CertiK

Founded Year

2018Stage

Grant | AliveTotal Raised

$297.35MLast Raised

$500K | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-49 points in the past 30 days

About CertiK

CertiK operates as a blockchain and smart contract auditing company. It provides a formal verification platform for contracts and blockchain ecosystems. The company was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing CertiK

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The blockchain security & audits market is a critical component of the overall blockchain ecosystem, providing assurance and trust in the security of blockchain-based systems. This market is focused on offering various solutions to address the growing security concerns related to the use of blockchain technology, including secure storage of private keys, vulnerability assessments, smart contract a…

CertiK named as Leader among 15 other companies, including Coincover, Halborn, and Beosin.

Loading...

Research containing CertiK

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CertiK in 5 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market mapExpert Collections containing CertiK

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CertiK is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Regtech

1,811 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,434 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Cybersecurity

10,544 items

These companies protect organizations from digital threats.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Blockchain 50

50 items

Latest CertiK News

Mar 25, 2025

Stop us if you've heard this one, but ‘pig butchering' scammers rely on a combination of Tether and Bahamian banks to launder their ill-gotten gains. On March 23, the New York Times dropped an investigative report into Southeast Asia-based scammers and their reliance on the infamous Cambodia-based Huione Guarantee darknet marketplace that offers scammers the tools of their trade—everything from software to web development to cattle prods for shocking their enslaved drones who don't make their quotas. Huione also offers opportunities to help launder the loot obtained via these scams. This involves a so-called ‘matchmaker' who maintains a worldwide network of ‘mules'—either individuals or shell companies that control bank accounts or digital asset wallets—who can help move money within hours of it landing in their hands. The matchmaker will claim around 15% of the total being laundered as payment for himself and his mules. Funds being laundered in China garner much higher commissions (up to 60%), reflecting the regime's no-nonsense efforts to protect its citizens from these scams. The percentage also depends on the nature of the scam and the likelihood that victims will report the crime to the authorities (many ‘romance scam' victims can be too embarrassed to come forward, while financial scam victims fear being scolded by friends and family for being so gullible). The matchmaker sends the mules' bank/wallet info to the scammer, who relays this info to the individual(s) being scammed. Once the victim sends the cash, it gets bounced around by the mules before ultimately being converted into digital assets. The mule takes his/her cut and sends the rest to the matchmaker, who takes their cut before forwarding the remaining sum to the scammer(s). Also, various Huione affiliates are taking a cut along each step of this process. Huione Group, an ostensibly legitimate financial conglomerate, claims to be unaffiliated with its illegitimate namesakes. However, Huione Guarantee—which was rebranded as ‘Haowang Guarantee' following last year's reports of its unsavory activities—proudly tells its customers that Huione Group is one of its “strategic partners and shareholders.” Another affiliate, Huione International Pay, is said to be a ‘matchmaker' itself, while other departments handle customer relations for scammers, track mule accounts, and monitor the Telegram channels in which hundreds of thousands of users offer goods and services. The work of the matchmakers is said to be so constant and repetitive that it's known in China as ‘moving bricks.' The 'guarantee' in Huione/Haowang Guarantee stemmed partly from its willingness to provide escrow services for the matchmakers/mules. This enforces ‘honor among thieves,' ensuring that the scammers don't become victims themselves. There's always a Tether connection The actions of the money mules are where the spectre of ‘crypto' generally rears its ugly head. Mules take the most risk and are the most active members of this laundering chain, rapidly shifting small sums between many bank accounts, most of which aren't open for very long. The Times cited one court case in which the funds obtained from U.S. scam victims were sent to unspecified banks in the Bahamas. From there, the funds were used to buy USDT, the market-leading stablecoin issued by Tether—a name that looms large in all pig butchering conversations—via the Binance digital asset exchange. The USDT is later converted to cash at a Cambodian casino or using Huione's official payment channels. Tether's struggles to maintain U.S. banking relationships are the stuff of legend, leading to its deep ties to Bahamas-based Deltec Bank & Trust. Tether has been linked to other Bahamas-based financial institutions, including Capital Union Bank and Britannia Bank & Trust. Last September, Deltec sold its private clients line of business to Britannia. Following last year's exposé by the blockchain analysis firm Elliptic, Tether froze nearly $30 million worth of USDT linked to Huione. However, Elliptic noted that this might have had more to do with the same wallet receiving funds associated with North Korea's state-sponsored hackers Lazarus Group. Regardless, Elliptic estimated that “over $11 billion” worth of digital assets (primarily USDT) had flowed through Huione over the past three years, making this frozen $30 million a drop in the bucket. In its July 2024 report, Elliptic said there hadn't been a single quarter in which less than $1 billion worth of USDT was received by Huione merchants since Q1 2023. Back to the top ↑ Stableconned Still, there may be some impact on Huione's activities from Tether's belated compliance. While USDT remains popular on the site, Elliptic reported in January that Huione had launched various bespoke ‘crypto' products, including its exchange, network and dollar-denominated stablecoin (USDH). Huione promoted USDH for its ability to avoid “the common freezing and transfer restrictions of traditional digital currencies.” In February, blockchain security firm CertiK issued a public apology for auditing the USDH smart contract for a fee. While CertiK's audit flagged several security issues with the contract, Huione posted the audit on its website anyway, apparently concluding that most users would just see the CertiK logo and skip the fine print. To some observers, the mere fact that CertiK performed the USDH audit served as an endorsement of the group behind the project, a view the company vehemently rejected (albeit with some egg on its face). CertiK co-founder Ronghui Gu later tweeted that the company had been “contacted by a third-party dev agency, so we failed to link it to the fraudsters until much later … deeper due diligence and extra alerts would have helped.” But others pointed out that CertiK's since-deleted USDH audit report included the name Huione. Given that the audit was performed just five months after Elliptic's bombshell report, many feel that CertiK should have been more aware of what they were being asked to inspect. Back to the top ↑ Tether's getting engaged Interestingly, the Times report on Huione came just as Tether CEO Paolo Ardoino and Tron founder Justin Sun are set to address a panel at this week's DC Blockchain Summit event. The panel, T3 FCU: Coming Together on Cyber Crime, will focus on the T3 Financial Crime Unit, a crypto crime-fighting initiative involving Tether, Tron and blockchain analysts TRM Labs that launched last year. While the total volume of USDT issued on the Tron blockchain ($64.7 billion) is currently below USDT issued on the Ethereum network ($75.9 billion), it wasn't always thus. It was only after USDT on Tron earned an unwanted reputation as the preferred currency of criminals and terror groups that USDT's shift back to Ethereum began in earnest. Tether has been trying to clean up its regulatory act in the hopes of not being banished from the U.S. market following the expected passage of new stablecoin legislation. Tron's Sun has been taking a more direct route, buying favor with the new administration by putting money directly in the president's pocket, a gambit that so far appears to be working as designed. Apart from printing the criminal world's reserve currency, one of the principal concerns surrounding Tether is the lack of independent confirmation of the reserve assets allegedly backing the now $143.5 billion in circulating USDT. Despite years of assurances that a comprehensive third-party audit of its reserves was in the works, Tether has only ever issued quarterly ‘attestations' based on a one-day snapshot of Tether's accounts, with no guarantees of what those accounts looked like the day before or the day after. Ardoino has claimed on multiple occasions that none of the so-called ‘big four' accounting firms wants anything to do with Tether for reputational reasons. However, he never explained why these four companies were the only ones capable of looking at Tether's books. On March 21, Ardoino told Reuters that Tether was “engaging with a Big Four accounting firm,” although he declined to specify the name of the firm or what stage these ‘engagements' might be at. Tether recently hired a new CFO (Simon McWilliams) to take “a historic step toward a full financial audit,” which Ardoino now says is “a top priority” for the firm. With respect, ‘engaging with' is typical Tether. Sounds great, means nothing. Does booking a meeting and then refusing to answer any questions count? What about parking outside an auditor's office and honking the horn? Or standing outside the auditor's window late one night holding a boombox over one's head blasting Peter Gabriel's In Your Eyes? Hiring an auditor is a straight-up affair for a normal company with nothing to hide. Here are our books; let us know if you have any questions. The fact that this is proving such a Herculean labor strongly suggests that Tether's ‘books' are a collection of indecipherable scribbles on cocktail napkins. If that. Back to the top ↑ Watch: Chronicle Upgrade, Teranode, and Bitcoin Stewardship title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””> Source: https://coingeek.com/tether-pig-butchering-money-laundering-auditor-engaging/

CertiK Frequently Asked Questions (FAQ)

When was CertiK founded?

CertiK was founded in 2018.

Where is CertiK's headquarters?

CertiK's headquarters is located at 1001 Avenue of The Americas, New York.

What is CertiK's latest funding round?

CertiK's latest funding round is Grant.

How much did CertiK raise?

CertiK raised a total of $297.35M.

Who are the investors of CertiK?

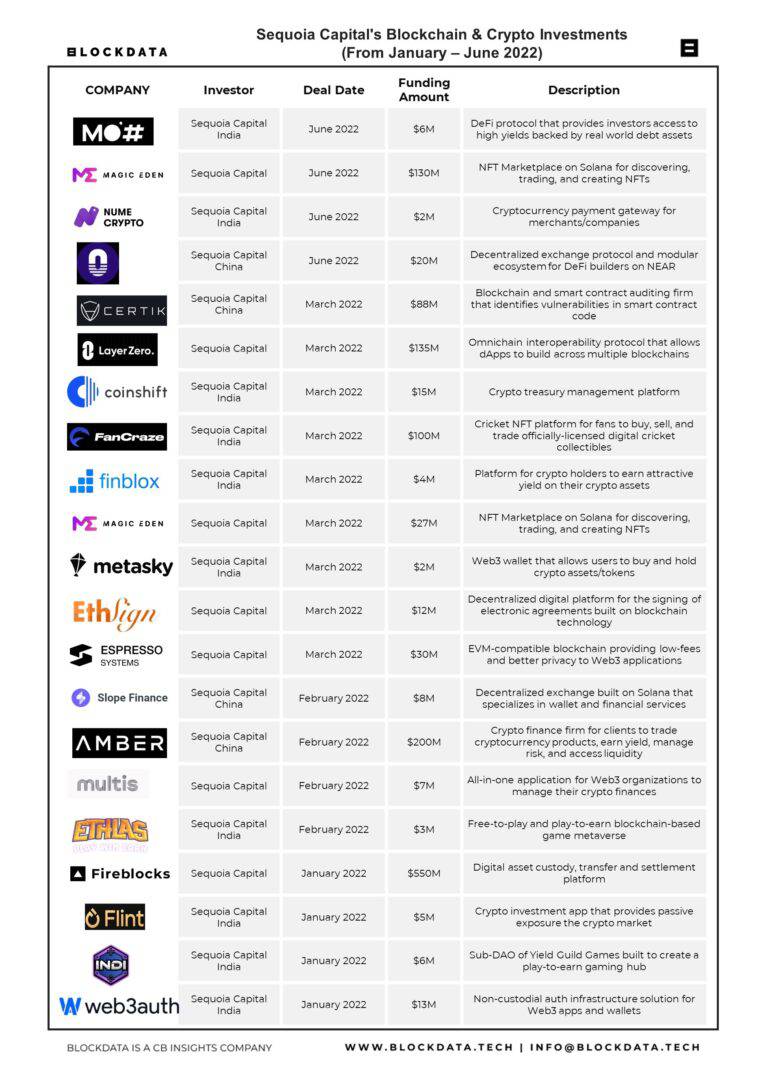

Investors of CertiK include Sui, Tiger Global Management, SoftBank, Lightspeed Venture Partners, HongShan and 21 more.

Who are CertiK's competitors?

Competitors of CertiK include CredShields, Quantstamp, Sec3, MetaTrust, Armur AI and 7 more.

Loading...

Compare CertiK to Competitors

Hacken oprates as a blockchain security auditor focused on improving the safety and ethical standards of the Web3, cryptocurrency, and decentralized finance (DeFi) sectors. The company offers a suite of services including smart contract audits, blockchain protocol audits, penetration testing, and bug bounty programs to identify and mitigate vulnerabilities. Hacken serves a diverse range of clients within the blockchain and cryptocurrency industries, aiming to protect digital assets and maintain integrity in the ecosystem. It was founded in 2017 and is based in Tallinn, Estonia.

SlowMist is a blockchain security firm that specializes in protecting the blockchain ecosystem. The company offers a range of services including security audits for exchanges, wallets, and smart contracts, as well as threat intelligence, defense deployment, and security consulting. SlowMist caters to various sectors within the blockchain industry, providing security solutions to exchanges, wallet providers, and blockchain enterprises. It was founded in 2018 and is based in Xiamen, Fujian.

CredShields specializes in cybersecurity solutions, focusing on the protection of web3 applications and smart contracts. The company offers a suite of security tools and services, including smart contract audits, vulnerability scanning, and threat monitoring, to ensure the safety of applications from development to post-deployment. CredShields primarily serves the blockchain and web3 sectors, providing security for companies operating with cryptocurrencies and decentralized applications. It was founded in 2021 and is based in Singapore.

PeckShield is a blockchain security company that specializes in identifying and mitigating risks in the blockchain ecosystem. The company offers a range of services including smart contract audits, wallet security assessments, and security consultancy to enhance the safety of blockchain infrastructure and applications. PeckShield primarily serves blockchain infrastructure vendors, exchanges, crypto wallets, mining pools, DApp developers, and DeFi pioneers. It was founded in 2018 and is based in Hangzhou, Zhejiang .

MythX provides a security analysis platform that identifies vulnerabilities in Ethereum and EVM-based blockchain smart contracts through microservices including static analysis, dynamic analysis, and symbolic execution. The services integrate with developer tools and provide analysis reports to improve the security of smart contract development. It is based in Brooklyn, New York.

Firewall focuses on enhancing smart contract security within the blockchain industry. The company offers an optimistic security solution that includes programmable finality and a proof-of-exploit consensus mechanism to protect against smart contract exploits and fraud. It was founded in 2023 and is based in San Francisco, California.

Loading...