DailyPay

Founded Year

2015Stage

Line of Credit - V | AliveTotal Raised

$1.353BValuation

$0000Last Raised

$100M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-28 points in the past 30 days

About DailyPay

DailyPay specializes in providing an on-demand pay platform within the financial services sector. Their main offering is an earned wage access platform that allows employees to receive their earned pay before the traditional payday, aiming to improve financial wellness and support employee engagement. DailyPay's platform integrates with existing payroll systems, offering additional features such as real-time cash rewards, digital tip access, and the ability to disburse off-cycle pay. It was founded in 2015 and is based in New York, New York.

Loading...

DailyPay's Product Videos

_copy_thumbnail.png?w=3840)

ESPs containing DailyPay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The earned wage access (EWA) platforms market aims to solve the problem of people having to wait 2-4 weeks for their pay, which can lead to financial stress and reliance on high-cost credit options. EWA platforms allow employees to access their earned pay as they go, improving employee wellbeing and reducing turnover. These platforms sometimes also offer additional financial wellness services, suc…

DailyPay named as Leader among 15 other companies, including Automatic Data Processing, Dayforce, and Wagestream.

DailyPay's Products & Differentiators

DailyPay

DailyPay partners with America’s largest employers to offer the financial wellness benefit of earned wage access to millions of workers nationwide. With the employer-sponsored benefit, employees are empowered with choice and control over their earned pay to pay bills, spend, save, or invest on their own schedule. DailyPay is on a mission to provide financial equity and inclusion for millions of workers nationwide.

Loading...

Research containing DailyPay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned DailyPay in 1 CB Insights research brief, most recently on Mar 30, 2022.

Mar 30, 2022

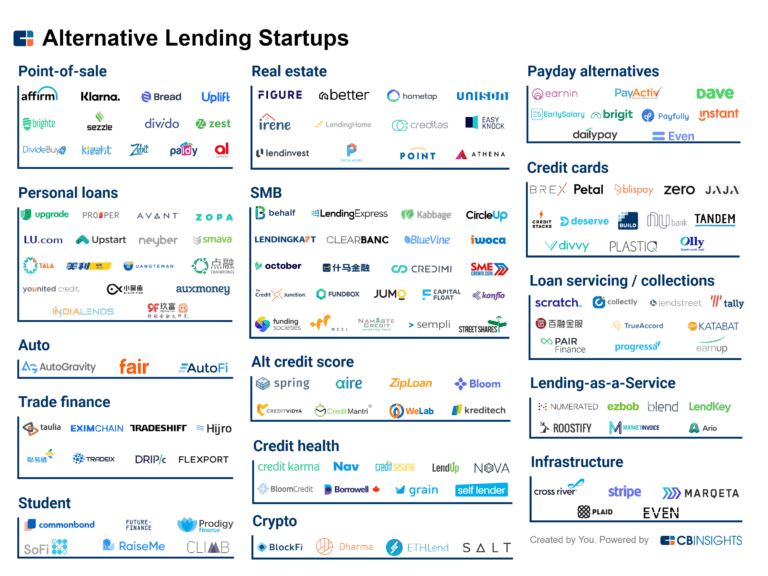

140+ startups shaping the digital lending spaceExpert Collections containing DailyPay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

DailyPay is included in 11 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,270 items

Digital Lending

2,374 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Payments

3,123 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Financial Wellness

245 items

Track startups and capture company information and workflow.

DailyPay Patents

DailyPay has filed 3 patents.

The 3 most popular patent topics include:

- classification algorithms

- data management

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/30/2022 | 2/20/2024 | Grant |

Application Date | 8/30/2022 |

|---|---|

Grant Date | 2/20/2024 |

Title | |

Related Topics | |

Status | Grant |

Latest DailyPay News

Mar 28, 2025

DailyPay expands its platform Friday 28 March 2025 12:33 CET | News DailyPay has announced the expansion of its platform in order to meet the needs of its workers in the region of the US. Following this announcement, DailyPay customers will have the possibility to stop waiting as long to get their federal tax refunds through the use of the company’s worktech platform. In order to benefit from the capability, they will need to simply direct their federal refund to their DailyPay Visa PrepaidCard to automatically get their refund up to 5 days early, for no cost. The process of providing American customers with faster access to their tax refund in USD represents an important step in the company’s strategy of helping workers improve their financial stability. DailyPay will also continue to focus on meeting the needs, preferences, and demands of clients and users in an ever-evolving market, while prioritising the process of remaining compliant with the regulatory requirements and laws of the local industry as well. More information on DailyPay’s platform expansion DailyPay represents a company that leverages its technology platform in order to optimise the manner in which American employers build stronger relationships with their employees. This benefit gives workers the possibility to feel more motivated to work, while supporting their financial well-being outside their workplace. According to the official press release, DailyPay's early-access federal tax refund offering is set to accelerate the growth of DailyPay’s platform, which already features the DailyPay Card with cash back offers, Credit Health, International Remittances, Savings feature, and the firm’s earned wage access solution. At the same time, the launch is expected to accelerate the company’s strategy of development, as well as its overall plan to offer customers an improved experience and overall optimised insights on how to remain financially stable. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

DailyPay Frequently Asked Questions (FAQ)

When was DailyPay founded?

DailyPay was founded in 2015.

Where is DailyPay's headquarters?

DailyPay's headquarters is located at 55 Water Street, New York.

What is DailyPay's latest funding round?

DailyPay's latest funding round is Line of Credit - V.

How much did DailyPay raise?

DailyPay raised a total of $1.353B.

Who are the investors of DailyPay?

Investors of DailyPay include Citibank, Carrick Capital Partners, Barclays Bank, TPG Angelo Gordon, Neuberger Berman and 12 more.

Who are DailyPay's competitors?

Competitors of DailyPay include Rain, Immediate, Paywatch, Wagestream, ZayZoon and 7 more.

What products does DailyPay offer?

DailyPay's products include DailyPay and 2 more.

Who are DailyPay's customers?

Customers of DailyPay include Hilton, Kroger, Target, HCA Healthcare and Aramark.

Loading...

Compare DailyPay to Competitors

PayActiv is a financial wellness company that provides a platform for earned-wage access and financial services. The company offers solutions that allow employees to access their earned wages before payday, along with tools for budgeting, savings, and financial counseling. PayActiv primarily serves various sectors, including retail, healthcare, and hospitality industries. It was founded in 2012 and is based in San Jose, California.

Immediate is a financial wellness company that specializes in providing on-demand access to earned wages for employees in various sectors. The company's main offerings include a platform that integrates with major payroll systems to allow employees to access their earned wages in real time, helping to alleviate financial stress and reduce reliance on alternative lending. Immediate primarily serves businesses looking to enhance their employee benefits package with financial wellness solutions. It was founded in 2019 and is based in Birmingham, Alabama.

ZayZoon is a financial empowerment platform that focuses on improving the financial wellbeing of employees within small and medium-sized businesses. The company offers Earned Wage Access, allowing employees to receive a portion of their earned wages before their scheduled payday, and a suite of financial wellness tools designed to educate and improve employees' financial health. ZayZoon's services are primarily utilized by businesses looking to enhance employee benefits, reduce financial stress, and improve retention and productivity. It was founded in 2014 and is based in Calgary, Canada.

Branch specializes in providing payment solutions for the workforce across various industries. Its services include offering businesses the ability to pay their workers through direct deposits, cashless tips, and earned wage access, as well as providing financial wellness tools for employees. Branch primarily serves sectors such as healthcare, hospitality, logistics, gig platforms, and business services. Branch was formerly known as Branch Messenger. It was founded in 2015 and is based in Golden Valley, Minnesota.

EarnIn specializes in earned wage access services. It provides a platform for users to access their earned wages along with credit monitoring, automated savings, and low-balance protection, without mandatory fees or interest charges. It primarily serves individuals seeking greater financial flexibility and control over their earnings. EarnIn was formerly known as ActiveHours. It was founded in 2012 and is based in Palo Alto, California.

Paymenow is a financial wellness and inclusion platform that specializes in providing Earned Wage Access (EWA) services. The company offers a solution that allows employees to access a portion of their earned wages in real-time before their scheduled payday, aiming to alleviate financial stress and reduce reliance on costly loans. Paymenow also emphasizes responsible financial behavior by integrating financial education into its platform, offering tiered access to wages based on the completion of educational modules. It was founded in 2019 and is based in Stellenbosch, South Africa.

Loading...