CoinSwitch

Founded Year

2017Stage

Series C | AliveTotal Raised

$300MValuation

$0000Last Raised

$260M | 3 yrs agoAbout CoinSwitch

CoinSwitch is a cryptocurrency trading platform that operates in the fintech sector. The company offers services such as a systematic investment plan for crypto assets, an index tracking the performance of cryptocurrencies in rupees, and advanced trading capabilities through APIs. CoinSwitch primarily caters to individual investors and traders looking for cryptocurrency investment and trading solutions. It was founded in 2017 and is based in Bengaluru, India.

Loading...

ESPs containing CoinSwitch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The crypto asset management market refers to the management of cryptocurrency assets on behalf of investors, including individuals, institutions, and corporations, with the goal of maximizing returns and minimizing risk. The market includes vendors with focus on digital asset management services in crypto-denomination, crypto investment products like ETFs and ETPs, and index-driven digital asset m…

CoinSwitch named as Challenger among 14 other companies, including Galaxy, CoinShares, and Grayscale Investments.

Loading...

Research containing CoinSwitch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CoinSwitch in 3 CB Insights research briefs, most recently on Sep 10, 2022.

Sep 10, 2022

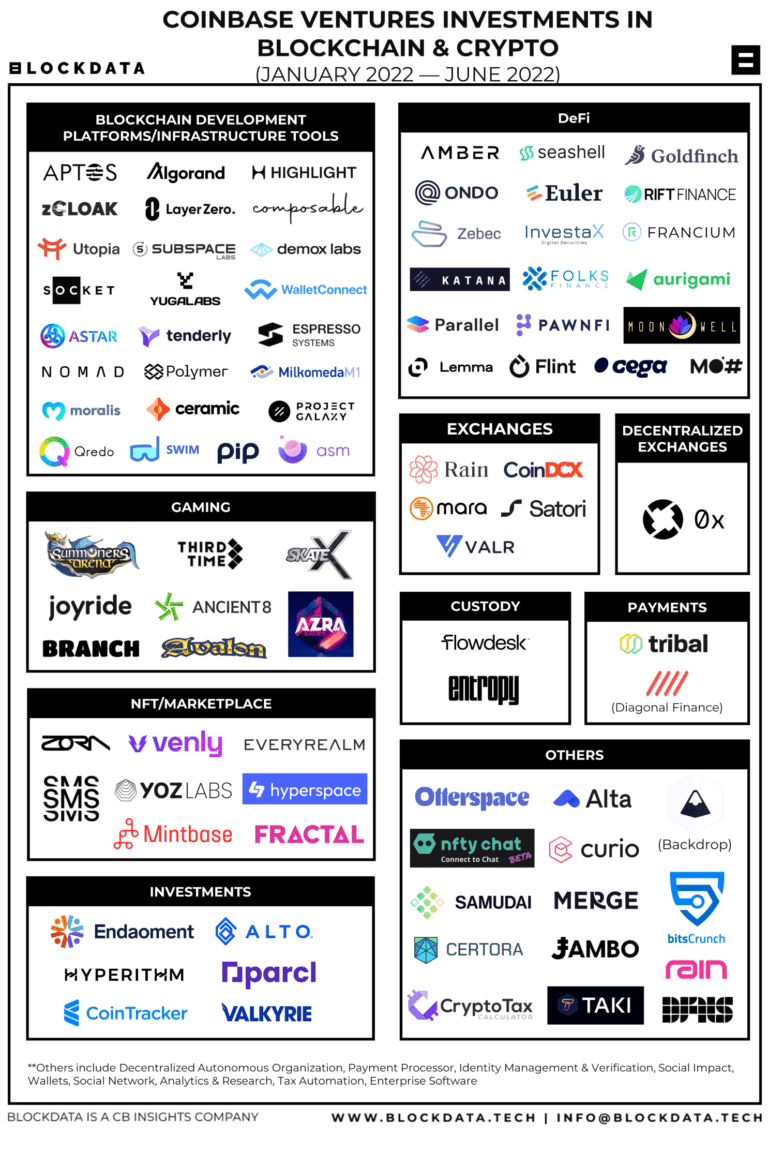

Where Coinbase Ventures is investing

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing CoinSwitch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoinSwitch is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

9,296 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,667 items

Excludes US-based companies

Blockchain 50

50 items

Latest CoinSwitch News

Mar 31, 2025

The country hosts one of the largest crypto user bases globally, indicating a robust demand for digital currencies irrespective of obstacles. “India ranks first in global crypto adoption for the second consecutive year,” as reported by Chainalysis , highlighting the consumers' unwavering interest. Explore India's thriving crypto landscape in 2025, where local platforms drive innovation amidst regulatory hurdles and a burgeoning user base. India's top crypto trading platforms in 2025 In 2025, Indian traders have a plethora of platforms to choose from, each catering to varied needs, from effortless onboarding to advanced trading tools. This article dives into five leading platforms, ensuring that all users—from beginners to seasoned traders—find their perfect match. CoinDCX: Leading with Diversity CoinDCX stands as a premier choice with its comprehensive support of over 400 digital assets and a user base surpassing 10 million . The exchange offers various trading options, including spot trading with competitive fees, and advanced features like margin trading. Why we chose it This platform excels by offering extensive features with a focus on user experience. With INR support and secure onboarding protocols, CoinDCX presents an ideal option for newcomers and professionals alike. Its compliance with Indian AML laws and FIU registration illustrates robust regulatory adherence. CoinSwitch (Kuber): Becoming a Household Name CoinSwitch has carved its niche with a mobile-first strategy appealing to the younger demographic. With more than 20 million subscribers , it offers competitive trading fees and an extensive range of assets for its users, backed by strong security measures. Why we chose it Within its aggregator model, CoinSwitch pulls competitive pricing from multiple exchanges, ensuring that users enjoy favorable rates. Despite some limitations regarding withdrawal options, its platform remains user-friendly, aimed at fostering its growing base. ZebPay: A Veteran in the Industry As one of India's earliest exchanges, ZebPay's focus on security with 98% of assets in cold storage distinguishes it in the crowded market. The availability of varied trading features—including a bespoke quick trade option—attracts many users. Why we chose it With its strong operational history and robust security infrastructure, ZebPay has become synonymous with trust within the Indian market. Despite facing some challenges, its commitment to user security enhances its reputation over time. Binance: The Global Powerhouse Offering access to a vast array of crypto assets, Binance continues to cater to Indian users through its platform while ensuring extremely low trading fees and high liquidity. The P2P trading framework presents an opportunity to engage in crypto purchases with INR. Why we chose it Binance's international standing, combined with its local adaptations, ensures Indian traders experience competitive edge. Regulatory registration with India's FIU bolsters its operational credibility. WazirX: A Comeback Story WazirX, despite facing significant setbacks following a cyberattack, is actively restructuring and focusing on improving its platform security and user experience. Historical precedence in user engagement offers a glimpse of potential recovery. Why we chose it Reputation from prior success coupled with an agenda to enhance security measures makes WazirX a platform to watch. A robust recovery plan signifies hope for long-term users who continue to seek reliable trading environments. Top crypto trading platforms in India compared Criteria CoinDCX CoinSwitch (Kuber) ZebPay Binance WazirX Ease of use User-friendly Very user-friendly Very user-friendly Mixed (mobility complex for beginners) User-friendly (historically) Customer support 24/7 live chat Email, ticket In-app, help center Mixed (slow at times) 24/7 (claimed, poor recent reviews) Trading fees Competitive, tiered Mixed (lower on PRO/Futures) Competitive, free on crypto-crypto Very low Competitive, WRX discounts Security Strong (2FA, cold storage) Strong (FIU register) Strong (cold storage, insurance) Strong (SAFU fund) Poor (recent hack, new partners) Regulatory compliance FIU compliant FIU registered FIU registered FIU registered FIU registered Supported assets INR support Yes (direct) Yes (direct) Yes (INR & USDT) Yes (P2P only) Currently suspended Quick checklist for crypto traders in India ➤ If you are new to crypto and/or trading: CoinSwitch and CoinDCX are excellent for newcomers with user-friendly interfaces and INR support. ➤ If you are experienced: Binance and CoinDCX Pro offer low fees and access to futures, catering to higher volume traders. ➤ If trading in large volumes: Choose Binance or CoinDCX Pro for competitive tiered fees and VIP services. ➤ If INR support is crucial: CoinSwitch and CoinDCX provide seamless poit-of-entry support for Indian rupee transactions. ➤ If security is your primary concern: Opt for ZebPay, CoinDCX, and CoinSwitch, which have proven security measures and compliance standards. India's crypto scene grows against all odds India's resilience in the face of regulatory and tax burdens has made it one of the fastest-growing crypto markets worldwide. High taxes—30% on crypto profits and a 1% TDS—have not deterred users, fostering adoption across a diverse demographic. Chainalysis recognized India as the leader in global crypto adoption for 2023, illustrating a consistent rise in participation across both centralized and decentralized platforms. Finding your fit in India's crypto market As a burgeoning market, understanding the nuances of each platform can guide traders in choosing one that aligns with their trading style, be it simplicity or sophisticated trading tools. Caution is key as regulatory landscapes evolve, and the necessity for informed engagement persists. Don't forget to enable notifications for our Twitter account and Telegram channel to stay informed about the latest cryptocurrency news. Source: https://en.coinotag.com/indias-crypto-market-resilience-exploring-top-platforms-like-coindcx-in-2025/

CoinSwitch Frequently Asked Questions (FAQ)

When was CoinSwitch founded?

CoinSwitch was founded in 2017.

Where is CoinSwitch's headquarters?

CoinSwitch's headquarters is located at 1st Flr ,Wing A, Exora Business Park, Prestige Tech ParkII, Bengaluru.

What is CoinSwitch's latest funding round?

CoinSwitch's latest funding round is Series C.

How much did CoinSwitch raise?

CoinSwitch raised a total of $300M.

Who are the investors of CoinSwitch?

Investors of CoinSwitch include Peak XV Partners, Ribbit Capital, Paradigm, Tiger Global Management, Coinbase Ventures and 4 more.

Who are CoinSwitch's competitors?

Competitors of CoinSwitch include CoinDCX and 1 more.

Loading...

Compare CoinSwitch to Competitors

Unocoin is a cryptocurrency exchange platform that focuses on providing services for trading and managing digital assets in the financial sector. The company offers a platform for buying, selling, and storing cryptocurrencies, as well as converting INR to crypto and vice versa, with additional features such as a systematic buying plan and an API for market data and trading. Unocoin primarily caters to individual investors and traders looking to engage with cryptocurrencies. It was founded in 2013 and is based in Tumkur, India.

Zebpay is a cryptocurrency exchange platform that enables users to buy, sell, and trade various cryptocurrencies. The company provides services, including a crypto lending option, curated crypto portfolios, and API services for trading. Zebpay serves individual investors and traders interested in the cryptocurrency market. It was founded in 2014 and is based in Singapore.

Gemini is a cryptocurrency exchange and custodian that specializes in digital asset services. The company offers a platform for buying, selling, storing, and staking various cryptocurrencies, as well as trading cryptocurrency derivatives. Gemini serves a diverse market, including individual and institutional investors, fintechs, and banks. Gemini was formerly known as Gemini Trust Company. It was founded in 2015 and is based in New York, New York.

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

Nomoex focuses on providing a platform for trading cryptocurrencies. The company offers a range of services including a trading platform for Bitcoin, Ethereum, USDT, and other altcoins, as well as a secure vault for crypto storage and investment. Nomoex caters to both beginners and professional traders with its interface and trading tools. It was founded in 2022 and is based in Warsaw, Poland.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Loading...