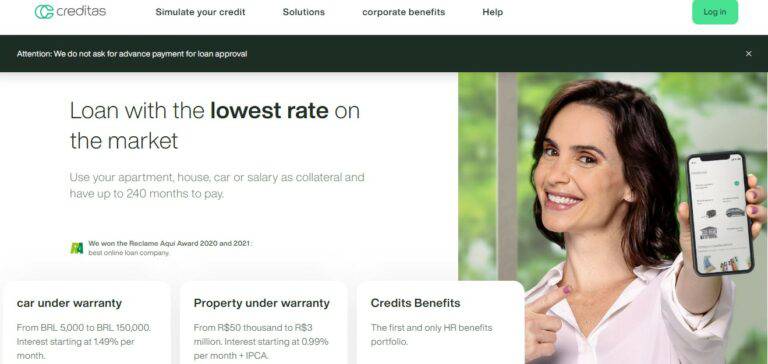

Creditas

Founded Year

2012Stage

Series F - II | AliveTotal Raised

$917.44MValuation

$0000Last Raised

$50M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-5 points in the past 30 days

About Creditas

Creditas is a digital platform that specializes in financial solutions within the lending sector. The company offers loans using vehicles and real estate as collateral, payroll-deducted personal loans, and vehicle financing services. Creditas primarily serves individuals seeking personal finance solutions and companies looking for corporate benefits and insurance services. Creditas was formerly known as BankFacil. It was founded in 2012 and is based in Sao Paulo, Brazil.

Loading...

Creditas's Products & Differentiators

Auto Equity Loans

Personal loans with the customer car as a collateral

Loading...

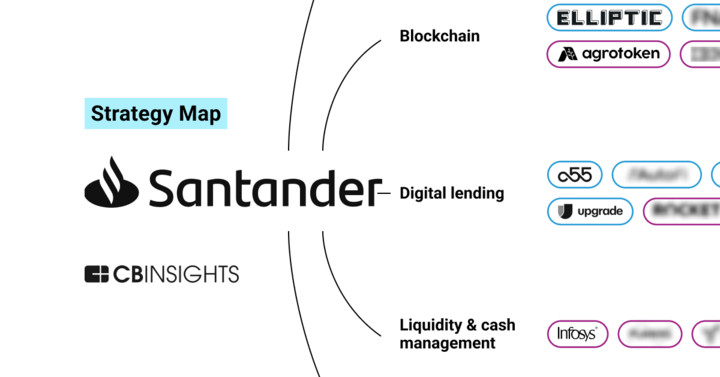

Research containing Creditas

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Creditas in 3 CB Insights research briefs, most recently on Mar 28, 2023.

Expert Collections containing Creditas

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Creditas is included in 7 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,490 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,270 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,674 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Auto Commerce

700 items

Companies involved in the rental, selling, trading, or purchasing of cars, RVs, trucks, and fleets, including auto financing companies, vehicle auction services, online classified advertising companies with a focus on auto, and dealership software platforms.

Fintech

13,662 items

Excludes US-based companies

Latest Creditas News

Mar 20, 2025

Quinta, 20 Março 2025 18:35 Crédito de Imagens:Divulgação - Escrito ou enviado por Fernanda Cezar Créditos: Freepik Levantamento da Minuto Seguros mensurou que as reduções nos valores das apólices foram maiores no Rio de Janeiro A Minuto Seguros, uma empresa Creditas e a maior corretora digital independente do Brasil, realizou um estudo sobre o valor do seguro dos carros mais vendidos do país. Em fevereiro, foi registrada uma queda nos preços em ambos os gêneros: Para os homens, o custo médio foi de R$ 2.211,52, uma redução de 12,76%; já para as mulheres o valor foi de R$ 2.493,73, uma diminuição de 8,38%. De acordo com Michel Tanam, gerente comercial da Minuto Seguros, essa redução mostra que o mercado está ajustando os valores das apólices. “A queda nos preços reflete um cenário favorável para os consumidores, indicando um possível equilíbrio entre a oferta e a demanda por seguros”, explicou o especialista. O ranking abrange 11 capitais brasileiras e considera a lista divulgada pela Fenabrave (Federação Nacional da Distribuição de Veículos Automotores) para determinar os 10 carros mais vendidos no período. Destaques de fevereiro: (As comparações percentuais a seguir consideram o preço médio de janeiro/25 contra fevereiro/25) O Rio de Janeiro destacou-se como a capital com as maiores reduções percentuais no valor do seguro. Para as mulheres, houve um recuo de 19%, fazendo com que o preço médio das apólices passasse de R$ 4.339,31 em janeiro para R$ 3.484,23 em fevereiro. Já para os homens, a diminuição foi de 13%, levando o custo das apólices de R$ 3.380,81 em janeiro para R$ 2.928,41 no mês seguinte. Vale ressaltar a importância de consultar diferentes seguradoras para obter a melhor cotação, já que os valores podem variar consideravelmente entre as empresas. Maiores variações por modelo: ● Novo Polo Comfortline TSI 1.0 Flex Aut. : Manteve-se como o carro mais vendido. O seguro para homens teve uma redução média de valor em 7,78%, com pico de 13,64% em São Paulo. Para mulheres, a redução média foi de 2,31%, com a maior queda (14,73%) também para os paulistas; ● Argo 1.0 6V Flex Manual: O valor do seguro sofreu uma redução média de 36,38% para o público masculino, chegando a 54,29% na Bahia. Para as mulheres, a queda chegou à casa dos 18,73%, com pico de 50,51% também na Bahia; ● Creta Action 1.6 16V Flex Aut. : Para homens, a queda média foi de 34,52%, com destaque para 47,59% no Rio de Janeiro. Para mulheres, a redução média foi de 33,66%, com pico de 46,60% no mesmo estado; ● Mobi Like 1.0 8V Flex Manual: Para homens, a redução no valor chegou aos 28,76%, em Pernambuco o valor foi ainda menor, de 38,92%. Para mulheres, a média ficou em 31,79%, tendo a maior queda também no estado pernambucano (44,75%). Detalhes da cotação Capitais: São Paulo (SP), Rio de Janeiro (RJ), Belo Horizonte (MG), Curitiba (PR), Florianópolis (SC), Recife (PE), Goiânia (GO), Porto Alegre (RS), Brasília (DF), Vitória (ES) e Salvador (BA). Seguradoras: Azul, Alfa, Aliro, Allianz, Bradesco, HDI, Itaú, Ituran, Liberty, Sompo Seguros, Mapfre, Mitsui, Porto Seguro, Tokio Marine e Zurich. Perfis: Homem e mulher, 35 anos, casado(a). As cotações mencionadas no texto são as de menor valor dentro dos perfis avaliados com as seguradoras. Sobre a Minuto Seguros A Minuto Seguros é a maior corretora digital independente do Brasil, que oferece aos clientes uma experiência simples, segura e rápida, por meio de uma equipe de atendimento humano com diferenciais únicos no mercado e preparados para oferecer suporte. Adquirida em 2021 pela Creditas, plataforma de produtos e soluções financeiras líder na América Latina, a Minuto Seguros oferece a união da praticidade virtual com o comprometimento e o respeito do atendimento real e possui parceria com as principais seguradoras do País. Além do Seguro Auto, destacam-se o Seguro Residencial, o Seguro Viagem, Seguro de Vida, Plano de Saúde, o Seguro para Pequenas e Médias Empresas e outras soluções para empresas. Compartilhe::Participe do GRUPO SEGS - PORTAL NACIONAL no FACEBOOK...:

Creditas Frequently Asked Questions (FAQ)

When was Creditas founded?

Creditas was founded in 2012.

Where is Creditas's headquarters?

Creditas's headquarters is located at Engenheiro Luís Carlos Berrini Avenue, 105, Sao Paulo.

What is Creditas's latest funding round?

Creditas's latest funding round is Series F - II.

How much did Creditas raise?

Creditas raised a total of $917.44M.

Who are the investors of Creditas?

Investors of Creditas include Andbank, Kaszek Ventures, VEF, SoftBank Latin America Fund, QED Investors and 23 more.

Who are Creditas's competitors?

Competitors of Creditas include Uala, Addi, Albo, SalaryFits, Neon and 7 more.

What products does Creditas offer?

Creditas's products include Auto Equity Loans and 4 more.

Loading...

Compare Creditas to Competitors

Klar is a financial services company that offers credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Albo offers financial services for personal and business needs. The company provides personal and business debit accounts, loans, and payroll services, and facilitates cryptocurrency transactions, all managed through a single app. Albo primarily serves individuals and small to medium-sized businesses with their financial management and growth. It was founded in 2016 and is based in Mexico City, Mexico.

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Uala provides a financial technology platform for the digital payment services sector. It offers a mobile application that allows users to manage their finances by purchasing, transferring, investing, and earning interest on their funds. It serves consumers looking for financial services. Uala was formerly known as Bancar Technologies. It was founded in 2017 and is based in Caba, Argentina.

Digio is a digital banking platform that provides financial services. The company offers products including a digital bank account, credit card management, personal loans, and a rewards program, all accessible via a mobile application. Digio serves individuals who manage their finances through digital means. It was founded in 2013 and is based in Barueri, Brazil.

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Loading...