Amazon

Founded Year

1994Stage

PIPE - II | IPOTotal Raised

$8.98MMarket Cap

2036.56BStock Price

192.17Revenue

$0000About Amazon

Amazon is a customer-centric company focused on e-commerce, cloud computing, and artificial intelligence. The company offers a vast array of products and services, including online retail shopping, digital streaming, and innovative technological solutions. Amazon primarily serves consumers, businesses, and developers through its diverse range of services and platforms. Amazon was formerly known as Cadabra. It was founded in 1994 and is based in Seattle, Washington.

Loading...

ESPs containing Amazon

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The federated learning platforms market enables model training across multiple decentralized devices or data sources without centralizing sensitive data. These platforms allow organizations to develop AI models collaboratively while maintaining data privacy, security, and regulatory compliance. Key features include privacy-preserving training techniques, secure model aggregation, and integration w…

Amazon named as Leader among 15 other companies, including Google, IBM, and Microsoft.

Loading...

Research containing Amazon

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amazon in 74 CB Insights research briefs, most recently on Mar 28, 2025.

Mar 6, 2025

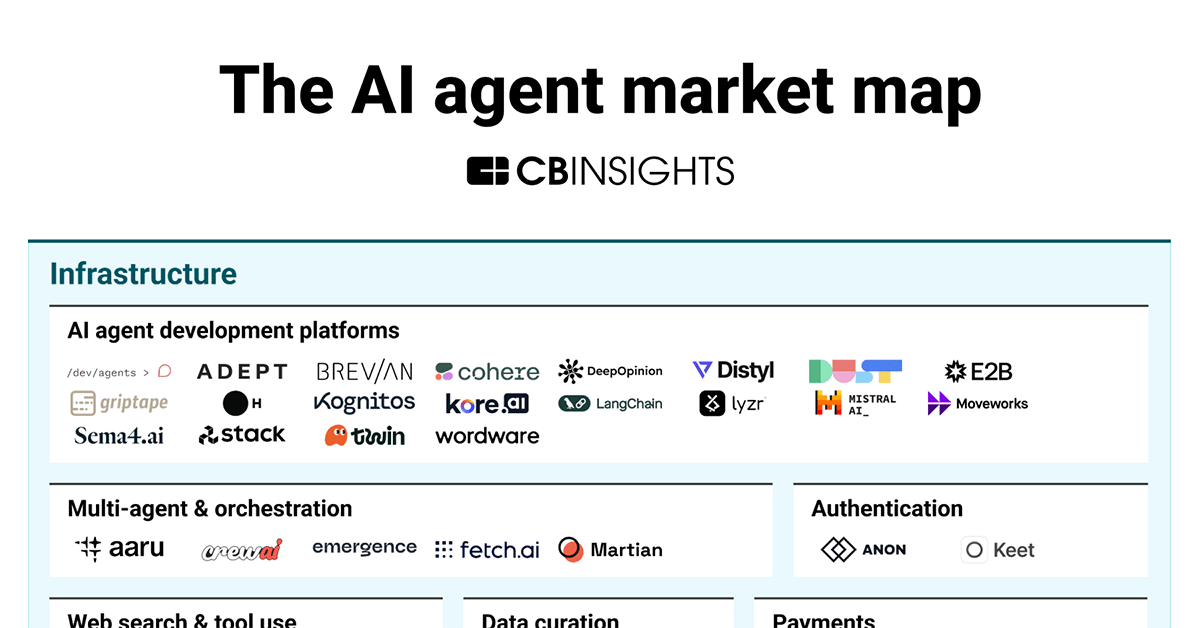

The AI agent market map

Feb 13, 2025

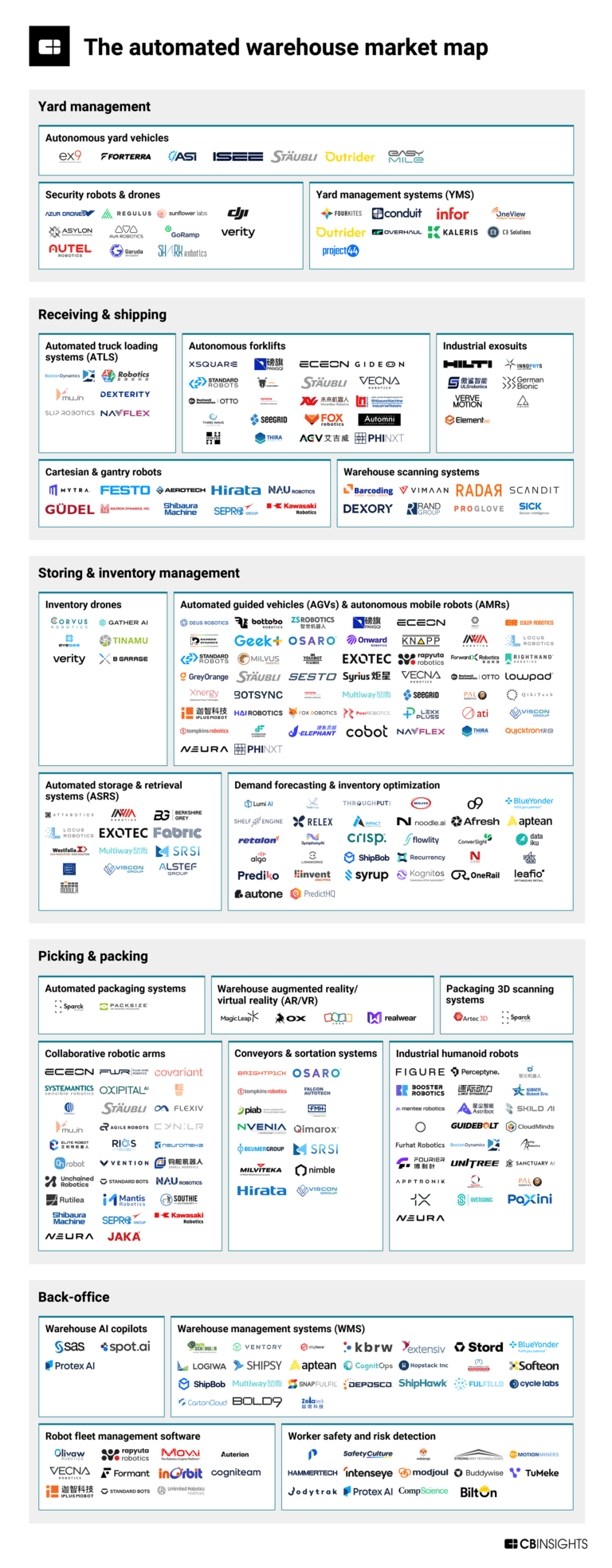

The automated warehouse market map

Feb 6, 2025 report

State of Climate Tech 2024 Report

Expert Collections containing Amazon

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amazon is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,267 items

Food & Beverage

123 items

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

New Retail Formats

11 items

Companies offering automated checkout solutions for retailers or operating cashless, cashier-free retail stores.

Conference Exhibitors

5,302 items

NRF Big Show 2025: Exhibitors

959 items

Amazon Patents

Amazon has filed 10000 patents.

The 3 most popular patent topics include:

- data management

- network protocols

- computational linguistics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/15/2020 | 4/1/2025 | Machine learning, Classification algorithms, Artificial neural networks, Customer experience, Statistical classification | Grant |

Application Date | 4/15/2020 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Machine learning, Classification algorithms, Artificial neural networks, Customer experience, Statistical classification |

Status | Grant |

Latest Amazon News

Apr 2, 2025

. Read on to find out. Posted by Image source: The Motley Fool. You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More This article was originally published on Fool.com . All figures quoted in US dollars unless otherwise stated. Ark Invest CEO Cathie Wood and Berkshire Hathaway CEO Warren Buffett couldn't be any more different in their investment approaches. Ark Invest offers investors the opportunity to invest in a number of exchange-traded funds (ETFs) , many of which are weighted heavily toward speculative, unprofitable businesses. Wood's rationale is that she and her team tend to bet on high-risk, high-reward opportunities in emerging areas, such as artificial intelligence (AI) or biotech . By contrast, Buffett's investment style leans heavily into the idea of identifying businesses that generate strong, steady cash flow and carry a high degree of brand appeal. Buffett tends to prefer industries such as insurance or consumer goods as opposed to higher-growth areas in the technology sector. Nevertheless, Wood and Buffett do share one particular mega-cap tech stock. While it's not a core position for either portfolio, both Ark Invest and Berkshire Hathaway own shares in "Magnificent Seven" member Amazon (NASDAQ: AMZN) . Is now a good time to follow Wood and Buffett and add Amazon to your portfolio? Read on to find out. Technology stocks are getting demolished right now It's been a rough start to the year for technology investors. Newly instituted tariffs, in combination with fears of inflation coming back and some recent mystifying words from Federal Reserve Chairman Jerome Powell, have investors scratching their heads about the health and future prospects of the economy. Unsurprisingly, many investors are acting upon these fearful emotions and beginning to sell off stock and raise some cash for a potentially rainy day. AI stocks have been particularly vulnerable to the ongoing sell-off in the Nasdaq Composite. This isn't too surprising, given that many of the mega-cap tech stocks pictured above have experienced meteoric rises for much of the last two years. As the chart above illustrates, shares of Amazon are down 6% on the year (as of March 26), slightly underperforming the Nasdaq index. Despite appearances, Amazon's business is in great shape Although the pronounced selling illustrated above may give the appearance that something at Amazon could be going poorly, the actual results couldn't be any different from such a narrative. Last year, revenue from Amazon Web Services (AWS) increased by 18% year over year to $107 billion. This is notable for two primary reasons. First, AWS is Amazon's most profitable category among its major reportable segments. While revenue accelerated thanks to the soaring demand for more cloud infrastructure needed for rising AI workloads, operating income for AWS rocketed by 62%. These dynamics underscore that Amazon's investments in AI have so far contributed to a lucrative combination of rising revenue and widening profit margins. The second reason investors should keep a keen eye on AWS is that it is growing at a much steeper rate than Amazon's overall business -- which grew by 11% last year. Image source: Investor Relations. As Amazon's free cash flow continues to compound, the company remains well positioned to keep investing in new areas that can add efficiencies across major business segments. For example, while both efforts are still relatively nascent, Amazon is aggressively incorporating robotics into their warehouses and is also working to bring custom silicon chips to the market in order to compete with Nvidia. Both of these initiatives have the potential to bring additional efficiencies to Amazon's core e-commerce and cloud computing businesses, which makes me bullish that the company still has meaningful room for growth across its ecosystem. Amazon stock bargain that looks primed to thrive for the long run From a macro perspective, it's not surprising to see shares of Amazon slide in tandem with its mega-cap tech cohorts. But when it comes to more specific reasons driving Amazon's sell-off, I'm hard-pressed to buy into any bearish narratives. While tariffs could lead to higher prices (i.e., inflation) and a situation like that could slow down demand for both consumers and corporations, thereby taking a toll on Amazon's e-commerce and cloud businesses, I think operating under the assumption that all of these things will happen in succession is short-sighted. But don't take it just from me. Amazon's leadership has made it clear that the company is going to continue investing aggressively in AI this year despite some lingering fears over the economy from Wall Street.

Amazon Frequently Asked Questions (FAQ)

When was Amazon founded?

Amazon was founded in 1994.

Where is Amazon's headquarters?

Amazon's headquarters is located at 410 Terry Avenue North, Seattle.

What is Amazon's latest funding round?

Amazon's latest funding round is PIPE - II.

How much did Amazon raise?

Amazon raised a total of $8.98M.

Who are the investors of Amazon?

Investors of Amazon include Temasek, AOL, Kleiner Perkins, Nick Hanauer, Tom Alberg and 4 more.

Who are Amazon's competitors?

Competitors of Amazon include Favo, Coppel, SoftBank, Jiajiayue Group, JM Holdings and 7 more.

Loading...

Compare Amazon to Competitors

Big C Retail is a retail, wholesale, and traditional trade platform operating in different business sectors. The company offers a range of products through online and offline sales channels, serving a diverse customer base. Big C Retail also manages town center businesses within its retail venues and open-air markets, providing space for third-party tenants, and operates coffee shops and bookstores. It is based in Bangkok, Thailand.

Aldi is a supermarket chain operating within the food retail industry. The company offers a range of private label products including groceries and basic household items, serving the general public. It was founded in 1976 and is based in Essen, Germany.

IKEA specializes in home furnishing solutions. The company offers furniture and home accessories, produced with attention to environmental impact. IKEA primarily caters to the retail sector, providing products for individuals and families. It was founded in 1943 and is based in Delft, Netherlands.

China Resources operates commodity retail businesses. The Company distributes foods, apparel, and other products. China Resources also conducts pharmaceuticals, real estate selling, and other businesses. It was founded in 2003 and is based in Shenzhen, China.

CJ Express is a retail company focused on providing a unique supermarket experience under the theme 'More Than a Supermarket.' The company offers a variety of consumer goods and services through its strong store brands, aiming to meet all consumer needs and stand out in the retail market. CJ Express primarily serves the retail industry, with a focus on expanding its own retail brand. It was founded in 2005 and is based in Bangkok, Thailand.

Coppel is a department store chain that operates in the retail sector. The company offers a variety of products through a consumer credit system and provides delivery services. Coppel offers department store products. It was founded in 1941 and is based in Culiacan, Mexico.

Loading...