BackBase

Founded Year

2003Stage

Unattributed | AliveTotal Raised

$127.83MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+48 points in the past 30 days

About BackBase

BackBase is a technology company that operates in the financial services sector and provides digital banking solutions. The company offers an Engagement Banking Platform that allows banks to update customer journeys and replace legacy IT systems with a composable, omnichannel banking architecture. BackBase's platform includes tools for digital onboarding, banking apps development, lending, investing, and front-office assistance, which are intended for use in the banking industry. It was founded in 2003 and is based in Amsterdam, Netherlands.

Loading...

ESPs containing BackBase

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

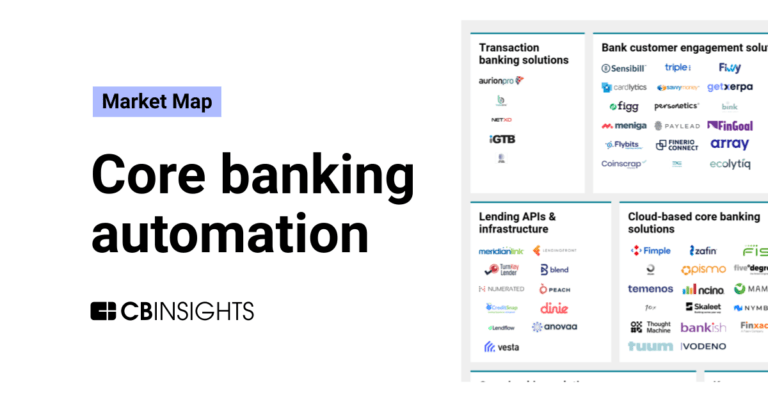

The cloud-based core banking solutions market offers financial institutions technology to modernize legacy systems and deliver personalized products and services. Vendors provide cloud-native platforms that are scalable, secure, and cost-effective. These solutions enable quick integration with other systems through APIs and microservices architecture. They allow consistent, easy updates to meet ch…

BackBase named as Challenger among 15 other companies, including Oracle, Temenos, and Fiserv.

Loading...

Research containing BackBase

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BackBase in 4 CB Insights research briefs, most recently on Jan 4, 2024.

Jan 4, 2024

The core banking automation market mapExpert Collections containing BackBase

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BackBase is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Capital Markets Tech

1,040 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

13,661 items

Excludes US-based companies

Digital Banking

108 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest BackBase News

Mar 28, 2025

Focus on digital expansion Owned by Albania’s BALFIN Group, Tirana Bank aims to significantly increase its digital customer base over the next five years. The project will initially focus on improving retail banking services, with plans to introduce new web and mobile banking applications, expand digital lending options for credit cards and consumer loans, and eventually extend these capabilities to business banking clients. A representative from Backbase stated that the partnership aligns with the company’s approach to modernising financial institutions through its Engagement Banking Platform. According to the representative, the platform will help Tirana Bank streamline its operations while enhancing customer interactions. Tirana Bank’s decision to implement Backbase’s cloud-native platform allows for continuous updates, ensuring compliance with security and regulatory requirements. According to the official press release, the change from an in-house digital infrastructure to Backbase’s system is expected to improve operational efficiency and support future innovation. A Tirana Bank official described the partnership as a key component of the bank’s digital transformation strategy, aimed at supporting its market presence and delivering more efficient banking services. The official emphasised that the platform’s flexibility will support the bank’s expansion plans while offering improved customer experiences. Backbase was selected following a competitive evaluation process, with Tirana Bank citing the platform’s adaptability and technological capabilities as key factors in its decision. The implementation will be managed in collaboration with Endava, a technology services company, which will provide expertise in artificial intelligence and digital innovation. A representative from Endava highlighted AI’s growing role in financial services, noting that the collaboration aims to enhance personalisation and operational efficiency for Tirana Bank. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

BackBase Frequently Asked Questions (FAQ)

When was BackBase founded?

BackBase was founded in 2003.

Where is BackBase's headquarters?

BackBase's headquarters is located at Oosterdoksstraat 114, Amsterdam.

What is BackBase's latest funding round?

BackBase's latest funding round is Unattributed.

How much did BackBase raise?

BackBase raised a total of $127.83M.

Who are the investors of BackBase?

Investors of BackBase include An Binh Commercial Joint Stock Bank, Leading European Tech Scaleups and Motive Partners.

Who are BackBase's competitors?

Competitors of BackBase include Apiture, Mambu, Technisys, Nava, nCino and 7 more.

Loading...

Compare BackBase to Competitors

Finastra provides a range of financial services, treasury, lending, and banking software solutions. The company offers a wide range of services, including lending and corporate banking, payments, treasury and capital markets, universal banking, and investment management. It primarily serves the financial technology industry. It was founded in 2017 and is based in London, United Kingdom.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Thought Machine specializes in core banking software and operates within the financial technology sector. The company offers a cloud-native core banking platform, Vault Core, and a payment processing platform, Vault Payments, which enable banks to create and manage a wide range of financial products and payment schemes. Thought Machine's products are designed to provide banks with flexibility, control, and the ability to deploy on any cloud infrastructure. It was founded in 2014 and is based in London, United Kingdom.

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

Ezbob focuses on embedded banking and finance technology in the financial services industry. The company offers digital finance solutions that enable financial institutions and payment companies to provide services such as term loans, account opening, lines of credit, overdrafts, asset finance, and credit cards. Ezbob primarily serves the banking and payment companies sector. It was founded in 2011 and is based in London, United Kingdom.

Meniga specializes in digital banking solutions within the financial technology sector. The company offers a suite of products that enhance digital banking experiences by leveraging data consolidation, customer engagement, and revenue generation strategies. Meniga primarily serves financial institutions looking to improve their digital services. It was founded in 2009 and is based in London, United Kingdom.

Loading...