Consensys

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$732.5MLast Raised

$14M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-47 points in the past 30 days

About Consensys

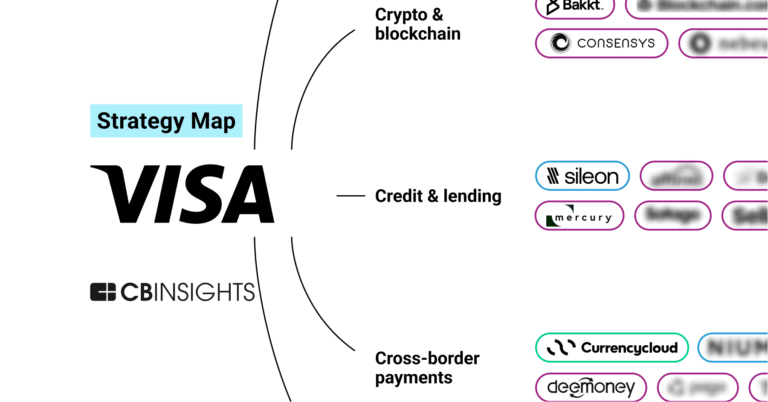

Consensys is a blockchain and web3 software company focused on developing products for the decentralized web. The company offers services including self-custodial wallet solutions, tools for building decentralized applications, zkEVM rollup technology for scaling Ethereum, smart contract auditing, and staking services. Consensys serves developers, creators, and users within the web3 ecosystem. It was founded in 2014 and is based in Fort Worth, Texas.

Loading...

Consensys's Product Videos

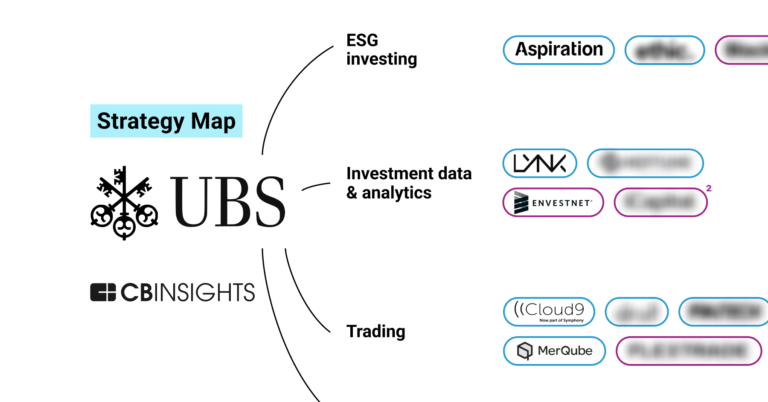

ESPs containing Consensys

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

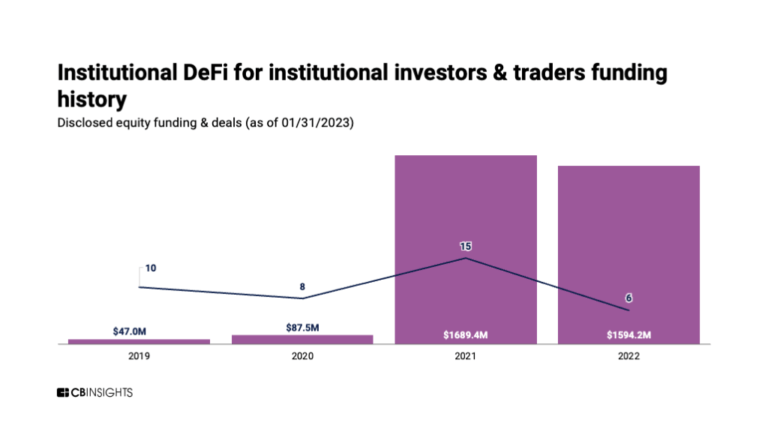

The institutional decentralized finance (DeFi) market refers to the use of decentralized finance protocols and platforms by institutional investors, such as hedge funds, asset managers, and corporations, to access DeFi services and generate returns. Technology vendors in this market offer end-to-end software solutions. These solutions provide secure access to top distributed networks, offering sec…

Consensys named as Leader among 15 other companies, including Circle, BitGo, and Fireblocks.

Consensys's Products & Differentiators

MetaMask

Mobile Wallet and Browser Extension

Loading...

Research containing Consensys

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Consensys in 17 CB Insights research briefs, most recently on Jul 6, 2023.

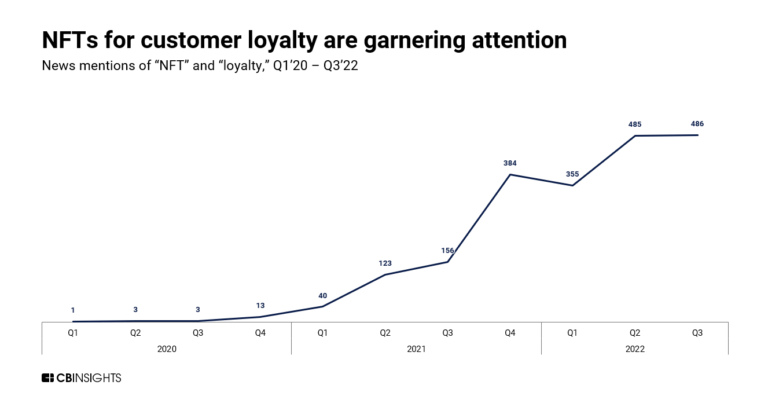

Dec 14, 2022

What L’Oréal, Nike, and LVMH are doing in Web3

Nov 19, 2022

State of Enterprise Blockchain 2022Expert Collections containing Consensys

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Consensys is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

14,486 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Conference Exhibitors

5,302 items

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Consensys Patents

Consensys has filed 5 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- alternative currencies

- blockchains

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/4/2020 | 12/31/2024 | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols | Grant |

Application Date | 12/4/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols |

Status | Grant |

Latest Consensys News

Mar 21, 2025

Consensys Letter Challenges CFPB's Rule on Regulating Unhosted Wallets Coin Prices Consensys Letter Challenges CFPB's Rule on Regulating Unhosted Wallets The Ethereum software firm expects the CFPB to withdraw the interpretive rule from its agenda or revise it to exclude the crypto sector. Create an account to save your articles. Ethereum software firm Consensys has pushed back against a proposed rule from the Consumer Financial Protection Bureau (CFPB) that could drastically change how unhosted blockchain wallets such as MetaMask are regulated. (Disclosure: Consensys is one of 22 investors in Decrypt.) Introduced in January, the proposed interpretive rule sought to regulate unhosted wallets under the Electronic Funds Transfer Act (EFTA), holding developers accountable for fraudulent or unauthorized transactions and enforcing traditional financial institution regulations on decentralized wallets. In a short comment sent to Scott Bessent, Acting Director of the CFPB, Consensys called the rule a “radical departure from current law” and that the regulatory regime would be detrimental to both “blockchain developers and users.” “It is our view that this proposal is clearly improper as a matter of substantive law, public policy, and administrative procedure,” the letter said about the rule, which was proposed just before Joe Biden’s departure from office. Describing the proposed rule as “industry-redefining,” Bill Hughes, Senior Counsel & Director of Global Regulatory Matters at Consensys, warned that its implementation would cause “unparalleled damage” to U.S.-based blockchain developers. Today, @Consensys submitted a short comment in response to the CFPB's proposed interpretive rule that unhosted wallets like @MetaMask are actually regulated under the Electronic Funds Transfer Act (EFTA) and CFPB's Regulation E. It is our view that this proposal, described in… https://t.co/JABqXCcVkL pic.twitter.com/PmrTjINwZW “Bending ourselves into a pretzel to apply the EFTA to unhosted wallets is bad policy because it would put wallets in an impossible bind,” he said. He also criticized the rule for bypassing proper legislative procedures, saying how implementing such changes through an interpretive rule violates the Administrative Procedure Act—a move Hughes claimed courts would likely oppose. Consensys fully expects the CFPB, now under the leadership of President Trump’s treasury pick Scott Bessent , to either withdraw this interpretive rule from its agenda or revise it to exclude the crypto sector. “When that happens, we will applaud the agency for doing the right thing both legally and policy-wise,” Hughes tweeted. Trump’s crypto agenda Since taking office, Trump has repeatedly showcased his commitment to crypto with key moves , from unveiling plans for a Bitcoin reserve to creating a crypto task force with pro-crypto leaders. The 47th U.S. President has vowed to make America the “ undisputed Bitcoin superpower ,” marking a departure from the previous administration’s regulatory stance on crypto. The CFPB, an agency proposed in 2007 by crypto-skeptic Senator Elizabeth Warren while she was a Harvard law school professor, has been closely associated with stricter consumer protections. While former CFPB Director Rohit Chopra defended the controversial rule as a measure to protect consumers, many— including Hughes —saw it as an overreach. Consensys has also directed the CFPB to a comment letter from the Blockchain Association, of which it is a member, and the DeFi Education Fund, with Hughes emphasizing that the platform fully endorses the upcoming letter which addresses the concerns with the rule. Daily Debrief Newsletter Start every day with the top news stories right now, plus original features, a podcast, videos and more. Your Email

Consensys Frequently Asked Questions (FAQ)

When was Consensys founded?

Consensys was founded in 2014.

Where is Consensys's headquarters?

Consensys's headquarters is located at 5049 Edwards Ranch Road, Fort Worth.

What is Consensys's latest funding round?

Consensys's latest funding round is Secondary Market.

How much did Consensys raise?

Consensys raised a total of $732.5M.

Who are the investors of Consensys?

Investors of Consensys include Fabrica Ventures, Mindrock Capital, ParaFi Capital, Marshall Wace Asset Management, Third Point Ventures and 35 more.

Who are Consensys's competitors?

Competitors of Consensys include Phantom, Taurus, Emtech, vlayer, Fireblocks and 7 more.

What products does Consensys offer?

Consensys's products include MetaMask and 4 more.

Loading...

Compare Consensys to Competitors

Hyperledger is an open source initiative focused on blockchain technologies within the decentralized systems domain. The organization provides services including the development of ledger technologies, interoperability solutions, decentralized identity systems, and cryptographic protocols. Hyperledger serves sectors that require financial infrastructures, digital identity solutions, and secure systems. It was founded in 2015 and is based in San Francisco, California.

R3 focuses on the digitization of financial services within the enterprise technology sector. It offers a private, permissioned distributed ledger technology (DLT) platform named Corda, designed to enable secure and direct digital collaboration among regulated institutions. R3's solutions cater to various sectors, including banks, central banks, corporations, exchanges, central counterparties, and fintech, providing services such as tokenization of digital assets and currencies, streamlined inter-bank transactions, and modernization of legacy workflows. It was founded in 2014 and is based in New York, New York.

Ripple provides digital asset infrastructure for financial services, focusing on cross-border payments and digital asset management. The company offers solutions for payment settlement, liquidity management, and a global payout network, as well as services for storing and managing digital assets. Ripple was formerly known as OpenCoin. It was founded in 2012 and is based in San Francisco, California.

Bitbond is an asset tokenization platform operating in the financial technology sector. The company offers a smart contract generator, known as Token Tool, which enables users to create and manage the lifecycle of tokens without technical expertise. Bitbond's services also include regulatory-compliant offerings for tokenized financial instruments, digital asset custody solutions, and on-chain payment settlement using stable coins, catering to regulated financial institutions and large issuers. It was founded in 2013 and is based in Berlin, Germany.

Corda is an open permissioned distributed application platform that enables the development of multi-party solutions within regulated markets. The platform includes asset modeling, workflow automation, and a secure ledger for digital assets, relevant to regulated financial environments. It is based in London, United Kingdom.

Algorand Technologies specializes in blockchain technology, focusing on the development of a high performance Layer-1 blockchain. The company offers a platform designed to support various applications with an emphasis on sustainability and powerful computing capabilities. It was founded in 2017 and is based in Singapore, Singapore.

Loading...