Chime

Founded Year

2012Stage

Series G - II | AliveTotal Raised

$2.599BLast Raised

$355M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-12 points in the past 30 days

About Chime

Chime provides banking services. The company offers a banking application that includes features such as direct deposit, no overdraft fees, and resources for financial literacy. Chime was formerly known as 1debit. It was founded in 2012 and is based in San Francisco, California.

Loading...

Chime's Products & Differentiators

SpotMe

Fee free overdraft alternative

Loading...

Research containing Chime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

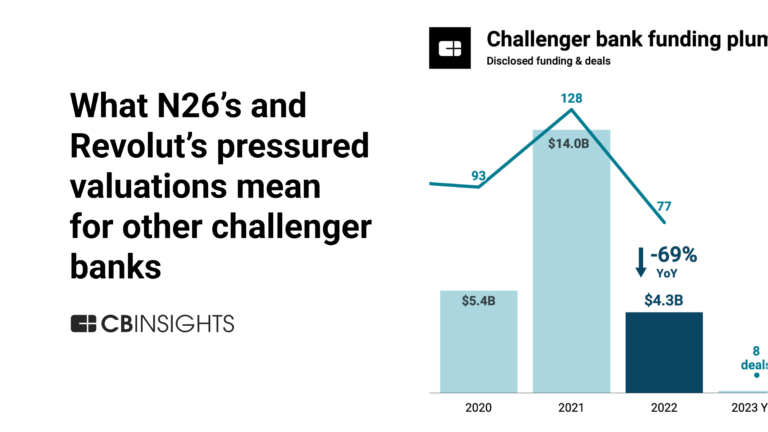

CB Insights Intelligence Analysts have mentioned Chime in 3 CB Insights research briefs, most recently on May 2, 2023.

Expert Collections containing Chime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chime is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

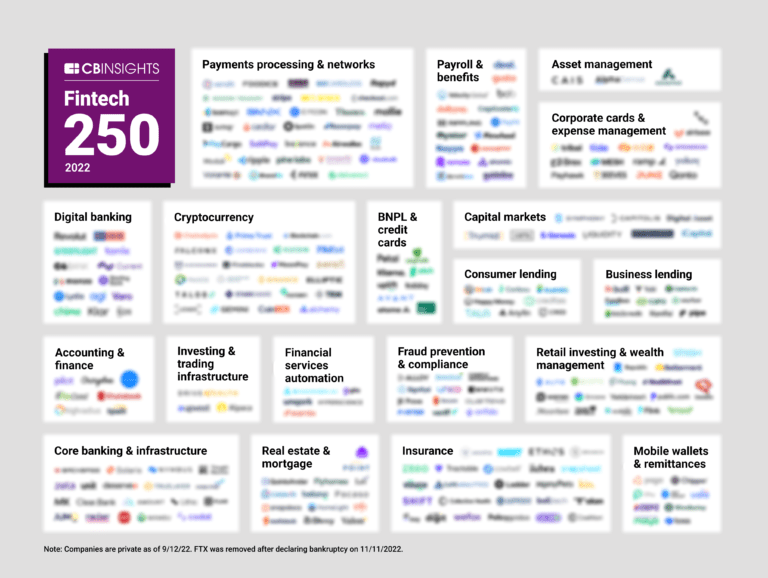

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Fintech

9,451 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,105 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Chime Patents

Chime has filed 5 patents.

The 3 most popular patent topics include:

- computer security

- computer network security

- computer access control protocols

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/4/2024 | 3/25/2025 | Graphical user interface elements, Graphical control elements, Graphical user interfaces, Windows administration, User interfaces | Grant |

Application Date | 3/4/2024 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Graphical user interface elements, Graphical control elements, Graphical user interfaces, Windows administration, User interfaces |

Status | Grant |

Latest Chime News

Mar 25, 2025

Chime Introduces $500 Instant Loans Chime has launched Instant Loans, a micro-lending product offering up to $500 instantly with a fixed interest rate of 29.76%, without credit checks. When members repay these loans on time, it can help boost their credit scores by 10 to 30 points, as Chime reports on-time payments to credit bureaus. The Instant Loans product complements Chime’s existing suite of financial tools targeted toward middle-income users, including MyPay (paycheck advances) and SpotMe (fee-free overdrafts). Neobank mega-competitor Chime announced that it has launched Instant Loans, a new product that allows users to access to up to $500 in funds instantly with a fixed interest rate. The Instant Loans are three-month installment loans of up to $500 available to Chime members who receive direct deposits to their Chime Checking Account and are pre-approved, with no credit check required. To underwrite the loans, Chime uses its own technology combined with its own unique data sources. Chime will notify members who are pre-approved within the Chime app and if a customer chooses to access the funds, they pay a fixed interest rate of $5 for every $100 borrowed and repay the funds in three monthly payments of $35 per $100 borrowed. This equates to an interest rate of 29.76%. When consumers repay on time, they can potentially build up their credit, as Chime reports each on-time payment to credit reporting agencies. According to Chime, customers who pay on time may see their credit score increase by 10 to 30 points. “We are relentlessly focused on helping everyday people achieve financial progress,” said Chime Chief Product Officer Madhu Muthukumar. “Our members have told us that they want simple and transparent tools to access money when they need it, and to help them build credit — and we’re excited Instant Loans provides both to our members.” Chime was founded in 2012 and is well known in fintech for offering tools and services that cater to lower-to-middle income consumers. The challenger bank is best known for its earned wage access tool that allows users to receive their paycheck up to two days earlier when they set up direct deposit, but Chime also offers a credit-building tool and a feature that will spot users up to $200 to avoid account overdrafts. Today’s launch of high interest micro-loans is a perfect fit for Chime, which aims to create transparency in lending with the fixed interest rate. The new Instant Loans product sits in Chime’s portfolio of other micro-loans, including MyPay, which is a paycheck advance product that allows members to access up to $500 of their check before payday with no interest; and SpotMe, which allows members to overdraft without fees. Views: 1

Chime Frequently Asked Questions (FAQ)

When was Chime founded?

Chime was founded in 2012.

Where is Chime's headquarters?

Chime's headquarters is located at 101 California Street, San Francisco.

What is Chime's latest funding round?

Chime's latest funding round is Series G - II.

How much did Chime raise?

Chime raised a total of $2.599B.

Who are the investors of Chime?

Investors of Chime include Crosslink Capital, Menlo Ventures, General Atlantic, Dragoneer Investment Group, Tiger Global Management and 24 more.

Who are Chime's competitors?

Competitors of Chime include Revolut, Current, Brigit, ONE, Jiko and 7 more.

What products does Chime offer?

Chime's products include SpotMe and 2 more.

Loading...

Compare Chime to Competitors

Varo is a digital bank that focuses on providing premium banking services through a mobile app. The company offers access to high-yield savings accounts, quicker access to funds, and automatic saving tools without the need for physical branches. Varo serves customers seeking convenient and modern banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

KikOff is a personal finance platform that offers a revolving line of credit and a secured credit card. These financial products aim to assist individuals in establishing a payment history and improving their credit scores. KikOff serves individuals interested in building or enhancing their credit profiles. It was founded in 2019 and is based in San Francisco, California.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

Bancacao is a developer of banking products. The company's Tzune is a digital financial services platform that offers fair, contactless, and personal solutions.

Loading...