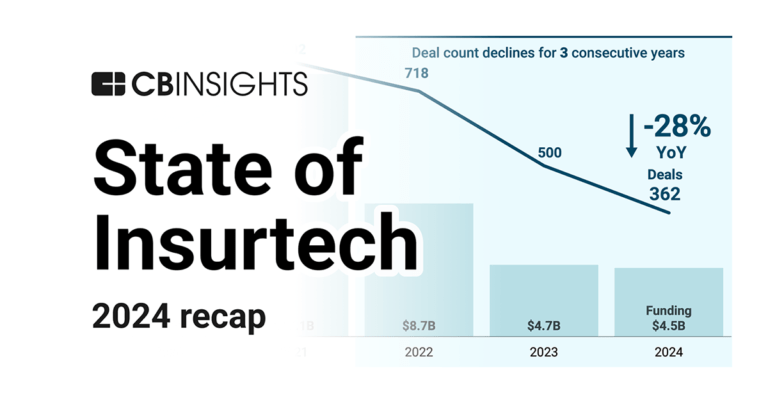

State of Insurtech 2024 Report

Oct 11, 2024

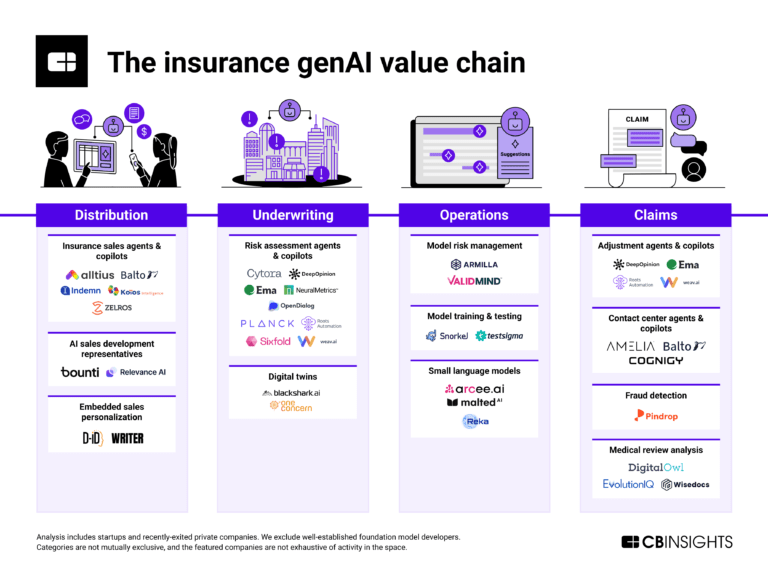

How genAI is reshaping the insurance value chain

Dec 18, 2023

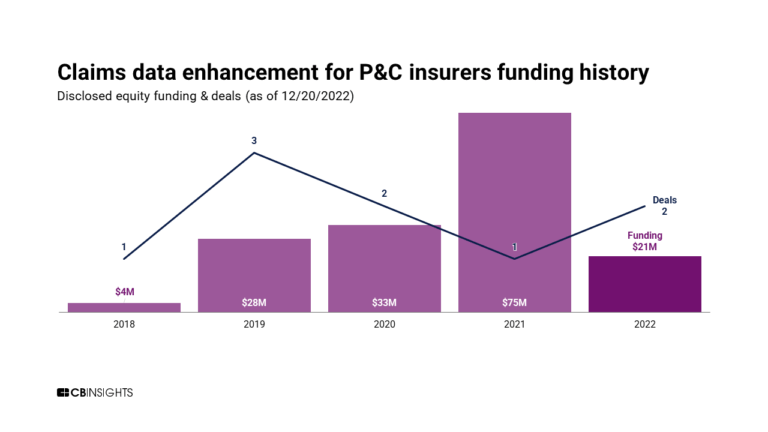

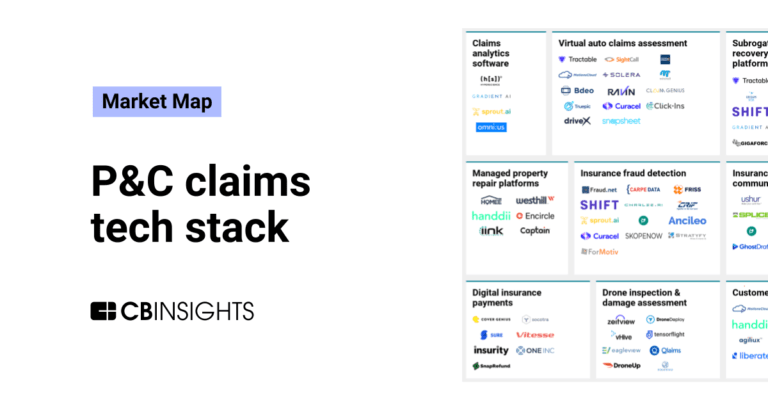

The P&C claims tech stack market map

Jun 15, 2022 report

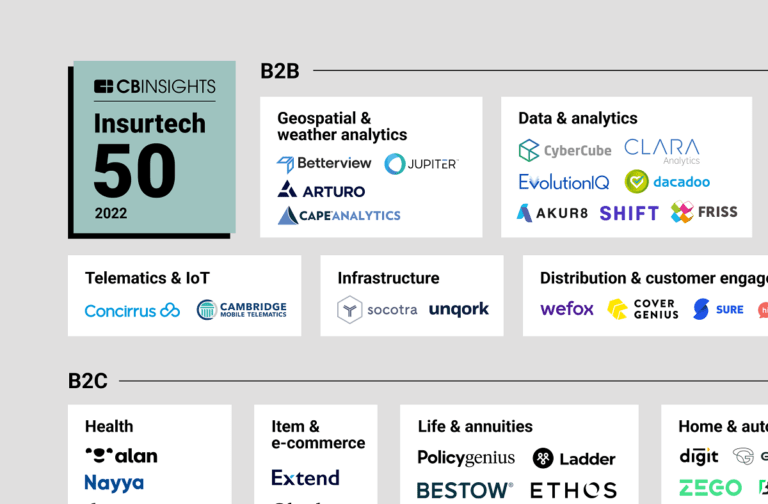

Insurtech 50: The most promising insurtech startups of 2022Expert Collections containing EvolutionIQ

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EvolutionIQ is included in 8 Expert Collections, including Insurtech.

Insurtech

4,489 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

AI 100

100 items

AI 100 (2024)

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest EvolutionIQ News

Mar 19, 2025

News provided by Share this article Share toX NEW YORK, March 19, 2025 /PRNewswire/ -- EvolutionIQ, a leader in AI-driven claims solutions, has announced the findings of its latest case study highlighting the impact of its Intervention product on workers' compensation claims. The case study reveals how AI-powered Intervention enables insurance carriers to engage medical specialists earlier, improve referral accuracy, and drive better claim outcomes—leading to more efficient case management and improved experiences for injured workers. The workers' compensation industry is facing rising claim complexity, increased regulatory demands, and workforce challenges, making proactive, AI-driven claims management more essential than ever. Revolutionizing Claims Handling with AI "Claims professionals are managing heavier caseloads than ever before, and they need tools that help them act with greater precision," said Mike Saltzman, Co-CEO of EvolutionIQ. "This study demonstrates that AI-powered Intervention is a game-changer, getting the right resources deployed at the right time—not only reducing inefficiencies but also driving better recovery outcomes for injured workers." EvolutionIQ's Intervention product continuously monitors structured and unstructured claims data, identifying claims that require medical specialist involvement earlier than traditional methods. By providing claims teams with clear, explainable AI-driven recommendations, the solution empowers them to proactively take action rather than reactively. The Future of AI in Workers' Compensation The adoption of AI-powered solutions like EvolutionIQ's claims insights platform is reshaping claims management, shifting the industry from a reactive to a proactive approach. As more workers' compensation carriers embrace this technology, the claims process is becoming more efficient, precise, and aligned with the needs of injured workers and claims teams alike. Read the case study by visiting https://learn.evolutioniq.com/interventioncasestudy About EvolutionIQ EvolutionIQ, a CCC Intelligent Solutions company, pioneered Claims Guidance technology in 2019. Its AI-powered solutions guide insurance claims professionals to their highest potential impact on bodily injury claims, including specific next-best-action guidance and medical synthesis and insights. EvolutionIQ improves the claimant experience and delivers better claim outcomes to claimants, carriers, and their customers. The company serves group disability, individual disability, and workers' compensation markets worldwide. For more information, visit evolutioniq.com . Media Contact:

EvolutionIQ Frequently Asked Questions (FAQ)

When was EvolutionIQ founded?

EvolutionIQ was founded in 2019.

Where is EvolutionIQ's headquarters?

EvolutionIQ's headquarters is located at 250 Hudson Street, New York.

What is EvolutionIQ's latest funding round?

EvolutionIQ's latest funding round is Acquired.

How much did EvolutionIQ raise?

EvolutionIQ raised a total of $60.35M.

Who are the investors of EvolutionIQ?

Investors of EvolutionIQ include CCC Intelligent Solutions, First Round Capital, Amasia, Guidewire, Foundation Capital and 15 more.

Who are EvolutionIQ's competitors?

Competitors of EvolutionIQ include Charlee.ai and 7 more.

What products does EvolutionIQ offer?

EvolutionIQ's products include IQInvestigate and 1 more.

Who are EvolutionIQ's customers?

Customers of EvolutionIQ include Reliance Standard and Argo Group.

Loading...

Compare EvolutionIQ to Competitors

Shift Technology specializes in AI decision-making solutions for the insurance industry. The company offers a suite of products that automate and optimize decisions in areas such as fraud detection, claims processing, and underwriting risk assessment. Its AI-driven tools are designed to enhance operational efficiency and improve the policyholder experience. It was founded in 2014 and is based in Paris, France.

Charlee.ai specializes in artificial intelligence and predictive analytics within the insurance sector. The company offers solutions that analyze claims and predict litigation and severity, utilizing natural language processing to enhance claims workflows and manage reserves effectively. Charlee.ai's predictive analytics solutions are tailored to the insurance industry, including personal, commercial, and workers' compensation sectors. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

Gradient AI specializes in artificial intelligence solutions for the insurance sector. The company offers a software-as-a-service platform that utilizes AI to enhance underwriting results, minimize claim costs, and boost operational efficiency. Gradient AI primarily serves the insurance industry, including carriers, MGAs, TPAs, and other related entities. It was formerly known as Milliman - Gradient A.I. It was founded in 2012 and is based in Boston, Massachusetts.

Skopenow provides open-source intelligence (OSINT) solutions across various sectors. The company offers an OSINT platform that supports the search, collection, and analysis of open-source data to aid situational awareness and investigative processes. Skopenow's tools assist organizations in identifying risks and threats, visualizing data, and incorporating OSINT into their workflows while maintaining anonymity. It was founded in 2016 and is based in New York, New York.

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Daisy Intelligence specializes in AI-powered decision-making for the retail and insurance sectors. The company offers solutions for promotion optimization, price optimization, demand planning, assortment optimization, space planning in retail, and fraud detection, claims automation, and underwriting in insurance. Its services cater to the retail industry and insurance industry, providing actionable insights and automated recommendations to enhance business performance. It was founded in 2003 and is based in Toronto, Ontario. Daisy Intelligence operates as a subsidiary of JSM Capital and Manjis Holdings.

Loading...