Olive

Founded Year

2012Stage

Dead | DeadTotal Raised

$858.8MAbout Olive

Olive provides healthcare revenue cycle management solutions. The company offers services for healthcare providers, including financial clearance, revenue capture, claim management, payment management, denial prevention, and analytics and reporting. Olive serves various sectors within the healthcare industry, such as physician and specialty practices, ambulatory surgery centers, clinical laboratories, and health systems. Olive was formerly known as CrossChx. It was founded in 2012 and is based in Columbus, Ohio. Olive ceased operations in October 2023.

Loading...

Olive's Products & Differentiators

Prior Authorization Suite

Olive’s Prior Authorization Suite ensures you understand the comprehensive eligibility picture for each patient, by combining End-to-End Prior Authorization and Eligibility.

Loading...

Research containing Olive

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Olive in 9 CB Insights research briefs, most recently on May 29, 2024.

May 29, 2024

483 startup failure post-mortems

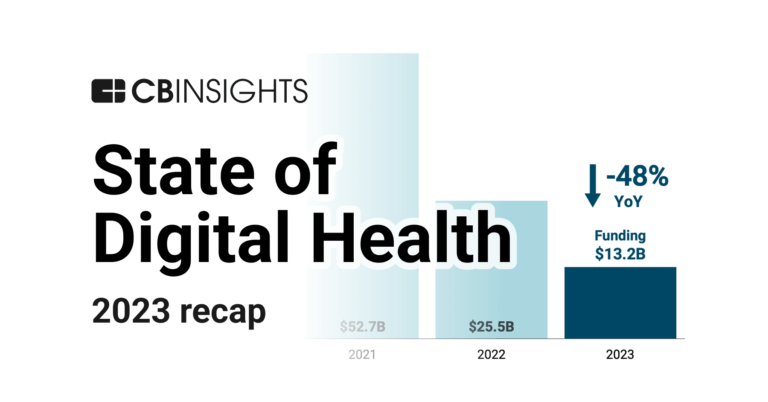

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 8, 2024

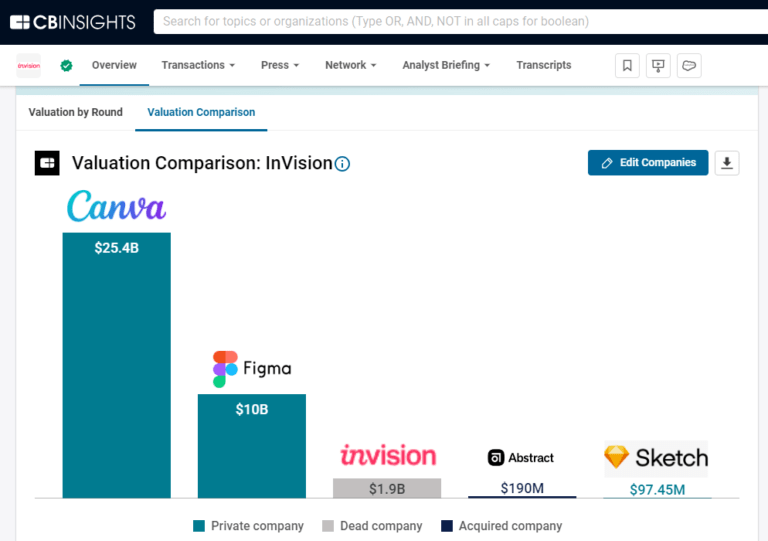

A $1.9B design unicorn is calling it quits

Nov 21, 2023

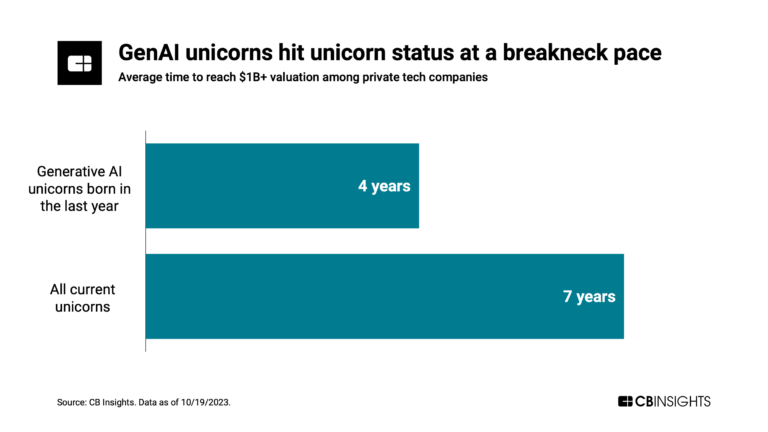

Has the global unicorn club reached its peak?

Sep 22, 2023

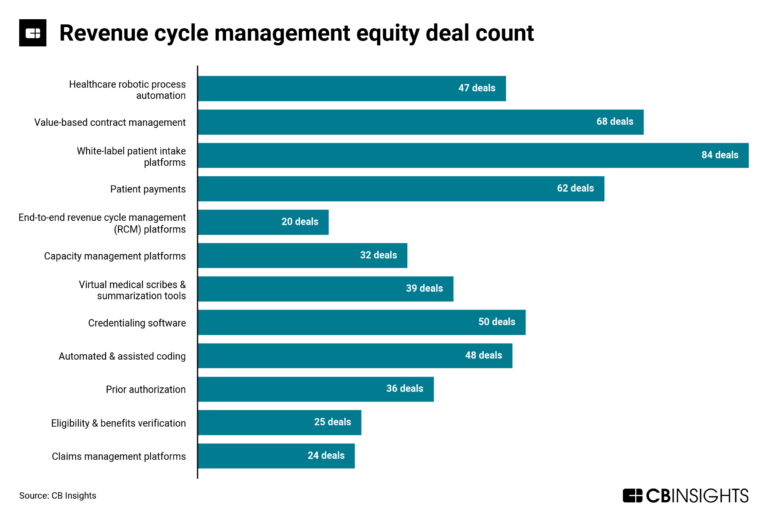

The revenue cycle management market map

Aug 1, 2023

The state of healthcare AI in 5 chartsExpert Collections containing Olive

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Olive is included in 7 Expert Collections, including Robotic Process Automation.

Robotic Process Automation

322 items

RPA refers to the software-enabled automation of data-intensive tasks that are low-skill but highly sensitive operationally, including data entry, transaction processing, and compliance.

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Conference Exhibitors

5,302 items

Digital Health

11,305 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

AI 100

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Value-Based Care & Population Health

193 items

Olive Patents

Olive has filed 53 patents.

The 3 most popular patent topics include:

- social networking services

- cubism

- modern art

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/22/2020 | 3/4/2025 | Videotelephony, Machine learning, Social networking services, Teleconferencing, Conservation and restoration | Grant |

Application Date | 6/22/2020 |

|---|---|

Grant Date | 3/4/2025 |

Title | |

Related Topics | Videotelephony, Machine learning, Social networking services, Teleconferencing, Conservation and restoration |

Status | Grant |

Latest Olive News

Nov 28, 2024

Over the last five years, 706 AI startups have failed, of which 54 are from India. Share by Vandana Nair Founded in 2012 by Sean Lane and Jeremy Yoder, Olive AI, a healthcare startup, looked to boost operational efficiency by using AI. Over the years, the company raised significant funding from high-profile investors and reached a peak valuation of $4 billion in 2021. The initial success was promising, with over 900 hospitals adopting this technology. However, rapid, unsustainable growth and strategic miscalculations led to OliveAI’s shutting down in late 2023. “The lack of focus, coupled with the champagne and cocaine mentality brought on by easy VC money totalling almost $1 billion, is what killed yet another AI health startup, Olive AI,” author Sergei Polevikov said. It’s perplexing to think that even with backing from trustworthy investors, a startup can fold due to miscalculations. As surprising as it sounds, data shows that several AI startups backed by prominent investors have shut down in the last five years. When VCs Can Be Counter-Productive In a 2019 interview with OpenAI chief Sam Altman, venture capitalist and Khosla Ventures founder Vinod Khosla said, “I get in a lot of trouble for saying this, [but] 90% of investors add no value. In my assessment, 70% of investors add negative value to a company. That means they are advising a company when they haven’t earned the right to advise an entrepreneur.” In fact, Khosla has been reiterating this sentiment for over a decade . As a VC who has backed several emerging startups, including OpenAI, one might wonder what drives this critical stance against his own clan. Well, Khosla has his reasons. When junior staff asked why they couldn’t join a board like their peers at other firms, Khosla said that it was unfair to entrepreneurs. “Just because you got an MBA and joined a venture firm doesn’t mean you’re qualified to advise an entrepreneur,” he clarified. He believes the key qualification for a VC to offer advice is having built a large company and personally experienced the difficulties, uncertainty, and challenges involved. Without having firsthand experience of the challenges behind running one’s own company, the ability to advise others holds little weight. Holistic VC Power During an interaction with AIM, Pranavan S , founder and CEO of Control One , a Bengaluru-based startup building AI-driven innovation by building physical agents, said, “Given the competitive landscape in the field of AI, VC money plays an important role in the infrastructure, team and research needs. Apart from the funds, a VC network or brand name helps build confidence with customers and also strengthen networking and partnerships.” Founded in 2023, Control One has raised $350,000 from industry leaders including iRobot co-founder Helen Greiner , CRED founder Kunal Shah , and executives from Tesla, Walmart, and General Electric. AI startups have been witnessing a remarkable surge in investments. It was reported that, from April to June this year, AI startup investments touched $24 billion, which was double the previous quarter. Though VC expertise brings in holistic support to scale a business, conflicts among them are common. Pranav believes these conflicts often stem from mismatched expectations. “At times, founders tend to overpromise and that needs to be kept in check. Once the milestones and expectations are set right, the chances of disagreement drop drastically,” he said. At Loggerheads AIM gained insights from a VC’s point of view after speaking to Abhishek Prasad , managing partner at Cornerstone Venture Partners . “Friction can arise when VCs behave like bosses and assume roles of mentors or have a know-it-all approach while not bringing any tangible value. In the Indian context, given we are still a young VC ecosystem, we have seen VCs often operate as super angels and not as professional investors in the journey of the founder, leading to situations that often lead to friction,” Prasad said. Prasad further explained that discord occurs between VCs and founders when they don’t agree on a shared path forward. This friction often arises when VCs push for directions that conflict with the founder’s vision or agenda. “For a VC, the company may be one among many and a game of optimising, whereas for the founder the particular company is all she or he has got. This often leads to mistrust and founders start becoming wary of their relationship with the VC and often stop confiding in VCs, leading to further strain in the relationship,” he added. AI and Deeptech Startup Evolution With the rise of AI startups, VC firms investing in AI companies are also transforming, which in turn implies that expectations from them are also evolving. VC firm Bharat Innovation Fund (BIF), which focuses on deep tech startups, started investing in them around 2018. BIF co-founder Ashwin Raguraman said they focus on what they call globally competitive startups, whether they are competitive today or have the potential to become globally competitive and address global markets. Though BIF has not yet invested in generative AI startups, they are closely monitoring developments in this area, particularly those that go beyond simple applications and demonstrate maturity and innovation. The firm is keen on supporting ‘AI-native’ companies that integrate AI from the ground up rather than those merely adopting existing models. VC-Founder Relationship Speaking about the relationship between VCs and startup founders at a panel discussion in the recent AI summit Cypher 2024, Ashwin emphasised the importance of VCs questioning founders. “We ask questions before we invest [and] after we invest. We ask questions as board members, but I think…asking questions especially after we invest is to be a sounding board. We can’t necessarily give answers. The founder has to find the answers because that’s when they internalise it and then execute it. So we’re good at asking questions,” said Ashwin. Interestingly, when asked about a VC’s involvement in a founder’s business, Ashwin’s answer was pretty clear. “In an ideal situation, we’d like to start at 0% investor hands-on, because then it means that the entrepreneur is delivering, and we don’t need to spend time. They’re going to deliver returns. [But] there are times when that zero goes all the way to 70-80% and that’s not a good situation. I know that when I’m hands-on 70%, we are trying to save something that is perhaps sinking without our effort,” he said. Cypher 2024 – Panel Discussion with VCs and Startup founders. From left: Arjun Rao, general partner at Speciale Invest, Ashwin Raguraman co-founder & partner at Bharat Innovation Fund, Korak Roy, AIM video presenter, Rimjhim Agrawal, co-founder & CTO at BrainSight AI, and Abhishek Upperwal CEO/founder at Soket Labs VC-Backed Failures Irrespective of how much a VC gets involved in a startup or tries to maintain a balance, the startup can fail. A number of prominent VC-backed startups have failed in the past. Founder Problems VC guidance or misguidance can often cause startups to falter. In addition, the company board can also have tiffs with the founders. The members, who sometimes comprise investors, can lead to a different kind of friction. Interestingly, during the interview with Khosla, Altman shared that in risk-driven, decision-making situations, he prefers having a board that calms the entrepreneur, rather than adding to the stress. It’s bizarre that this statement was made in a 2019 interview, especially considering that just a year ago, Altman found himself at odds with his own board. The board ousted him over accusations of a lack of transparency in his decision-making process. While that didn’t last long – just over two days, to be precise – he was reinstated as CEO, and his board was disbanded. Eventually, new board members, possibly his allies, were appointed. However, the company has faced a number of high-profile exits, including the departure of co-founders, over the last year. Reflecting on what Khosla said, it is evident that conflicts regarding ideas and involvement are mostly the reason for counterintuitive performance results. The figure of 70%, however, may not be an absolute number. (Total 16 views)

Olive Frequently Asked Questions (FAQ)

When was Olive founded?

Olive was founded in 2012.

Where is Olive's headquarters?

Olive's headquarters is located at 99 East Main Street, Columbus.

What is Olive's latest funding round?

Olive's latest funding round is Dead.

How much did Olive raise?

Olive raised a total of $858.8M.

Who are the investors of Olive?

Investors of Olive include Tiger Global Management, Vista Equity Partners, Base10 Partners, Drive Capital, General Catalyst and 16 more.

Who are Olive's competitors?

Competitors of Olive include Rotera, Medical Brain, Itiliti Health, Access Healthcare, Pieces and 7 more.

What products does Olive offer?

Olive's products include Prior Authorization Suite and 2 more.

Loading...

Compare Olive to Competitors

Rhyme specializes in streamlining the prior authorization process within the healthcare sector by providing a network that facilitates real-time, relationship-based connections between payers and providers. The company's main offering, LiveAuth, automates prior authorization steps and integrates with existing healthcare tools to enable faster and more efficient decision-making without manual intervention. Rhyme primarily serves the healthcare industry, including hospitals, affiliated physicians, and health plan members. Rhyme was formerly known as PriorAuthNow. It was founded in 2016 and is based in New Albany, Ohio.

Notable is an artificial intelligence (AI) platform that automates healthcare operations. The company offers solutions for patient engagement, workflow automation, and electronic health record (EHR) integration. Notable serves the healthcare sector with tools related to patient acquisition and retention. It was founded in 2017 and is based in San Mateo, California.

AKASA provides generative AI (artificial intelligence) solutions for the healthcare revenue cycle, concentrating on financial processes within the healthcare sector. The company's offerings include automation and optimization of prior authorization, medical coding, claim status updates, and claim attachment processes, powered by generative AI trained on clinical and financial data. It serves hospitals and health systems, with a goal of improving operational efficiency and financial outcomes. AKASA was formerly known as Alpha Health. It was founded in 2018 and is based in San Francisco, California.

Cohere Health is a clinical intelligence company that specializes in the healthcare sector. It focuses on transforming utilization management and prior authorization processes. The company offers intelligent prior authorization solutions that aim to align physicians and health plans on evidence-based care paths, thereby reducing administrative expenses and improving patient outcomes. Its technology leverages artificial intelligence and machine learning to provide a range of services, including automated workflow digitization, decision support, and optimization of utilization management. It was founded in 2019 and is based in Boston, Massachusetts.

Janus specializes in optimizing healthcare revenue cycle management through data-driven solutions. The company offers a suite of tools that automate and enhance the efficiency of revenue cycle operations, such as claim processing and denial management, for healthcare providers. It caters to the healthcare industry. It was founded in 2020 and is based in Chicago, Illinois.

Ensemble Health Partners provides revenue cycle management services for the healthcare sector. The company offers services aimed at addressing patient experience, collections, denials and underpayments, electronic health records (EHR), and payer strategies. Ensemble Health Partners serves hospitals, health systems, and affiliated physician groups. It was founded in 2014 and is based in Cincinnati, Ohio.

Loading...