Cashfree Payments

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$117.92MLast Raised

$23M | 17 days agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+218 points in the past 30 days

About Cashfree Payments

Cashfree Payments provides payments and banking solutions that enable businesses to collect payments and make payouts. The company offers services such as a payment gateway for online transactions and payout solutions for disbursing funds. It also provides identity verification and fraud detection services. It was founded in 2015 and is based in Bengaluru, India.

Loading...

Cashfree Payments's Product Videos

Cashfree Payments's Products & Differentiators

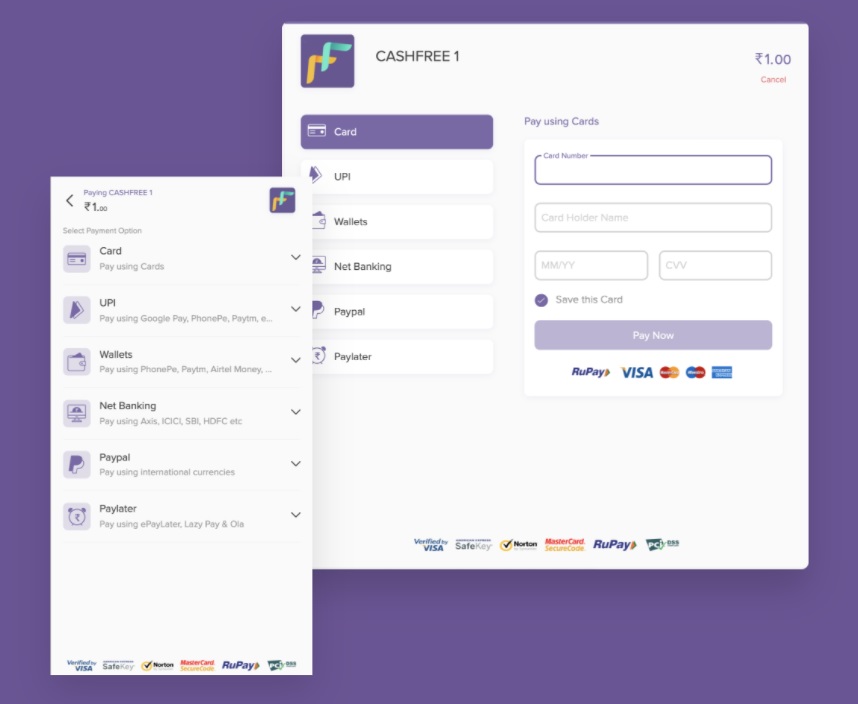

Payment Gateway

Cashfree Payment Gateway is a smart payment collection solution that helps online businesses accept domestic and international payments via a wide range of payment methods for your website & mobile app.

Loading...

Research containing Cashfree Payments

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cashfree Payments in 2 CB Insights research briefs, most recently on Mar 28, 2025.

Expert Collections containing Cashfree Payments

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cashfree Payments is included in 3 Expert Collections, including Payments.

Payments

3,333 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,699 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Cashfree Payments News

Mar 27, 2025

Disclaimer: This content generated by AI & may have errors or hallucinations. Edit before use. Read our Terms of use Smartly Disclaimer: This content generated by AI & may have errors or hallucinations. Edit before use. Read our Terms of use According to reports , Paytm subsidiary Paytm Payments Services Limited (PPSL) has terminated its integration with third-party platforms like Juspay and will directly process transactions via its own payment gateway. The development was first reported by Moneycontrol, which viewed Paytm’s notification to merchants advising them to transfer their businesses to PPSL before April 1, 2025, to avoid service disruptions. Why this matters? Paytm became the fourth fintech entity to cut ties with Juspay, following PhonePe , Razorpay, and Cashfree. In a previously emailed confirmation to MediaNama, Razorpay stated, “We believe that only through direct integrations, we can ensure our latest innovations reach our customers swiftly and enhance their operations and experiences seamlessly”. A Cashfree Payments spokesperson responded in a similar vein, claiming to accelerate the delivery of features and offering superior support and merchant experience through direct integration. These exits follow Juspay receiving a finalised payment aggregator license from the Reserve Bank of India (RBI) in February 2024. For context , payment aggregators (PAs) are third-party providers consolidating multiple payment methods into a single setup, streamlining payment acceptance for merchants. Conversely, payment gateways (PGs) are technological solutions serving as intermediaries between customers and merchant banks, securely transmitting encrypted payment data. As MediaNama explained previously, PGs merely provide technical solutions and do not collect payment by themselves; therefore, while PAs can function as PGs, the opposite cannot be done. However, with the new license in hand, Juspay launched HyperPG , its own PA service, stepping into direct competition with the likes of PhonePe and other mentioned PAs. What’s the way forward for Juspay? MediaNama contacted Juspay to get some insights into their perspectives on severances. Question: With the termination of these partnerships, what specific strategies is Juspay implementing to mitigate potential impacts on its transaction volumes and revenue streams? Responding to this, a Juspay spokesperson stressed that it doesn’t have any partnerships with PAs and functions solely as a technology service provider (TSP) for merchants. “When merchants partner with us, our technology seamlessly integrates into their tech stack, and our team functions as an extension of theirs. The business relationship is between the merchant and PAs for payments processing/settlement and separately between the merchant and Juspay for payments orchestration and other value adds we offer them” they added. The spokesperson also denied any business impact, emphasising long-standing merchant reliance on Juspay. Question: How does Juspay intend to address concerns from payment aggregators about potential conflicts of interest, especially after securing its own Payment Aggregator license from the Reserve Bank of India? In response to this query, Juspay emphasized that there exists no conflict of interest. The spokesperson explained that merchants make all transaction routing decisions independently, based on specific business requirements. These include cost optimisation, volume commitments with different payment aggregators, and specific feature needs, among others. “Juspay holds no role in influencing the merchant’s choice of PAs- as we are simply a TSP for the merchant”, they concluded. Advertisements Question: What measures is Juspay taking to maintain its relevance and value proposition to merchants and other stakeholders? Juspay began by stating that it champions diversity, interoperability and merchants’ freedom of choice. The spokesperson claimed that the open-sourcing of Juspay’s routing engine – a part of the orchestration system that directs the incoming payment transactions to the most viable payment gateway – was a part of the fintech’s plan to open-source more elements of the payments stack and “democratize access to enterprise-grade payments infrastructure for merchants in India and across the world”. For context, Juspay recently open-sourced its payments orchestration as a part of its broader open-source initiative, Hyperswitch . Jumping into the payment orchestration boat To explain , payment orchestration comprises integrating a business’ PGs, processors, and other financial service providers into a unified platform to manage all payment operations. Having moved away from Juspay, fintechs like Razorpay with ‘ Optimizer ‘ and Cashfree with ‘ FlowWise ‘ have launched their own payment orchestration services. Also Read:

Cashfree Payments Frequently Asked Questions (FAQ)

When was Cashfree Payments founded?

Cashfree Payments was founded in 2015.

Where is Cashfree Payments's headquarters?

Cashfree Payments's headquarters is located at 80 Feet Road, Koramangala 1A Block, Koramangala 3 Block, Koramangala, Bengaluru.

What is Cashfree Payments's latest funding round?

Cashfree Payments's latest funding round is Series C - II.

How much did Cashfree Payments raise?

Cashfree Payments raised a total of $117.92M.

Who are the investors of Cashfree Payments?

Investors of Cashfree Payments include Apis Partners, Krafton, State Bank of India, Y Combinator, Smilegate Investment and 6 more.

Who are Cashfree Payments's competitors?

Competitors of Cashfree Payments include Safexpay and 1 more.

What products does Cashfree Payments offer?

Cashfree Payments's products include Payment Gateway and 4 more.

Loading...

Compare Cashfree Payments to Competitors

Open Financial Technologies is a connected banking platform for simplifying business payments and cash flow management for Small and Medium-sized Enterprise (SMEs) and startups. The company offers financial tools that enable businesses to integrate their bank accounts for seamless vendor payments, receivables tracking, and automatic reconciliation with accounting software. Open primarily serves the e-commerce industry, retail, manufacturing, real estate, healthcare, hospitality, and professional services sectors. It was founded in 2017 and is based in Bengaluru, India.

Floral Supply Syndicate specializes in a broad range of floral and decorative supplies for various design industries. The company offers products such as craft materials, decorative packaging, fancy ribbons, and an extensive selection of holiday merchandise. Floral Supply Syndicate primarily serves industries such as floristry, event planning, interior design, and retail, providing them with essential supplies for their operations. It was founded in 1939 and is based in Camarillo, California.

Razorpay is a comprehensive financial solutions company that specializes in online payment processing and business banking solutions. The company offers a suite of products that enable businesses to accept, process, and disburse payments, manage payroll, and access credit services. Razorpay caters to a diverse range of sectors, including e-commerce, education, financial services, SaaS, and freelancers. It was founded in 2014 and is based in Bengaluru, India.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Thillais Analytical Solutions specializes in enterprise software solutions and consulting within the technology sector. The company provides implementation, maintenance, and support services for various Oracle products, as well as staffing and project placement services. Thillais Analytical Solutions also develops proprietary tools for master data conversion and the creation of bolt-on applications using PeopleTools technology. It is based in Chennai, India.

Safexpay operates as a financial technology company creating customized payment platforms for businesses. The company's main offerings include a suite of payment aggregation and neo-banking solutions, designed to facilitate transactions across multiple channels. It primarily serves sectors such as government, education, e-commerce, banking, and other industries. It was founded in 2017 and is based in Mumbai, India.

Loading...