Snapsheet

Founded Year

2011Stage

Series E - III | AliveTotal Raised

$125.6MLast Raised

$5M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Snapsheet

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

Loading...

ESPs containing Snapsheet

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

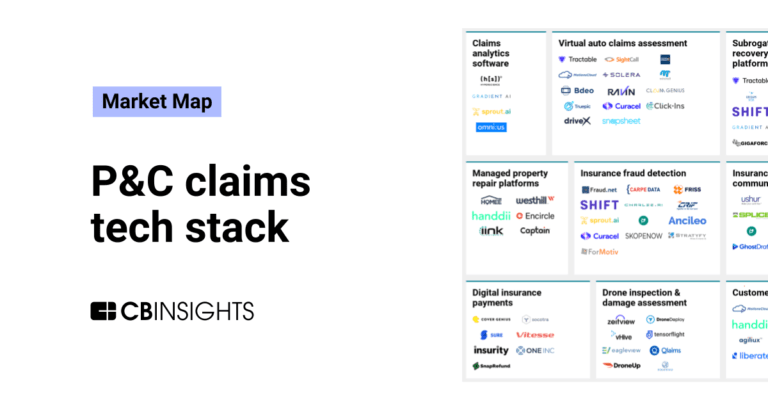

The virtual auto claims assessment market automates the analysis and assessment of auto insurance claims. These vendors typically use augmented reality and computer vision to analyze property claims data submitted by policyholders or adjusters. Additionally, some of these platforms have the ability to capture real-time data, from sources like telematics sensors, at scale. Insurance companies can b…

Snapsheet named as Leader among 13 other companies, including Verisk, CCC Intelligent Solutions, and Tractable.

Snapsheet's Products & Differentiators

Claims

Snapsheet Claims is a modern, cloud-based claims management platform designed to streamline and enhance the entire claims process for insurance companies. Machine Learning and AI Integration Learning from Data: Machine learning models are trained on large datasets, including historical claims data, to identify patterns and make predictions. This enables the platform to continually improve its accuracy and efficiency over time. Adaptability: As the platform interacts with users and processes more claims, it learns and adapts to new types of data, emerging fraud patterns, and changes in user behavior. Enhanced Decision Making: AI supports adjusters by providing predictive analytics, detecting anomalies, and highlighting potential issues, thus enhancing the overall decision-making process.

Loading...

Research containing Snapsheet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Snapsheet in 4 CB Insights research briefs, most recently on Jun 7, 2024.

Dec 18, 2023

The P&C claims tech stack market mapExpert Collections containing Snapsheet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Snapsheet is included in 6 Expert Collections, including Fintech 100.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,487 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,449 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Artificial Intelligence

7,221 items

Latest Snapsheet News

Feb 27, 2025

News provided by Share this article Share toX CHICAGO, Feb. 27, 2025 /PRNewswire/ -- Snapsheet, a leader in claims management technology, is excited to announce a strategic partnership with CrashBay, an advanced repair management platform, to enhance efficiency and transparency in the claims and repair process for insurers. Crashbay, Snapsheet logos This collaboration brings together Snapsheet's cloud-based claims management system with CrashBay's marketplace for auto repair, providing insurers with an integrated system that streamlines workflows from claim initiation to repair completion. By connecting claims processing with real-time repair facility insights, insurers, and policyholders benefit from improved cycle times, optimized repair shop selection, and a more seamless claims experience. Enhancing the Claims and Repair Process The integration of CrashBay's repair management technology into Snapsheet's ecosystem offers insurers a simplified, automated process for repair coordination. Through this partnership, insurers gain access to a nationwide network of repair facilities, ensuring efficient routing of vehicles for service while reducing delays and administrative burdens. Key benefits of the Snapsheet and CrashBay partnership include: Optimized Repair Selection – Shop recommendations based on location, availability, and specialization ensure efficient repair assignments. End-to-End Automation – The seamless integration between Snapsheet and CrashBay reduces manual processes and speeds up claims resolution. Improved Policyholder Experience – Insurers can offer a frictionless repair process with real-time tracking and communication. "A fast-growing scale-up and a pioneer in this space, CrashBay is part of a new category offering a digital marketplace solution that leverages innovative technology to enhance the customer experience," said Andy Cohen, President of Snapsheet. "We are proud to equip CrashBay, along with our clients across the globe, with a platform that allows them to build a claims operating model for the digital world." "Our partnership with Snapsheet represents a powerful alignment of technology and expertise," said John Harvey, CEO of CrashBay. "Together, we're bringing a new level of automation and transparency to insurers, ensuring claims and repairs are handled with maximum efficiency and minimal friction," said Andrew Daniels, President and COO of CrashBay. About CrashBay CrashBay is an auto repair management marketplace that connects insurers, fleets, and repair shops to optimize repair scheduling and management. CrashBay operates across the US and Canada with member shops coast to coast in both countries. With real-time insights, automated workflows, and an extensive marketplace of shops, CrashBay improves efficiency and transparency in the claims and repair process. For more information, visit www.crashbay.com . About Snapsheet Snapsheet ignited the virtual appraisals revolution and is a leader in claims management technology. Built on a foundation of claims innovation, Snapsheet boasts a swift digital insurance claims process for auto, property, and commercial lines in the United States. Collaborating with over 140 customers, including many of the largest insurance carriers, TPAs, MGAs, and insurtechs, Snapsheet streamlines claims, appraisals, and payment processes through advanced technology. Learn more at www.snapsheetclaims.com . SOURCE CrashBay

Snapsheet Frequently Asked Questions (FAQ)

When was Snapsheet founded?

Snapsheet was founded in 2011.

Where is Snapsheet's headquarters?

Snapsheet's headquarters is located at 1 North Dearborn Street, Chicago.

What is Snapsheet's latest funding round?

Snapsheet's latest funding round is Series E - III.

How much did Snapsheet raise?

Snapsheet raised a total of $125.6M.

Who are the investors of Snapsheet?

Investors of Snapsheet include Tola Capital, Lightbank, F-Prime Capital, Ping An Global Voyager Fund, Regeneration.VC and 20 more.

Who are Snapsheet's competitors?

Competitors of Snapsheet include Next Insurance, NeueHealth, BIMA, Alan, Digit Insurance and 7 more.

What products does Snapsheet offer?

Snapsheet's products include Claims and 2 more.

Loading...

Compare Snapsheet to Competitors

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

BIMA provides mobile-delivered insurance and health services in the financial services sector. The company offers a range of life, accident, and health insurance products that are registered and paid for via mobile technology, ensuring a paperless experience. BIMA primarily serves underserved communities through partnerships with mobile operators and microfinance institutions. It was founded in 2010 and is based in Singapore.

Alan focuses on providing health insurance services and preventive health solutions within the healthcare industry. The company offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. Alan primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Tractable focuses on artificial intelligence in the automotive and property insurance sectors. The company provides solutions for damage appraisal, assisting in the assessment and protection of vehicles and homes. Tractable's technology aims to improve claims processes, from reporting to settlement, and to support the appraisal of automotive parts. It was founded in 2014 and is based in London, United Kingdom.

Advocate provides a software platform to replace manual insurance review processes with automated solutions for lenders in the financial services industry. The platform aims to improve pre-closing and servicing functions. Advocate serves commercial real estate lenders and other financial institutions involved in loan programs. It was founded in 2020 and is based in New York, New York.

Loading...