Carbonplace

Founded Year

2021Stage

Seed | AliveTotal Raised

$45MLast Raised

$45M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-82 points in the past 30 days

About Carbonplace

Carbonplace is a global carbon credit transaction network operating within the environmental finance sector. The company provides a platform for the secure and transparent transfer, management, and retirement of certified carbon credits, utilizing blockchain-enabled distributed ledger technology. Carbonplace primarily serves banks, corporate buyers and sellers of carbon credits, and finance partners in the voluntary carbon market. It was founded in 2021 and is based in London, England.

Loading...

ESPs containing Carbonplace

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

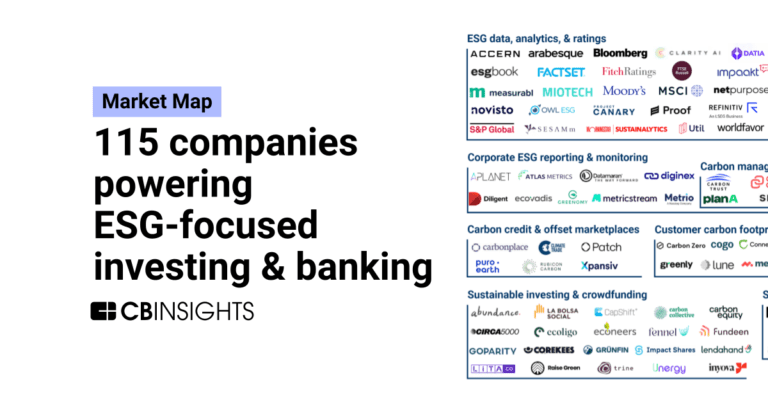

The carbon offset marketplaces market allows companies to offset their carbon footprint through the purchase of carbon credits from certified sustainable projects around the world. Carbon offsetting is a mechanism where individuals or organizations invest in projects that reduce greenhouse gas emissions to compensate for their own emissions. These solutions enable the purchase of carbon credits ei…

Carbonplace named as Challenger among 15 other companies, including Xpansiv, Patch, and Pachama.

Loading...

Research containing Carbonplace

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Carbonplace in 5 CB Insights research briefs, most recently on Sep 12, 2023.

Expert Collections containing Carbonplace

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Carbonplace is included in 3 Expert Collections, including Decarbonization Tech.

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

Blockchain

8,310 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,662 items

Excludes US-based companies

Latest Carbonplace News

Mar 17, 2025

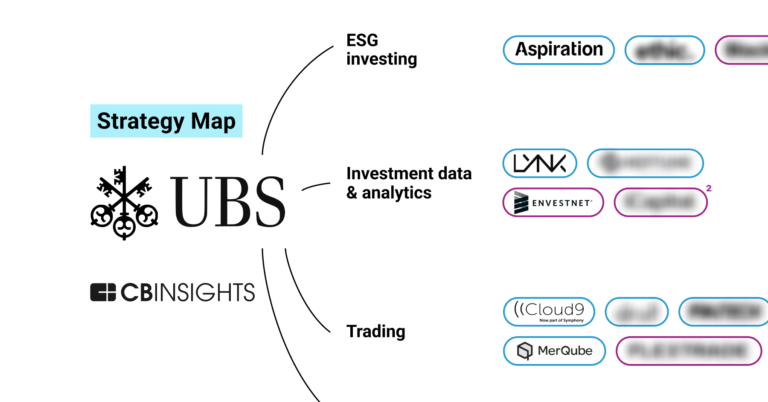

Mar 17, 2025 • GCV reporters Matthew Raeside, Director of IB principal investments at UBS, is one of our top 50 Rising Stars in corporate venturing for 2025. Matthew Raeside was a Royal Navy officer, controlling fighter aircraft on Type 45 Destroyers before joining UBS through the Swiss investment bank’s ex-forces recruitment scheme. “I remember my first day on the trading floor and I looked around and said, ‘it is exactly the same’. People sitting behind banks of screens, all with headsets on, taking in information, taking actions and passing it on.” Raeside fell in love with venture investing during a rotation on the bank’s Principal Investments desk. The variety of the work was a key draw. “What I like most about the day to day is the level of problem solving required. Every situation that presents itself is unique in some aspect,” he says. “There is no day I have had since starting that has been the same,” he says. The UBS strategic investments team is made up of eight people, half of whom work on investments, while the other half works more directly with the portfolio startups on implementation. The team’s investments are strategic and focused on areas that can enhance UBS’s capabilities, mainly fintech and market infrastructure, with some focus on emerging themes such as sustainability, digital assets and AI. “What I like most about the day to day is the level of problem solving required. Every situation that presents itself is unique in some aspect.” One company that Raeside has personally been deeply involved with is Carbonplace, a portfolio management and settlement platform for the voluntary carbon markets. UBS’s investment team, alongside eight other banks, helped build the company from initial idea to an established business with more than 30 employees. Raeside now sits on the board. Balancing the needs of small nimble startups and the large corporate structure of UBS is one of the biggest challenges, he says. “You have young companies that are very dynamic, but you are working in a much larger organisation with controls, policies and procedures. Achieving a balance between those and being able to operate in both of those worlds is the unique corporate venturing skill.” See the full list of Rising Stars 2025 here . LEADERSHIP SOCIETY Informing, connecting, and transforming the global corporate venture capital ecosystem. The Global Corporate Venturing (GCV) Leadership Society’s mission is to help bridge the different strengths and ambitions of investors across industry sectors, geography, structure, and their returns.

Carbonplace Frequently Asked Questions (FAQ)

When was Carbonplace founded?

Carbonplace was founded in 2021.

Where is Carbonplace's headquarters?

Carbonplace's headquarters is located at One Silk Street, London.

What is Carbonplace's latest funding round?

Carbonplace's latest funding round is Seed.

How much did Carbonplace raise?

Carbonplace raised a total of $45M.

Who are the investors of Carbonplace?

Investors of Carbonplace include Canadian Imperial Bank of Commerce, Banco Bilbao Vizcaya Argentaria, UBS, BNP Paribas, Sumitomo Mitsui Banking and 6 more.

Loading...

Loading...