Anchorage Digital

Founded Year

2017Stage

Series D | AliveTotal Raised

$487MValuation

$0000Last Raised

$350M | 3 yrs agoAbout Anchorage Digital

Anchorage Digital is a crypto platform that provides financial services and infrastructure solutions for institutions. The company offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Anchorage Digital

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

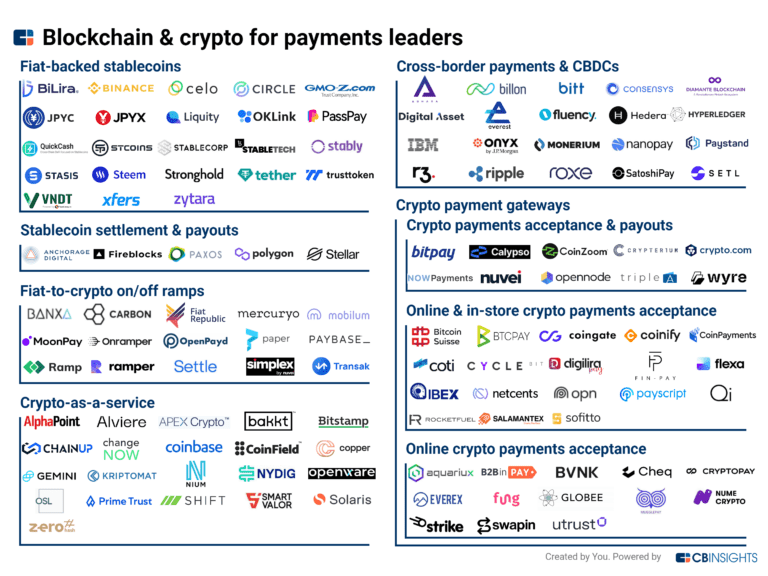

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Anchorage Digital named as Challenger among 7 other companies, including Circle, Fireblocks, and Stellar.

Anchorage Digital's Products & Differentiators

Custody

Safekeeping of over 60 digital assets

Loading...

Research containing Anchorage Digital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Anchorage Digital in 7 CB Insights research briefs, most recently on Feb 23, 2023.

Oct 15, 2022

What is institutional staking?

Jul 29, 2022

Where a16z is investing in crypto and blockchainExpert Collections containing Anchorage Digital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Anchorage Digital is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

Blockchain

8,902 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Capital Markets Tech

1,161 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,452 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Anchorage Digital News

Mar 29, 2025

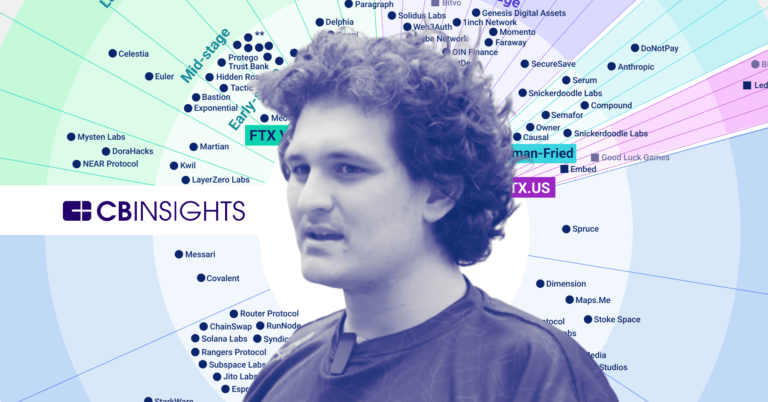

At a U.S. Senate Banking Committee hearing on March 27, Senator Elizabeth Warren criticized Atkins, calling his decisions “stunningly bad” during his tenure at the SEC from 2002 to 2008 – just before the 2008 financial crisis. Millions of dollars and a dim future Warren was particularly interested in the fate of Atkins' consulting firm Patomak Global Partners, whose client was the infamous crypto exchange FTX, which collapsed in 2022. The senator demanded disclosure of potential buyers of the company, which Atkins has promised to sell if confirmed as SEC chairman. “Your clients pay you more than $1 200 an hour for advice on how to influence regulators like the SEC. And if you get approved, you'll be in the perfect position to help all those clients who have been paying you millions of dollars for years,” Warren said, hinting that Atkins' objectivity may be in question. A particularly poignant moment came when the senator asked for disclosure about potential buyers of Patomak, who she said were effectively “buying access to the future SEC chairman.” Atkins avoided a direct answer, saying only that he would “follow procedure.” Warren did not fail to characterize the possible sale of the company as an “upfront bribe” for the former SEC commissioner's future services. Republican support and a new approach to regulation In contrast to harsh criticism from Democrats, Republicans on the committee expressed support for Atkins' nomination. Committee Chairman Tim Scott criticized the SEC's course under former Chairman Gary Gensler and said Atkins would provide “long overdue clarity for digital assets.” Atkins himself outlined priorities in his published statement, “My top priority as chairman will be to work with my fellow commissioners and Congress to build a strong regulatory framework for digital assets through a rational, consistent, and principled approach.” The changes have already begun Although the Senate Banking Committee has yet to vote on Atkins' nomination, the SEC is already showing a friendlier approach to cryptocurrency companies since Donald Trump took office and appointed Commissioner Mark Uyeda as acting chairman of the agency. Under Uyeda's leadership, the commission has halted several investigations and enforcement actions against major crypto firms, including Coinbase and Ripple – both companies made contributions to political committees supporting Republican candidates in the 2024 election cycle. SEC chief nominee Paul Atkins owns shares in three crypto companies According to a report by Fortune, ahead of a Senate hearing scheduled for Thursday, Atkins has officially disclosed his assets. Notably, while there are stakes in crypto companies, the candidate himself does not directly own cryptocurrencies. Bloomberg reports that the combined fortune of Atkins and his wife is estimated at a minimum of $327 million. The details of Atkins' financial investments are impressive: according to documents obtained by Fortune, he held a seat on Securitize's board of directors and owned call options worth up to $500 000. In addition, his stake in Anchorage Digital is valued in the range of $250 to $500 thousand, and his investments in Off the Chain Capital range from $1 to a million. Path to Appointment President Donald Trump nominated Atkins, known for his support of cryptocurrencies, to head the SEC back in December of last year. Former chairman Gary Gensler stepped down on January 20, after which the commission was temporarily led by Mark Uyeda. It's worth noting that this won't be Atkins' first experience at the SEC. Former President George W. Bush already appointed him SEC commissioner for the period from 2002 to 2008. After that service, Atkins founded the consulting firm Patomak Global Partners, whose clients included cryptocurrency exchanges and DeFi platforms. He also joined the Digital Chamber's board of directors in 2020, but left that position after a nomination from Trump. In the crosshairs of criticism Atkins' nomination has already sparked a reaction in political circles. On March 24, Senator Elizabeth Warren sent the nominee a 34-page letter demanding clarification about his ties to the bankrupt cryptocurrency exchange FTX. The senator also raised questions about President Trump's possible conflicts of interest related to his memcoin. The upcoming Senate hearing could be indicative of the future of cryptocurrency regulation in the US. The appointment of a digital asset advocate to head the SEC potentially signals a possible softening of the regulatory approach to the industry. Atkins' appointment could mark a significant turnaround in U.S. regulatory policy toward cryptocurrencies, but questions about conflicts of interest remain on the table. Source: https://coinpaper.com/8273/future-sec-head-under-pressure-over-sale-of-ftx-linked-firm

Anchorage Digital Frequently Asked Questions (FAQ)

When was Anchorage Digital founded?

Anchorage Digital was founded in 2017.

Where is Anchorage Digital's headquarters?

Anchorage Digital's headquarters is located at One Embarcadero Street, San Francisco.

What is Anchorage Digital's latest funding round?

Anchorage Digital's latest funding round is Series D.

How much did Anchorage Digital raise?

Anchorage Digital raised a total of $487M.

Who are the investors of Anchorage Digital?

Investors of Anchorage Digital include Andreessen Horowitz, Blockchain Capital, Elad Gil, GIC, BlackRock and 25 more.

Who are Anchorage Digital's competitors?

Competitors of Anchorage Digital include Hex Trust, BitGo, Signature Bank, Fireblocks, Standard Custody & Trust Company and 7 more.

What products does Anchorage Digital offer?

Anchorage Digital's products include Custody and 2 more.

Who are Anchorage Digital's customers?

Customers of Anchorage Digital include Visa.

Loading...

Compare Anchorage Digital to Competitors

BitGo provides digital asset custody and financial services within the cryptocurrency sector. The company offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. BitGo serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Fireblocks is an enterprise-grade platform that specializes in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors, including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Hex Trust offers services including custody, staking, and market services for digital assets. Hex Trust serves protocols, foundations, financial institutions, and the Web3 and Metaverse sectors. It was founded in 2018 and is based in Hong Kong, Hong Kong.

Custonomy provides digital asset and real-world asset custody solutions within the fintech sector. The company offers a non-custodial enterprise wallet suite that utilizes multi-party computation technology for asset management across multiple blockchain networks. Custonomy serves sectors such as financial institutions, decentralized finance (DeFi), investment funds, custodians, and mining pools. It was founded in 2020 and is based in Hong Kong.

Loading...