Acko

Founded Year

2016Stage

Growth Equity | AliveTotal Raised

$428MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-37 points in the past 30 days

About Acko

Acko is a tech-driven company that specializes in insurance products across various sectors, such as auto, health, and life insurance. The company offers a range of insurance policies designed to provide financial protection and peace of mind, including vehicle coverage, health plans, life insurance, and travel protection. Acko's approach includes features like zero commission, instant policy renewal, and same-day claim settlements, catering to the digitally savvy consumer. It was founded in 2016 and is based in Bengaluru, India.

Loading...

ESPs containing Acko

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Acko named as Leader among 12 other companies, including Oscar, Clover Health, and Digit Insurance.

Acko's Products & Differentiators

Auto insurance

ACKO offers customized motor insurance products that can be easily accessed online and with quotes and all the relevant information pertaining to motor insurance available on the website. ACKO uses data and analytics to underwrite the customer, which in turn helps improve premium pricing accuracy. After the purchase is made, the policy is directly sent into the buyer’s inbox in less than two minutes. Claim assessment time is drastically reduced and a settlement is provided within 48 - 72 business hours.

Loading...

Research containing Acko

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Acko in 2 CB Insights research briefs, most recently on Aug 16, 2022.

Expert Collections containing Acko

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Acko is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,270 items

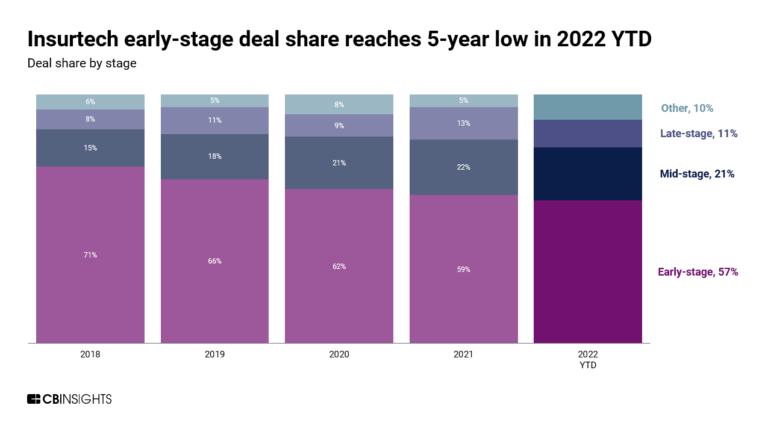

Insurtech

4,487 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,662 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Acko News

Mar 18, 2025

Citing an order issued by the financial services department, ET reported that the panel will have members from economic affairs department, NITI Aayog, financial services department, electronics and IT ministry, Department for Promotion of Industry and Internal Trade (DPIIT), Reserve Bank of India (RBI), and Securities and Exchange Board of India (SEBI). Besides, the committee will also comprise fintech founders like Groww's Lalit Keshre, Jupiter's Jitendra Gupta, Acko General Insurance's Varun Dua and BillDesk's Ajay Kaushal. The purpose of establishing the committee is to analyse the fintech sector's growth and its contribution to the banking, financial services and insurance sector, while also breaking down the issues and challenges being faced by startups and taking stock of the regulatory and policy developments, the agency said. As per the report, the committee will submit a report within three months from the date of the first meeting. The development comes months after in January. It is pertinent to note that the fintech startup has been hit by some of the regulatory actions by the Centre and the RBI over the last couple of years. of banks and non-banking financial companies (NBFCs) in 2023. Last year, it also tightened the norms for non-banking financial company-peer to peer (NBFC-P2P) lending platforms and , Faircent, LEO1, Finzy and Rang De, earlier this month for non-compliance. The Centre has also been to foster collaboration and mitigate challenges like cybersecurity, digital financial frauds, among others. The post appeared first on .

Acko Frequently Asked Questions (FAQ)

When was Acko founded?

Acko was founded in 2016.

Where is Acko's headquarters?

Acko's headquarters is located at Somasandrapalya, 27th Main Rd, Sector 2, HSR Layout, Bengaluru.

What is Acko's latest funding round?

Acko's latest funding round is Growth Equity.

How much did Acko raise?

Acko raised a total of $428M.

Who are the investors of Acko?

Investors of Acko include General Atlantic, Multiples Alternate Asset Management, Cpp Investment Board Private Holdings, Intact Ventures, Munich Re Ventures and 20 more.

Who are Acko's competitors?

Competitors of Acko include Bajaj Allianz General Insurance and 7 more.

What products does Acko offer?

Acko's products include Auto insurance and 2 more.

Loading...

Compare Acko to Competitors

Tata AIG General Insurance Company Limited specializes in general insurance services across various sectors. The company offers various insurance products including health, motor vehicle, travel, and business insurance. Tata AIG serves individuals and businesses with its insurance solutions. It was founded in 2001 and is based in Mumbai, India.

OneAssure is a health insurance brokerage that operates in the insurance sector. The company offers a platform for comparing, buying, and renewing health and term insurance policies, providing advice and facilitating claims settlements without unnecessary add-ons. OneAssure serves individuals and families seeking insurance coverage and financial security. It was founded in 2020 and is based in Bangalore, India.

Probus Insurance is a prominent insurance broker that operates in the insurance industry. The company offers a wide range of insurance plans including life, health, motor, travel, property, and commercial insurance. It primarily serves retail clients across various sectors. It was founded in 2003 and is based in mumbai, Delaware.

Coverfox is an insurtech platform focused on providing online insurance products in various sectors such as motor, health, and life insurance. The company offers a comparison tool for customers to evaluate and purchase insurance policies from over 50 providers, ensuring a diverse range of options. Coverfox also provides claims assistance and prioritizes data security for its users. It was founded in 2013 and is based in Mumbai, India.

Yingda Taihe Life Insurance provides individual and group insurance policies, investment products, and retirement savings products. The company operates within the insurance and financial services sector. It was founded in 2007 and is based in Beijing, China.

Sunshine Property and Casualty Insurance offers property damage insurance, liability insurance, credit insurance and guarantee insurance, short-term health insurance and accidental injury insurance. The company also offers reinsurance regarding property and casualty. Sunshine Property and Casualty was founded in 2005 and is based in Beijing, China.

Loading...